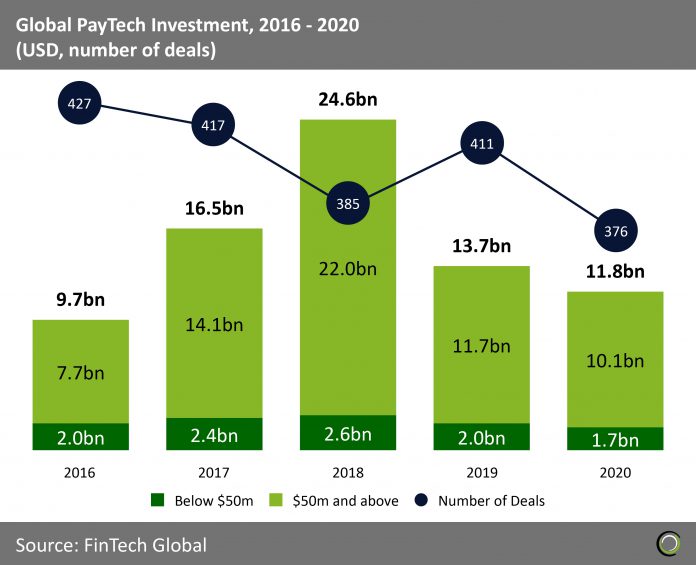

PayTech companies globally raised over $11.8bn across 376 transactions last year

- Global PayTech investment last year recorded its lowest funding levels since 2017. PayTech companies raised over $11.8bn, a decline of 13.19% year-on-year compared to 2019. At the same time deal activity decreased during the year with 376 deals completed compared to 411 transactions in 2019.

- The drop in funding is due in part to global remittances’ sharp decline by about 20% in 2020 due to the economic crisis induced by the Covid-19 pandemic and lockdowns. The fall, which is the sharpest decline in recent history, is largely due to a fall in the wages and employment of migrant workers, who tend to be more vulnerable to loss of employment and wages during an economic crisis in a host country.

- While the global economy is looking for virtual payments, remittances and no contact POS due to the Covid-19 pandemic the decline in both total funding and the number of deals signals that investors are not taking any additional risks by making new large investments

