Companies in the sector completed 126 deals globally with six $100m+ transactions closed in the US

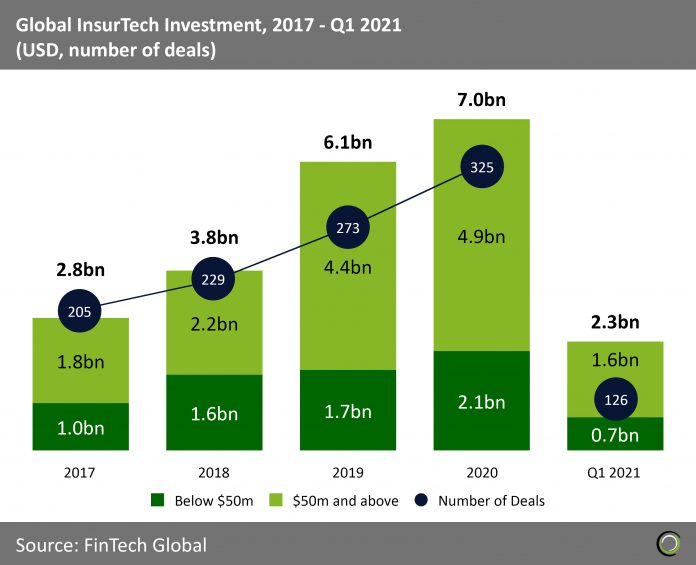

- The global InsurTech industry saw tremendous growth in investment between 2017 and 2020 as investors sought to take advantage of the increased demand for digital services from traditional insurance companies and financial institutions. Total funding reached a record $7.0bn levels last year despite the coronavirus-caused economic uncertainty.

- Increased share of total funding came from deals over $50m reaching 70% in 2020. However, capital invested and deal numbers also grew for transactions under that threshold. This shows that the sector received a healthy portion of investment in the early-stage market during the period as more areas of the insurance value chain were targeted by innovative startups.

- Investment in the sector had a strong start to 2021 with nearly $2.3bn invested across 126 deals. While most of the capital came from large transaction, funding raised in deals under $50m showed increased promise and is already at 33.3% of the record levels reached in 2020.

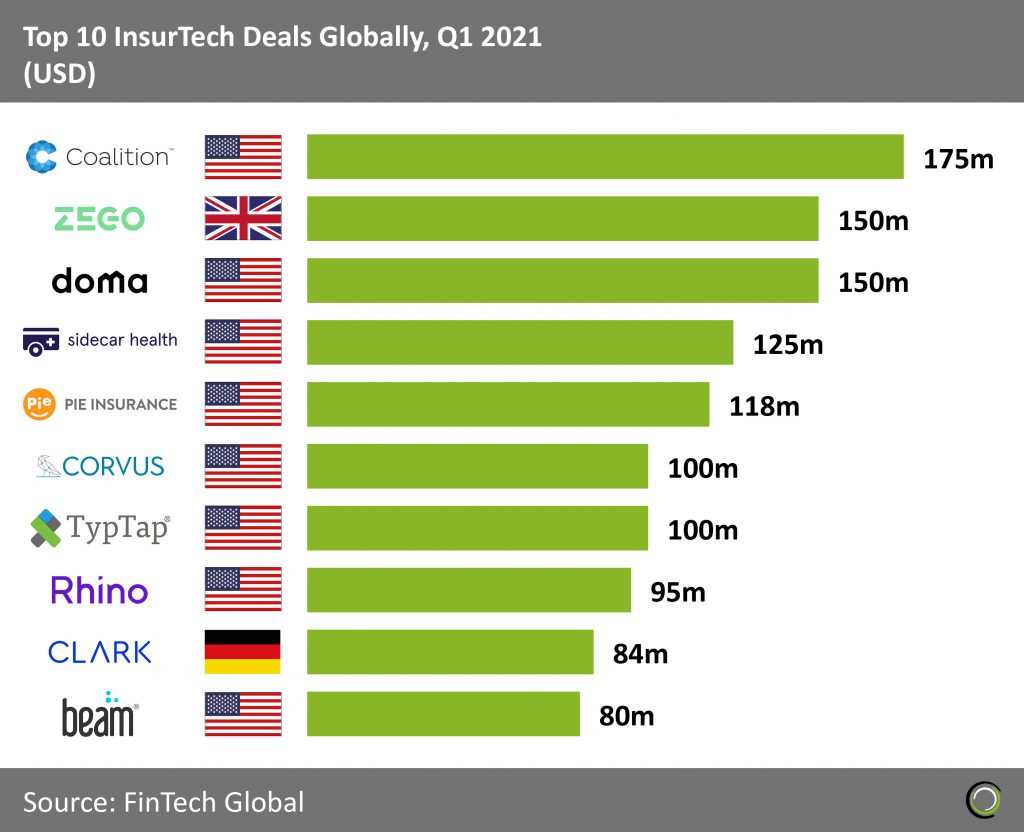

US companies raised eight of the top ten InsurTech deals globally in the opening quarter of 2021

- The top ten InsurTech deals in the first three months of the year collectively raised just under $1.2bn, making up 52.2% of the overall investment in the sector during the quarter. The total is much higher than the levels recorded in Q1 2020 when the ten largest transactions raised just over $500m.

- Notably as the coronavirus pandemic spread investors moved to back companies in established markets such as the US and Europe. As a result, American companies completed eight of the top deals in Q1 with Zego, a UK-based commercial motor insurance company, and Clark, a German insurance platform, rounding off the list.

- The largest deal of the period was raised by Coalition, an InsurTech offering comprehensive insurance to recover from cyber failures or breaches, which raised $175m in a Series D round led by Index Ventures. With the new capital, the company is looking to release new product lines, including insurance policies that address the risks facing modern enterprises but are missed by existing protections. Additionally, the company hopes to expand internationally into multiple new markets.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright © 2021 FinTech Global