Tag: indó

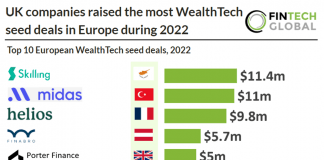

UK companies raised the most WealthTech seed deals in Europe during...

Key European WealthTech seed investment stats in 2022:

• Overall, there were 64 European WealthTech seed deals in 2022, an 11% share of total European...

Icelandic neobank indó taps Lucinity for financial crime offering

indó, an Icelandic neobank, has selected Lucinity to use its AML compliance software such as its transaction monitoring and case manager solutions.

Iceland’s first challenger bank indó launches from stealth

Icelandic FinTech company indó has launched from stealth after the close of its seed round on $4.5m.

This is the first challenger bank to emerge...

Swedish neobank Northmill raises $30.1m investment round

Swedish challenger bank Northmill has secured $30.1m in a new funding round led by investor M2 Asset Management.

Danish neobank Lunar opens business bank and accounts for SMEs

Nordic challenger bank Lunar has launched a new business bank and paid-for business accounts for smaller firms and freelancers.

Swedish challenger bank Northmill Bank broadens its savings offering

Neobanks in the Nordics are on the rise and Swedish contender Northmill has not been resting on its laurels to meet the demand, having just introduces fixed-rate savings accounts.

Neobank indó taps Enfuce to ensure it can launch Iceland’s first...

Icelandic challenger bank indó has inked a partnership with open banking and payments startup Enfuce, ensuring it can rely on the Finnish venture's compliance...

indó formally takes a stand against money laundering with new Lucinity...

In its mission to rebuild trust in the banking industry, Icelandic neobank indó has signed a partnership with Lucinity to bolster its anti-money laundering (AML) defences.

Why indó’s founders aim to create “the least powerful bank in...

On the back of closing a €1m seed round, Icelandic challenger bank indó is almost ready to go live.

48 FinTech funding rounds you missed in the last two weeks

The last two weeks have seen everything from huge $1bn investments rounds to undisclosed seed rounds. Let's check some of them out.