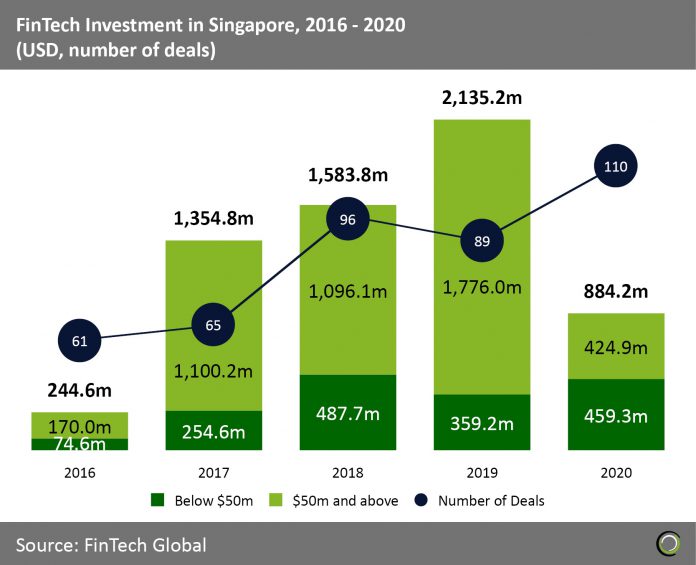

Lack of deals over $50m resulted in a 58.6% decline in funding last year

- On the back of a record 2019, the FinTech sector in Singapore experienced a sharp decline in funding last year registering its worst year since 2017. The decline in funding was brought on by a lack of deals over $50m. The drop of investments comes from the start of the year were the Covid-19 pandemic and the economic uncertainty that followed affected Singapore and made the country go into lockdown to prevent the spread of the virus. Despite the lockdown being lifted, there has been a slower recovery as foreign investors moved out of the region. Therefore, the Monetary Authority of Singapore has announced a $125m support package for the FinTech sector to deal with immediate challenges from Covid-19 and position strongly for the recovery and future growth.

- FinTech companies raised over $884m last year, a decline of 58.6% year-on-year compared to 2019. The decline in funding was brought on by a lack of large deals. At the same time deal activity increased during the period with 110 deals completed compared to 89 transaction in 2019.

- Despite the substantial decline in funding in 2020 Singapore still is an attractive investment destination due to its vibrant FinTech ecosystem supported by ultra-high-speed internet infrastructure, high concentration of banking, abundance of financial institutions and strong government support. In fact, despite funding declining sharply in 2020 deal activity reached a five year high and capital invested from early stage deals under $50m grew by 27.9% YoY. This means there is still capital supporting new innovative startups in country

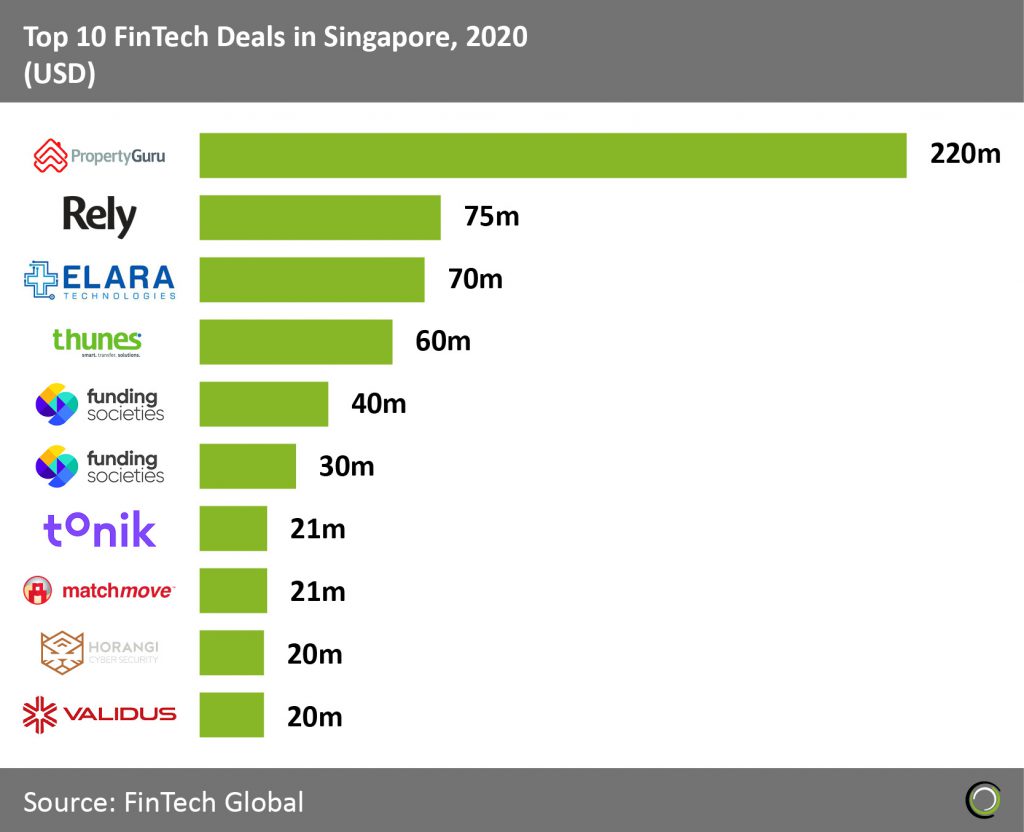

Singapore sees only four deals above $50m as investors turn to early stage deals amid the pandemic

- The top ten FinTech deals completed in 2020 raised in aggregate over $577m making up 65.3% of the overall investment in the country during the year.

