The US took the leading line in this week’s FinTech deal activity. Of the 23 deals completed, 12 of these were US-based businesses.

In total, $1.38bn was raised by companies this week. Of this, $1.32bn was raised by the ten biggest deals of the week. Going even deeper, companies outside of North America only raised $141m.

US companies made up six of this week’s ten biggest deals, including the biggest three (Octane, Wiz and Marco). Combined, these three deals represented $1bn. The other US-based companies in the top ten deals were Pagos, Novata and Archway.

Other countries represented in the top ten deals were Canada (Equisoft), the UK (Student Finance and Flock), and France (SESAMm).

As for the rest of the 13 deals, other countries represented were India, Germany, Switzerland and the Netherlands.

In terms of sectors, this week was very diverse. CyberTech companies were behind the most deals, making up four. WealthTech and InsurTech each recorded two deals. Other sectors represented this week were PayTech, marketplace lending, ESG FinTech, infrastructure and enterprise software, RegTech, cryptocurrency, and data and analytics.

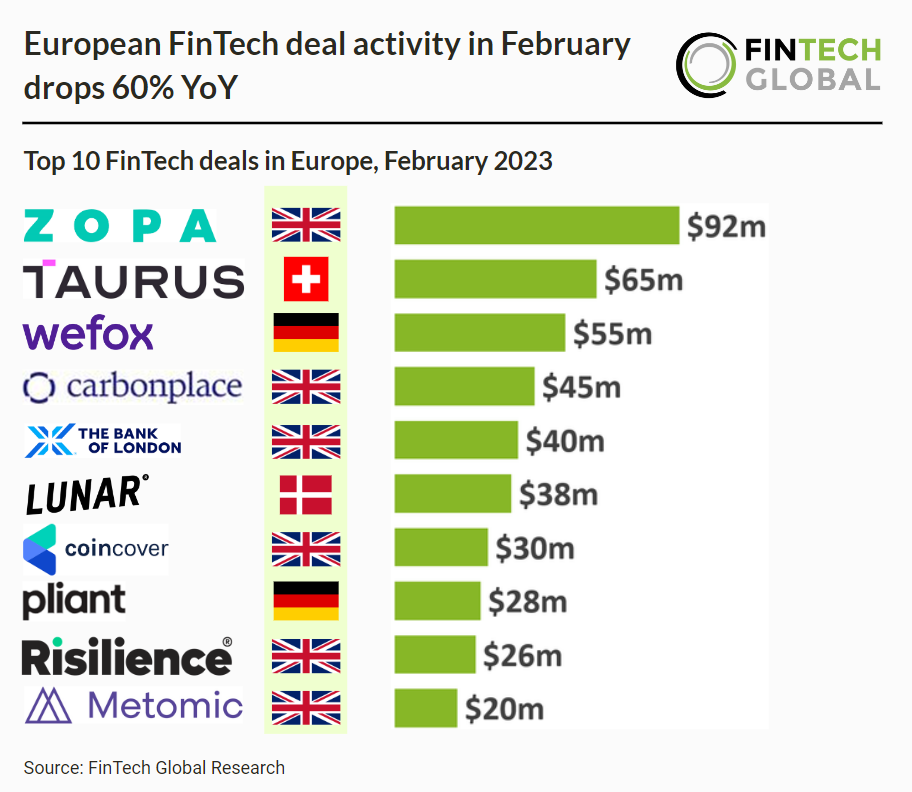

The lack of European deals was also highlighted by a recent report from FinTech Global. It found that European deal activity dropped by 60% YoY in February. During the month there were 82 deals completed, of which, the UK was responsible for 46%.

Not only is deal activity down, but so is the amount invested. The research claims the total volume of capital invested was down by 89% on the previous year.

One of the companies to raise funds this week was Robin AI. The company leverages generative AI technology to support the generation of contracts.