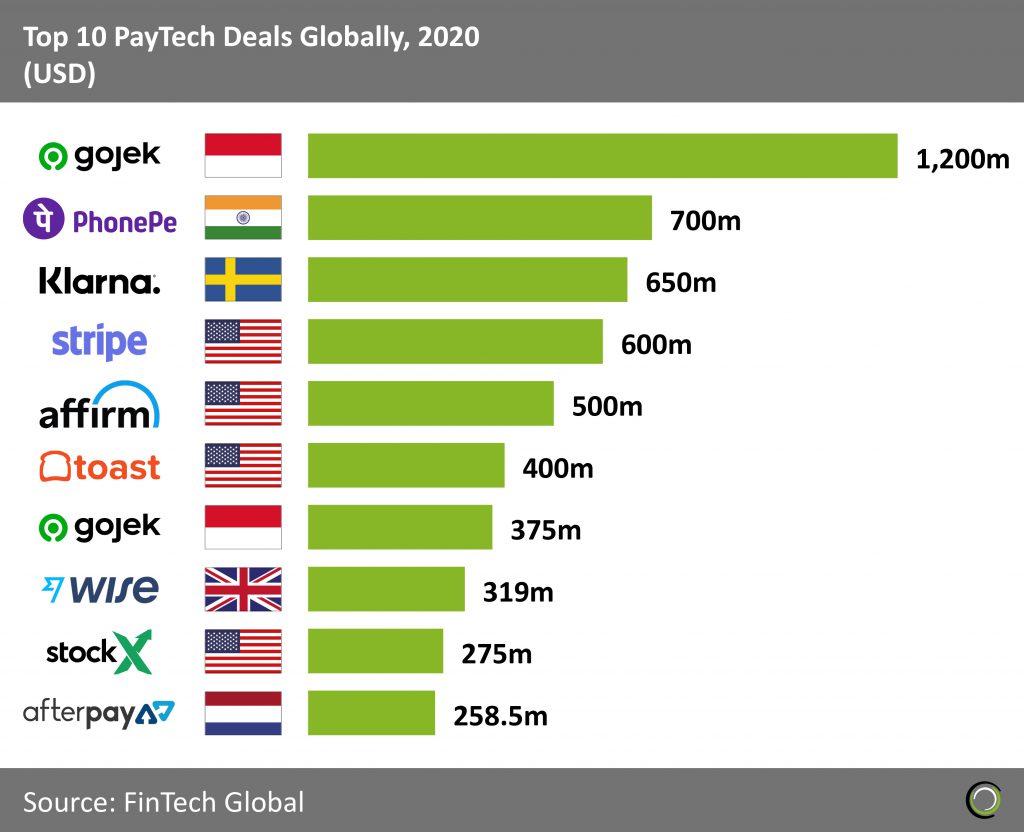

US companies account for four out of the ten top PayTech deals globally in 2020.

The top ten PayTech deals completed globally in 2020 raised in aggregate nearly $5.3bn making up 44.5% of the overall investment in the sector during the year.

The top ten PayTech deals completed globally in 2020 raised in aggregate nearly $5.3bn making up 44.5% of the overall investment in the sector during the year.- The largest deal of the year was completed by Gojek an app that provides a variety of services from payments, food delivery, transportation, and logistics which raised a $1.2bn Series F led by Mitsubishi Corporation and Visa. Despite the new funds, over 100 employees have been laid off by the company as the company moves its attention to a need for greater efficiency and long-term sustainability. Also, the new funds give the company more firepower to compete against their Singapore-based rival Grab.

- US companies took four out of the ten top deals via Stripe, Affirm, Toast and Wise. Stripe, a developer-oriented commerce company helping small and large companies accept web and mobile payments, raised a $600m Series G round led by Andreessen Horowitz and General Catalyst. The company will use the new funds to hire more staff, invest in its software, make strategic acquisitions, and expand internationally. Stripe has launches pending in Bulgaria, Cyprus, the Czech Republic, Hungary, Malta, and Romania. Affirm a financial technology services company providing instalment loans to consumers at the point of sale, raised a 500m Series G round led by Durable Capital Partners and GIC. The funding will be used to introduce an interest-free biweekly payment product for transactions as low as $50.

- The largest deal outside the United States and Asia was completed by Klarna, an eCommerce payment solutions platform for merchants and shoppers, which raised a $650m Private Equity Round lead by Silver Lake. This funding round makes Klarna the highest-valued private fintech company in Europe with a post-money valuation of $10.6bn.

