Key FinTech investment stats in Singapore:

• Singaporean FinTech companies raised 232 deals in 2022, a new record for the country

• FinTech funding in the country reached $2.4bn last year, a 29% decline from 2021

• Blockchain & Crypto was the most active FinTech subsector with 82 deals in 2022, a 35% share of total FinTech deals

Singapore saw their most active year for FinTech in 2022 with 232 deals raised by Singaporean companies whilst investment faltered, decreasing 29%. In total $2.4bn was raised by Singaporean companies in 2022 resulting in an average deal size of $10.3m, a 39% drop from 2021.

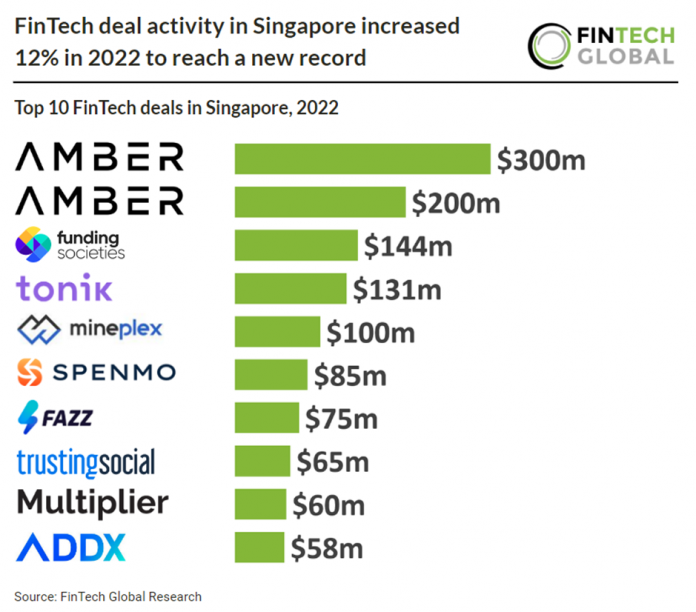

Amber Group, a digital asset trading and infrastructure provider, was the largest deal in Singapore during 2022, raising $300m in their latest Series C funding round, led by Fenbushi Capital. Amber’s CEO, Michael Wu, had initially planned to extend the company’s B+ round by $100m at a valuation of $3bn. However, following FTX’s dramatic implosion, which had a significant impact on the crypto industry, Amber’s valuation fell below $3bn. Although the company did not disclose how low the valuation dropped, Wu stated that Amber had refocused its efforts on a Series C round. While Amber had less than 10% of its assets on FTX prior to the exchange’s bankruptcy, the company did need to rebalance some positions. Nonetheless, this did not have any impact on Amber’s daily operations or business continuity.

Blockchain & Crypto was the most active FinTech subsector with 82 deals in 2022, a 35% share of total transactions. PayTech was the second most active with 32 deals, a 13.7% share of total deals and WealthTech was third with a 11.6% share.

Singapore, once know as the “crypto paradise” is continuing to tighten their Blockchain & Crypto regulation. The Monetary Authority of Singapore (MAS) published a consultation paper in October 2022 suggesting several regulatory measures for digital payment token service providers (DPTSPs) to decrease the possibility of consumer harm from cryptocurrency trading. The proposals target licensed and exempt payment service providers that offer a digital payment token service under the Payment Service Act 2019. Despite recognizing that prohibiting retail access is unlikely to be effective, the MAS’s proposals do not go so far as to impose such a ban.

More Singapore insights here

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global