Generative AI has been a hot topic in many sectors since the rise of Chat GPT. FinTech Global explored the rise of the technology and what it could mean for RegTech. According to Muinmos CEO Remonda Kirketerp-Møller, the technology could make the lives of compliance officers easier.

She said, “A Gen AI engine will be able to automatically prepare a prospectus, as well as fill in any accompanying reports to the regulator. Some might say this is a challenge because it may put compliance officers out of work, but in our experience, automating certain processes actually allows compliance officers to focus on other, often more interesting parts of their jobs.” Read the full article here.

Outside of funding rounds, one of the biggest stories this week was that FinTech giant Klarna reported $1bn in annual loss. Despite the net loss, which was a 47% increase from 2021, the company raised the chief executive’s pay by over a third, according to the Financial Times.

The firm is optimistic about its future, and is expecting to return to profitability by the third quarter of the year. The company last made an annual profit in 2018, a quarterly profit in Q2 of 2019 and a monthly profit in August 2020.

The US has been a tough market for the company, but things are looking better. Earlier this week, the BNPL player also announced it has seen a 71% YoY growth in GMV and improved credit loss rates by 37%.

Things were not all bleak for FinTech giants this week. UK-based Revolut revealed that it has recorded its first full year of profitability. The company generated £100.3m adjusted EBITDA and £26.3m in profit for 2021.

Without much further delay, here are this week’s 23 FinTech deals.

Octane completes $406.9m securitisation

Octane, which claims to be revolutionising the buying experience for recreational purchases, has closed a $406.9m securitisation collateralised by its fixed-rate instalment powersports loans.

The company had initially targeted $305.2m for the sale.

This is the largest of Octane’s deals to-date and the first to receive a AAA-rating from both Standard & Poor’s (S&P) and Kroll Bond Rating Agency (KBRA).

OCTL 2023-1 issued five classes of fixed-rate notes: Class A, Class B, Class C, Class D, and Class E. These were rated by the S&P and KBRA as AAA/AAA, AA/AA+, A/A+, BBB/BBB, and BB/BB+, respectively.

This latest issuance added seven new investors to Octane.

Founded in 2014, Octane offers a digital end-to-end buying experience that offers seamless ways to purchase recreational products, such as powersports, vehicles, RVs and outdoor power equipment.

Cloud cybersecurity provider Wiz joins decacorn club

Cloud cybersecurity provider Wiz has joined the decacorn club after a $400m funding round brings its valuation to $10bn.

Lightspeed Venture Partners, a venture capital firm aimed at multi-stage investments in the enterprise, consumer and health sectors, led the round.

Other contributions came from existing Wiz backers Greenoaks Capital Partners and Index Ventures.

With this new valuation, Wiz claims to be the largest cybersecurity unicorn and fastest SaaS company to achieve a $10bn valuation.

With the funds, the company hopes to hire more staff to its team, which is currently 650 strong. It also hopes to open new offices in Austin, Dallas and Washington DC. Wiz is not just focused on the US, with plans to expand in EMEA and APAC.

Wiz’s technology scans every layer of the cloud to provide complete visibility and leverages its security graph’s context to highlight the real risks. Through this, customers can quickly identify, prioritise and remove risks in their cloud.

The security graph offers contextual insights that proactively and systematically identify toxic combinations of real risk and attack paths into cloud systems.

Over the past year, the cloud cybersecurity provider expanded its platform with new modules for container and kubernetes security, data security posture management and cloud detection and response.

Its technology is used by 35% of Fortune 100 companies, including BMW and Morgan Stanley.

New York-headquartered Wiz was founded in early 2020 and launched out of stealth by December 2021. Since its inception, the company has raised a total of $900m in funding. Its backers include Sequoia Capital, Insight Partners, Blackstone and G Squared, as well as prominent angels including Starbucks founder Howard Schultz.

Trade finance firm Marco nets $200m credit facility

Marco, a tech-enabled trade financing platform built for SMEs in Latin America and the US, has received a $200m credit facility.