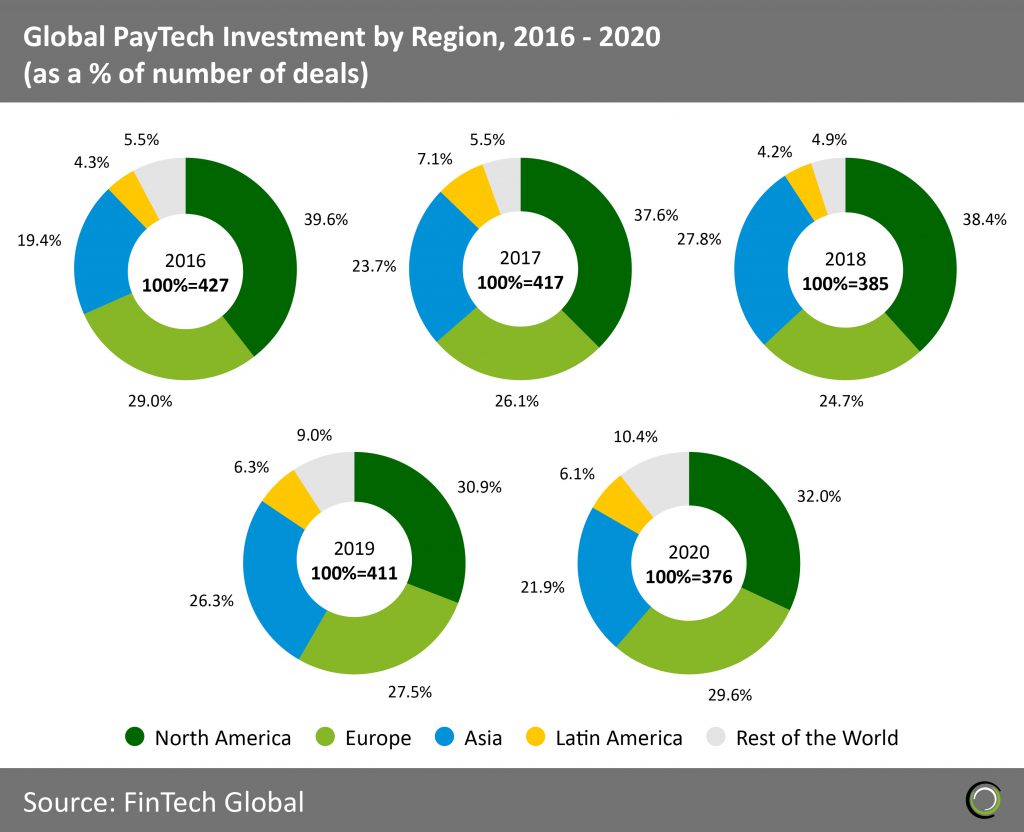

Companies in North America and Europe captured over 60% of the global PayTech deals in 2020

The digitalisation of global payments and the increase use of contactless payments has led to a rise in demand in the Payments & Remittances sector specifically for mobile payments, POS and E -commerce with companies in North America and Europe at the forefront of this innovation.

The digitalisation of global payments and the increase use of contactless payments has led to a rise in demand in the Payments & Remittances sector specifically for mobile payments, POS and E -commerce with companies in North America and Europe at the forefront of this innovation.- Companies in North America strengthened their position as the leaders in the PayTech sector, taking 32% of the total deal share in 2020 which is an increase of 1.1 percentage points (pp) compared to 2019.

- Europe’s deal share increased 2.1 percentage points (pp) compared to 2019. This is due to the fact that Europe is at the forefront of mobile payments and contactless POS. Research and investment in such technologies has been flowing since 2014. In fact, since 2017 cash payments have been declining in the region and in 2020 more than half of the European Payments were contactless.

- Asia’s share of PayTech deals fell by 4.4 percentage points (pp) due to early lockdowns at the start of the year. Despite the lockdown being lifted, there has been a slower recovery in the deal activity as foreign investors moved back to established markets.

