Swedish challenger bank Northmill has secured $30.1m in a new funding round led by investor M2 Asset Management.

“Northmill Bank is already a profitable company with a proven and sustainable business model, which stands out among today’s tech investments,” said Rutger Arnhult, chairman of the board of M2 Assets Management.

“We have been following their journey for a while and have been impressed by the founders, as well as the company.

“The banking market is well on its way to change and the winners will be those who best can adapt to the new digital reality. For me, this is an investment in a tech company with long-term owners, who are just at the beginning of their journey. I see great growth potential in the bank.”

Institutional investor and asset management firm Coeli also backed the raise.

“We are happy to welcome such competent and experienced owners to our growing neobank,” said Hikmet Ego, CEO and co-founder of Northmill Bank.

“Our fantastic employees, long-term perspective, proven business model and our strong belief in technology as a driver, have created the conditions now enabling us to accelerate further. Our investors share our view that the bank of the future will be built by being receptive and developing products that really help customers improve their personal finances.”

The Swedish Financial Supervisory Authority granted Northmill a Swedish banking licence in September 2019.

Since then the FinTech startup has been busy launching its own debit card, savings accounts and investing in Zendesk’s cloud-based customer relationship management platform.

Northmill is now gearing up to expand into Norway with its transaction management tool Reduce.

“When we now start to see a shift in banking towards smarter and more customer-oriented products, driven by customers’ changing demands and behaviours, we as Sweden’s only completely cloud-based bank see great opportunities to meet the new demands and be a positive driver for better banking services for all,” Ego said.

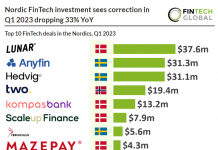

However, Northmill is not the only neobank tapping into the Nordic market. Danish challenger bank Lunar raised a €40m Series C round in October and Iceland has indó.

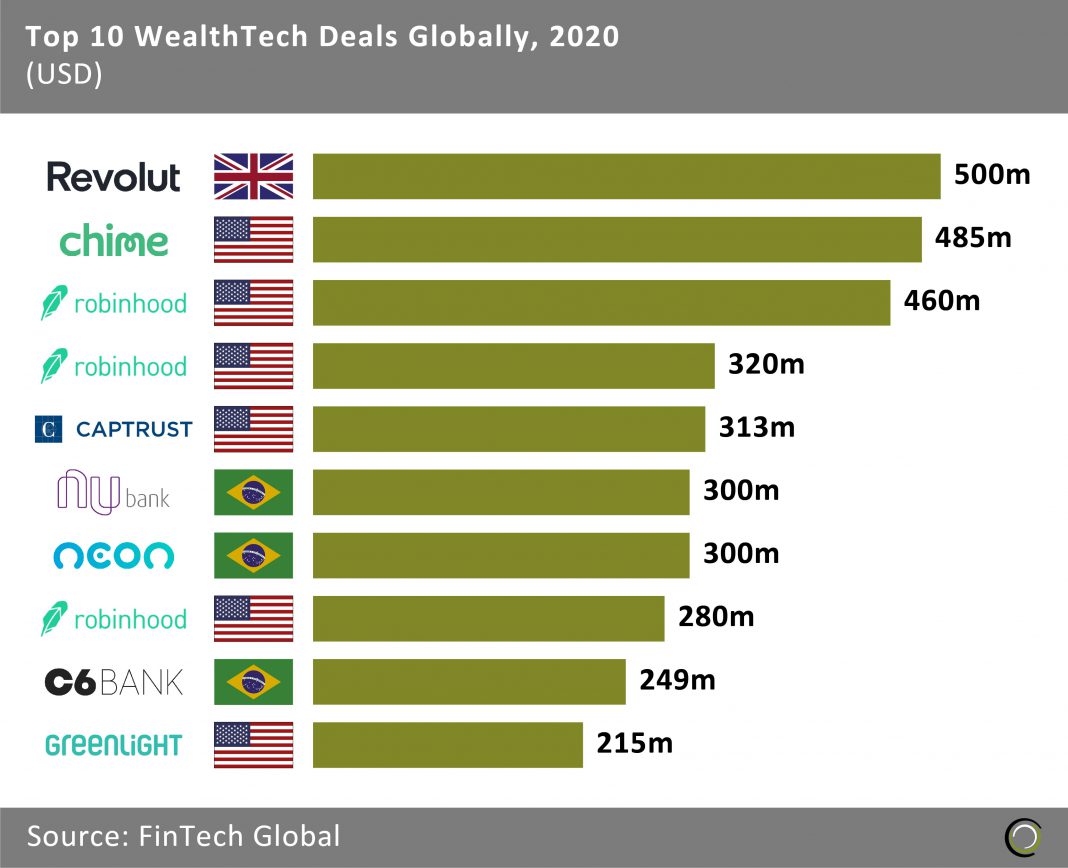

Challenger banks are also picking increasingly larger rounds, exemplified that six out of the ten biggest WealthTech investment funds in 2020 were active in the digital banking space, FinTech Global research reveals.

UK-based digital bank Revolut, raised the biggest WealthTech funding round of the year by picking up $500m in a Series D round led by US based investor TCV in February 2020.

UK-based digital bank Revolut, raised the biggest WealthTech funding round of the year by picking up $500m in a Series D round led by US based investor TCV in February 2020.

The second biggest round was the one raised by US-based Chime. The neobank raised a $485m Series F round led by Coatue, Iconiq and Tiger Global in September.

In the same month, Brazilian FinTech Nubank raised a $300m funding round, only to then top up its coffers in January 2021 by raising a $400m investment round at an eye-watering $25bn valuation, making it the world’s arguably most valuable challenger bank.

Copyright © 2021 FinTech Global