The facility was provided by middle-market lender MidCap Financial and global asset-based private credit specialist Castlelake. Marco also announced it raised $8.2m in equity funding, led by Arcadia Funds.

The company claims it couples smart decision models with best in-class industry experts. Marco said it is the first operating system for SMEs in trade in LatAm addressing the most pressing problem in today’s lending climate.

Marco added that it unleashes the big power of small businesses by simplifying, accelerating, and reimagining cross-border trade with cutting-edge technology.

The firm claims its tech-powered risk solutions outperform traditional financing methods, enabling SMEs to receive a decision within days instead of weeks and 24-hour approval turnaround, accelerating their ability to participate in the global economy.

Last year, Marco lent $100m faster than any other LatAm fintech, and has financed over $254m with zero losses since inception and saw 1,500%+ CAGR in funding between 2021 and 2022.

Marco aims to fund $750m by the end of 2023, focusing on target segments in the US and across LatAm, specifically in Mexico, Ecuador, Colombia, and Peru, where total exports exceed $490bn.

The new funding will support Marco’s growing client base and portfolio to expand its trade finance platform and suite of trade services aimed at closing the $2trn global trade finance gap that impacts SMEs.

Montreal InsurTech Equisoft bags $125m

Equisoft, a Montreal-based insurance and investment software developer, has raised $125m in equity investment.

Of the total investment $70m came from new investors Investissement Québec and the government of Québec, with the remainder coming from Export Development Canada and Fondaction.

The remainder came from existing long-time investment partners, Export Development Canada (EDC) and Fondaction.

Founded in 1994, Equisoft has positioned itself at the forefront of digital transformation for the life insurance industry and a leader in wealth and investment management technologies.

Since its inception in Montreal, Quebec, Equisoft has been focused on both its financial growth and positive economic, social, and environmental impact.

Equisoft said the new funding will contribute to its global expansion, both organically and through strategic acquisitions.

It will also accelerate further development of its integrated life insurance software platform and wealth products to better serve its global customer base.

Student Finance secures $41m for flexible payment plans

Student Finance, a European FinTech that offers flexible payment plans for education, has raised $41m in Series A funding.

According to StudentFinance, The World Economic Forum predicts that the world will need to retrain 1 billion people by 2030 in order to match the growth trend in technology required jobs.

As such, Student Finance is developing AI models to map the future of the most in-demand skills across regions and industries. The company said the insight gained from its models help determine opportunity within the markets and guide graduates into jobs and estimate their future earning potential.

Student Finance is a private lending company operating in Spain, Portugal and the UK and is not affiliated with Student Finance England.

According to a report from TechCrunch, the equity element was led by Iberis Capital, with participation from Armilar Venture Partners, Mustard Seed Maze, Giant Ventures, Seedcamp , Monzo founder Tom Blomfield, and former U.K. MP Ed Vaizey. The debt element was provided by French asset manager SmartLenders Asset Management.

London-based InsurTech Flock nets $38m

Flock, a London-based InsurTech focused on commercial vehicle fleets, has secured $38m in its Series B funding round.

Octopus Ventures served as the lead investor, with a commitment also coming from CommerzVentures. Existing investors Social Capital, Dig Ventures, Anthemis and Foresight Ventures also joined the round.

With the funds, Flock hopes to expand into new segments of the commercial motor industry, as well as new geographies.

In addition to this, the company is planning to double down on its data-driven approach to risk quantification and dynamic pricing. To do this, it will increase the size of its data science and engineering teams, as well as more than double its UK team.

Flock’s mission is to incentivise and enable commercial motor fleets to adopt safer driving habits. The company, which covers cars, vans and trucks, leverages millions of miles of driving data, environmental data, accident and crime data to accurately predict, price, and reduce vehicle risks.

It is the home of the world’s first real-time insurance product for car rental platforms, courier companies and corporate fleets. Safer driving is rewarded with lower insurance premiums.

It works with over 600 commercial fleet customers, including Jaguar Land Rover, Europe’s largest electric car subscription company Onto, and a third of the UK’s independent Amazon fleets.