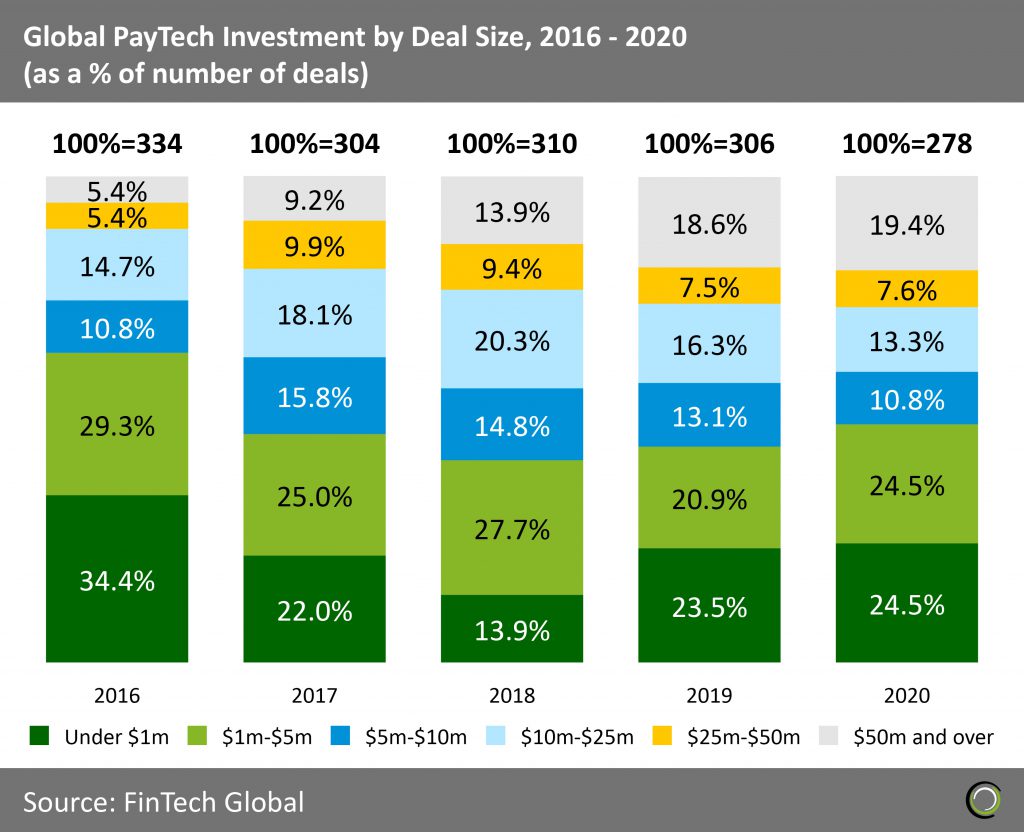

Shares of deals under $1m have been growing since 2018, showing that Investors are backing new innovation in the sector

From 2016 to 2018, the share of deals under $1m saw a decrease in its share of 20.5 percentage points (pp) to only 13.9% in 2018. Since then, deals under $1m have almost doubled, reaching a three-year high of 24.5% in 2020 suggesting investors are backing new innovation in the sector.

From 2016 to 2018, the share of deals under $1m saw a decrease in its share of 20.5 percentage points (pp) to only 13.9% in 2018. Since then, deals under $1m have almost doubled, reaching a three-year high of 24.5% in 2020 suggesting investors are backing new innovation in the sector.- The range that increased the most in 2020 were deals between $1m and $5m which increased 3.6. percentage points (pp) to reach 24.5%, its highest level since 2018. Increase in this range signals that investors rebalanced their portfolios focusing on backing companies that they are currently invested in while betting on new early-stage ventures who are seeing better prospects as digital transformation efforts are boosted amid the pandemic.

- The sector has shown continued signs of maturity over the past five years, evidenced by the share of deals valued above $50m increasing from 5.4% in 2016 to 19.5% in 2020.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global

The top ten PayTech deals completed globally in 2020 raised in aggregate nearly $5.3bn making up 44.5% of the overall investment in the sector during the year.

The top ten PayTech deals completed globally in 2020 raised in aggregate nearly $5.3bn making up 44.5% of the overall investment in the sector during the year. The digitalisation of global payments and the increase use of contactless payments has led to a rise in demand in the Payments & Remittances sector specifically for mobile payments, POS and E -commerce with companies in North America and Europe at the forefront of this innovation.

The digitalisation of global payments and the increase use of contactless payments has led to a rise in demand in the Payments & Remittances sector specifically for mobile payments, POS and E -commerce with companies in North America and Europe at the forefront of this innovation. From 2016 to 2018, the share of deals under $1m saw a decrease in its share of 20.5 percentage points (pp) to only 13.9% in 2018. Since then, deals under $1m have almost doubled, reaching a three-year high of 24.5% in 2020 suggesting investors are backing new innovation in the sector.

From 2016 to 2018, the share of deals under $1m saw a decrease in its share of 20.5 percentage points (pp) to only 13.9% in 2018. Since then, deals under $1m have almost doubled, reaching a three-year high of 24.5% in 2020 suggesting investors are backing new innovation in the sector.