- PropertyGuru Group, an online property company that operates rental and sale listing sites, raised the largest deal of the year after raising a $220m private equity round led by Vertex Ventures. The funding will accelerate the company’s growth strategy across all key markets as the group ramps up its investment to meet the rapidly evolving needs in the property ecosystem.

- Out of the top ten deals in Singapore, two deals were completed by Funding Societies. Funding Societies, an online platform for SMEs to acquire loans, raised $70m in a Series C round led by Dymon Asia Ventures. The company originally intended to utilise the fresh funds in new initiatives, however, due to market uncertainty caused by Covid-19, the original plans have now been scaled down.

- The Payments & Remittances sector took two out of the ten top deals in 2020 with Rely and Thunes raising large funding rounds. Rely, a company offering interest-free instalments service to shoppers, raised $74.8m through Debt Financing from Goldbell Financial Services. The fund will be used to scale its operation and partner with leading retailers in Singapore, Malaysia and South Korea. Thunes, a company providing a global cross-border payment network for seamless transfer of funds to 100 countries in 60 currencies, raised a $60m Series B round led by Helios Investment Partners. The funding will be used to grow its operations across Africa, Asia and Latin America.

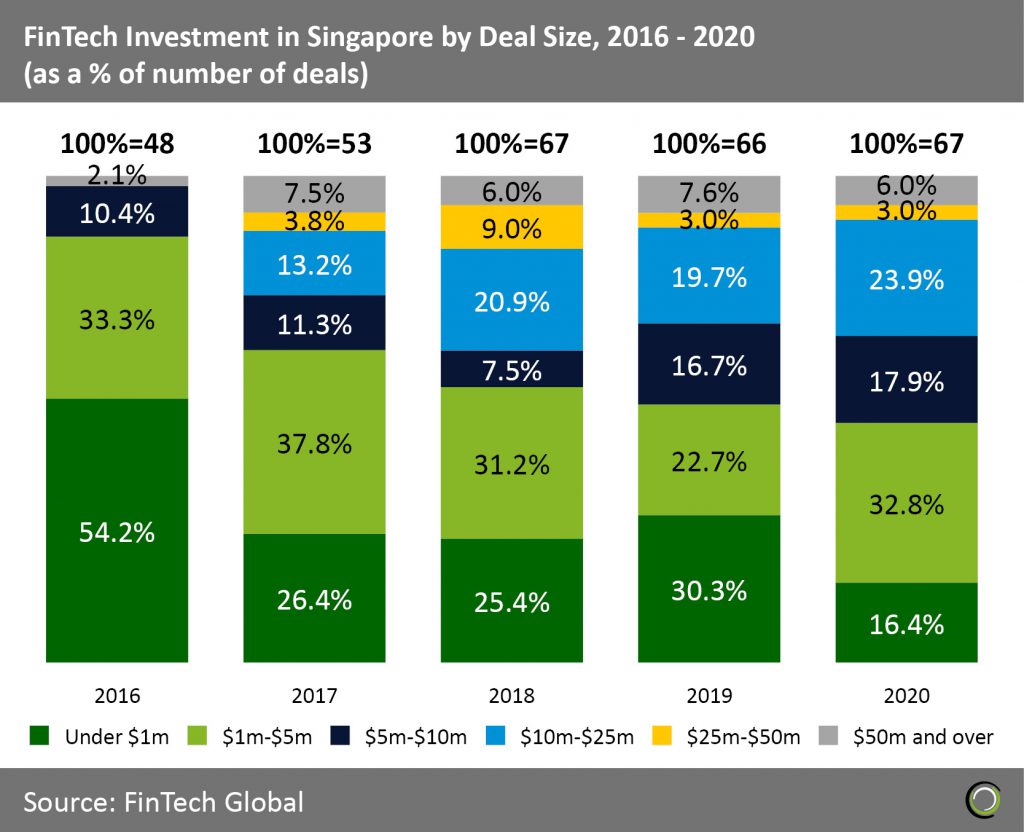

Deals under $1m see their lowest share in five years

- In 2020, the share of deals sized under $1m declined 13.9 percentage points (pp) to just 16.4%, the lowest share ever recorded in the country. Due to increased uncertainty and outlook post Covid-19 investors scaled back on risky very early stage-deals.

- There was a noticeable rise in the next deal size range. Deals sized between $1m and $5m increased 10.1 pp to reach 32.8%, its highest level since 2017. The increase in that bracket range signals that investors rebalanced their portfolios focusing on backing companies in their current portfolio and investing in new ones seeing better prospects as digital transformation efforts are boosted amid the pandemic.

- In 2020, the share of deals sized $50m and over declined 1.6 pp to just 6.0%, the lowest share for the sector in three years. From 2016 to 2017, the share of deals sized over $50m almost quadrupled. Paired with sizeable decline in the share of deals under $1m the Singaporean FinTech sector was attracting large foreign investors which pulled back last year due to lockdowns and other restrictions.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global