Flock’s services are also being used to create safer roads. Its real-time telematics data helps customers understand risk and identify high-risk drivers and routes. It claims to reduce its customers’ crash frequency by 10%.

SESAMm bags $37m to bolster the growth of its NLP technology

SESAMm, which develops natural language processing (NLP) technology for global investment firms, has raised $37m for its Series B2 funding round.

This capital infusion will help SESAMm expand into the US and Asian markets, as well as bolster its team with hires in its sustainability, technology, sales and marketing teams.

The capital will also be used to support the technology development to generate AI-powered ESG and sentiment analytics.

Deep tech venture capital firm Elaia co-led the funding round with Opera Tech Ventures, the venture arm of BNP Paribas. Other commitments came from asset manager Unigestion, Raiffeisen Bank International’s venture capital entity Elevator Ventures, AFG Partners, CEGEE Capital, and existing backers, including Carlyle and New Alpha Asset Management.

Founded in 2014 by CEO Sylvain Forté, COO Pierre Rinaldi, and CTO Florian Aubry, SESAMm claims to be one of the fastest-growing NLP analytics data providers. Its clients include private equity firms, hedge funds and other asset management companies, as well as corporations of all sizes.

Payments intelligence platform Pagos inks $34m

Pagos, a payments intelligence company, has scored $34m in a Series A funding round headed by Arbor Ventures.

Also taking part in the funding round was Infinity Ventures, Underscore VC and Point 72 Ventures. Pagos was founded by veterans from PayPal and Braintree.

Pagos claims it is merchant-centered, data powered, and tech enabled. The firm said it is focused on reducing payments complexity, driving better performance and revenue growth, and fostering a community of learning across the payments industry.

The firm’s core team has 50 plus years of collective experience in financial technology, and it claims its mission is driven by what they have learned.

Pagos said it wants firms to be able to deliver best-in-class payment experiences and understand when and where things are changing over time.

The Pagos platform is used by big name brands such as Warner Bros Discover, GoFundMe, Eventbrite and Adobe. It helps these companies turn digital payments data into actionable business insights.

The proceeds from the raise will be used to expand its engineering team and further develop its platform enterprise product suite.

ESG platform Novata raises $30m in Series B

Novata, a platform and public benefit corporation that provides private markets with an ESG solution, has scored $30m in a Series B raise.

The round was led by Hamilton Lane and saw participation from the Ford Foundation and S&P Global.

In addition, Microsoft joined the investor consortium through its Climate Innovation Fund. Partners and managing directors from companies such as Clearlake Capital, Lindsay Goldberg, The Vistria Group, Canson Capital Partners and Hellman & Friedman.

Novata claims its solution takes a much-needed systems-wide approach in the private markets, bringing together the non-profit and for-profit sectors to help drive impact toward sustainable and inclusive capitalism.

Since its launch in 2022, Novata has experienced significant global demand and today has more than 3,500 private companies contracted to use the platform.

The company launched its unique benchmarking capabilities in November 2022, enabling clients to compare key non-financial data against public and private market industry averages and identify opportunities for improvement.

Novata also launched its broad-reaching analytical tools, which it claims offering an unprecedented view of ESG performance in private markets by providing clients with access to anonymised and reliable data from thousands of companies in its contributory database.

Novata said its funding will enable the company to meet the private markets’ need for a simple and secure data management and analytics platform to enable investors to align their capital flows with the metrics that matters to them.

Archway secures $15m in Series A funding haul

Archway, a firm that provides a single access point to connect any banking platform to third-party financial software providers, has bagged $15m.

The company also launched its platform for banks to modernise and personalise digital customer interactions. The round was led by Madrona and WaFd Bank.

Archway’s platform enables banks to easily integrate their core banking products into the latest web, mobile, voice, and AI technologies. Archway said that it centralises the data from disparate systems and allows banks to have a holistic view of their customers to serve their banking needs better.

Archway provides a single access point through an API to seamlessly connect a bank’s core internal technology stack to consumer-facing applications. These applications could be anything from budgeting apps to loan application workflows.

Archway also helps banks consolidate and integrate their data safely, providing one source of truth for decision support and untangling the complexity of merging back-end systems.

DeFi firm Brale scores $11.1m in funding haul

Brale, an Iowa-based firm that claims it enables decentralised and centralised finance to work hand-in-hand, has landed $11.1m in funding.

The round was headed by New Enterprise Associates and saw participation from Matthew Prince – co-founder and CEO of Cloudflare – and Albert Wenger, who is the managing partner at USV. NEA’s Scott Sandell joined Brale’s Board of Directors.

According to FinSME, Brale enables institutions to create and manage stablecoins on distributed protocols.

Integrated natively with popular retail chains, its platform can create new stablecoins or extend an existing private project to additional blockchains.

Brale intends to use the newly raised capital to invest in research and development while supporting its regulatory efforts in the US.

Gen AI startup Robin AI secures $10.5m

Robin AI, a generative AI startup, has scored $10.5m in a funding round headed by investor Plural.

Also taking part in the round were Episode 1 and angel investors such as Tom Blomfield and senior executives across the legal and private equity industries.

Robin AI’s machine learning model is trained on proprietary data from 4.5 million legal documents, enabling users to draft and negotiate contracts 60-80% faster, saving up to 75% on legal fees.

These savings are enabled by Robin’s unique SaaS + services business model, which combines a ‘lawyer-in-the-loop’ with the latest machine learning technology and the integration of the latest models from Anthropic.

Robin AI has grown revenue 20x since its last fundraise and is already cash flow positive, reviewing over 12,000 contracts per year.

This latest round will drive further development of its tech team and has enabled the partial acquisition of competitor LawGeex, whose customers include UBS, PWC, Ebay and Pepsi.

Robin AI is adding a cohort of these customers to its existing base of private equity and financial services clients including law firm Clifford Chance, and impact fund Blue Earth Capital.

AI identify verification platform Vouched bags $6.3m

Vouched, an AI-driven identity verification firm, has scored $6.3m in funding from SpringRock Ventures and BHG VC.

Vouched’s expansion plans build upon the company’s rapid growth over the past year. The company now serves more than 300 banks, FinTechs, and healthcare providers, including Alloy and Hims Health. Vouched’s proprietary AI and computer vision platform now covers more than 85% of the global population, it claims.

Ramp secures $5m to help teams plan for the future

Ramp, a forecasting analytics startup, has raised $5m in seed funding to transform how global finance teams plan for the future.

The round was led by AlbionVC and Eurazeo. Triple Point Ventures participated, alongside high-profile angel investors including Barnaby Hussey-Yeo CEO at Cleo, and Stephane Kurgan, Ex COO at King.com, among others.

Ramp was created after co-founder Angus Lovitt realised the majority of quarterly target “misses” were not due to company performance but the quality of the forecast itself. In other words, factors that could have been predicted at the time.

According to Ramp, the root cause of such poor revenue forecasting is that in 99% of businesses, the financial modelling still takes place on spreadsheets which are no longer fit for purpose. “They’re inaccurate, time-consuming and too open to ‘subjective’ interference from different areas of the business with their own agendas,” the company said.

Ramp aims to allow teams to take the guesswork out of forecasting. The platform runs scenarios and forecast in minutes and predicts customer behaviour, future revenue and the annual growth of a firm.

This helps to avoid the costly consequences of incorrect resource allocation, wasted marketing spend, underinvesting, and missed targets, Ramp said.

Spade collects $5m to clean transaction data

Spade, which is improving transaction data to improve finance, has secured $5m in its seed funding round.

The investment was led by a16z, with commitments also coming from YCombinator, Gradient Ventures and Dash Fund. Angel investors from Square, Alloy, Coinbase, MANTL and Venmo also joined the round.

Following the close of the seed round, the company hopes to expand its international coverage, broaden the types of transactions it supports and improve its merchant data with proprietary insights.

Spade claims that it cleans and enriches transaction data in real time through first-party data sets. Transactions are matched one-to-one with actual merchant identities, categories and geolocations. They are also enriched with details such as logos, business hours and spending histories to give a fuller picture of a purchase.

With this information, card issuers, anti-fraud companies, neobanks and others can enhance real-time authorisation flows, implement spend controls, fine-tune fraud prevention models and more.

Xceedance backs Vitraya in Series A round for automated claims and payments

Vitraya Technologies, an India-based technology platform that enables automated claims decision making for insurers and real-time payouts to providers, has secured $4.1m in Series A funding.

Xceedance, a global provider of digital transformation solutions, technology, and analytical services to the insurance industry, together with a consortium of investors, backed Vitraya.

Founded in India, Vitraya Technologies is on a mission to revolutionise claims decision-making and settlements in health insurance.

Its holistic solution aims to address the pain points of both hospital administrators and insurance companies.

The platform uses AI and blockchain technologies to automate payment integrity, medical coding, and benefits administration for insurers. The automation ensures easy claims documentation and filing, reduced errors, document and information completeness, and minimal processing time for healthcare providers and insurance claims processors.

Vitraya said healthcare systems utilising solutions from Vitraya Technologies report reduced claims administration costs, better process transparency, and improved efficiency. Insurers report reduced processing costs and lower fraud losses.

CyberTech Secfix eyes Europe growth after $3.8m seed

Secfix, which helps SMEs in Europe automate security compliance, has raised $3.8m for its seed round as it seeks European expansion.

Octopus Ventures, a London-based venture capital firm, served as the lead investor. Other commitments came from Neosfer and the founders of Signavio and Blair.

Existing Secfix backers also committed to the seed round.

With the burst of funds, Secfix aims to bolster its expansion in Europe, boost its product growth and expand customer support. It is currently exploring ways to expand its tool integration offering and increase the platform’s level of automation.

Founded in 2020, Secfix automates all processes SMEs need to set up their IT security and get certified with the standards ISO 27001, TISAX, GDPR and SOC 2.

It helps companies meet security standards by connecting to their tech stack, including platforms such as Azure, Office365, AWS, GCP, Jira and Personio. It then collects the required information and generates a checklist to help them become and remain certified in the standards they need.

Secfix claims its platform can save businesses hundreds of engineering hours and get them compliant within weeks, whilst also saving auditors 30% of their time.

The CyberTech company was founded on the back of a marketplace for ethical hackers. The founders wanted to help companies find verified and trustworthy ethical hacking companies and was able to attract some big enterprises as customers, as well as smaller startups.

However, the founders soon realised there was a bigger problem for SMEs around the world, which was the need for tools to help meet ISO 27001 compliance. With this goal, the team expanded its solution to help companies automate their compliance.

CyberTech firm trackd lands $3.35m in seed funding

trackd, a cybersecurity firm that claims it takes the fear out of vulnerability remediation, is emerging from a period of stealth with $3.35m in seed funding.

The round was led by Flybridge and saw participation from Expa, SaaS Ventures and Lerer Hippeau.

trackd’s unified vulnerability and patch management platform leverages the collective experience of security and IT teams to automate vulnerability remediation without fear of disruption.

The company’s patch management platform records the experience of all patches applied by its users, anonymizes that data, and makes it available in real-time to all other users. Thus, if a patch is disruptive, that information is now available to other vulnerability remediation teams applying the same patch, enabling them to plan accordingly.

Conversely, if a patch is applied multiple times with no evidence of disruption, practitioners can leverage auto-patching to speed remediation with little to no impact on their finite resources.

NFT trading startup NeoSwap AI nets $2m pre-seed

NeoSwap AI, an AI-powered NFT trading startup, has closed its pre-seed investment round and bagged $2m.

The round was led by Digital Asset Capital Management and AngelHub. Also taking part in the round were Dhuna Ventures, Stacks Ventures, Gossamer Capital and several angel investors.

NeoSwap AI claims it seeks to revolutionise commerce with its multi-party, multi-item trading platform powered by artificial intelligence.

It said its proprietary algorithms allow for ‘efficient trade discovery’ using digital assets and minimal currency, offering a new and more efficient form of commerce compared to traditional centralized methods that require greater liquidity.

The company also recently made history with the world’s first Ordinals NFT smart auction, hosting the event for Brian Laughlan, creator of the notable “Satoshibles” NFT project.

Consumer FinTech ZIPZERO lands over £1m in seed funding

ZIPZERO, a consumer app that enables users to get cash rewards by sharing receipts from their purchases, has bagged over £1m in seed funding.

According to Financial IT, following the sharing of the receipts from purchases, these can then be used to pay household utility bills.

The company claims its mission is to improve the financial well-being of everyday consumers by enabling the transparent exchange and monetisation of individual shopping data.

The company raised over £1m from a range of angel investors including the founder of Global Processing Services Craig Dewar.

ZIPZERO already has more than 100,000 users in the UK and will use the funding to grow its platform further, as well as securing new partnerships with retailers and brands, and give consumers even greater value and autonomy over their personal shopping data.

More than 30,000 new users signed up to use the app in January 2023 alone, with consumers searching for ways to combat record-high energy bills and double-digit inflation. Many large retailers, including Asda, Boots, Ebay and Sainsbury’s, have partnered with ZIPZERO to support their customers, allowing them to earn cash towards the payment of their household bills each time they shop.

Guava secures $650k to advance racial wealth equity mission

Guava, digital banking and networking platform by and for black entrepreneurs, has scored $650,000 in funding from Laidlaw Scholars Ventures.

Guava has a mission to narrow the racial wealth gap in the US by facilitating the development, growth and resilience of black-owned businesses.

In addition to its mobile-first and seamlessly connected banking platform, Guava also offers access to an expansive community where Black entrepreneurs can connect, learn, and partner with each other.

Laidlaw Scholars Ventures, a new Venture Capital fund established by the Laidlaw Foundation to invest in mission-led businesses by Laidlaw Scholars, invested $650,000 as an extension of Guava’s pre-seed round last year.

The funding will be used to expand the product and its community aspect, supporting Guava in providing insights and sharing best practices with their customers.

Swiss climate tech startup secures CHF 500k pre-seed

Pelt8, a Swiss climate tech startup, has secured CHF 500,000 ($533,000) in its pre-seed funding round, which was led by SICTIC investors.

SICTIC (Swiss ICT Investor Club) is a non-profit association that connects investors with Swiss tech startups seeking seed and early-stage capital.

Among the investors was Stableton co-founder and CEO Andreas Bezner. The pre-seed round was backed by individuals from sustainability, technology and financial services.

Founded in 2021, Pelt8 enables climate action by implementing scalable processes and controls to collect sustainability-related data in an easy and auditable way. The platform supports international reporting standards, bespoke management reports and automates reporting.

Through Pelt8, clients can manage disclosures, collect clean data, and connect and share.

Smartlockr raises capital to bolster email data security

Smartlockr, a people-centric data security provider, has received an investment as it looks to grow internationally.

The size of the investment was not disclosed, but was backed by Round2 Capital, NextGen Ventures 2, and Security of Things Fund.

With the capital, the Dutch CyberTech company plans to grow internationally, and bolster the development of its technology.

The CyberTech company offers an easy-to-use platform for organisations to prevent data leaks of sensitive information.

Smartlockr is attempting to solve the human error in communications, which it claims is the main cause of preventable data breaches. It claims the issue is largely a result of firms forgetting about user-friendly experiences with cybersecurity.

Due to this, Smartlockr combines technical innovation with a people-centric approach, making it easy for users to share data and not make mistakes.

Keep up with all the latest FinTech news here.

Copyright © 2023 FinTech Global