As the WealthTech sector continues to grow at a rapid rate, FinTech Global has named the 100 most innovative companies in the space, as part of its third annual WealthTech100 list.

The prestigious list recognises the world’s most innovative tech solution providers, which are addressing the digital transformation challenges and opportunities faced by asset managers, private banks and financial advisors.

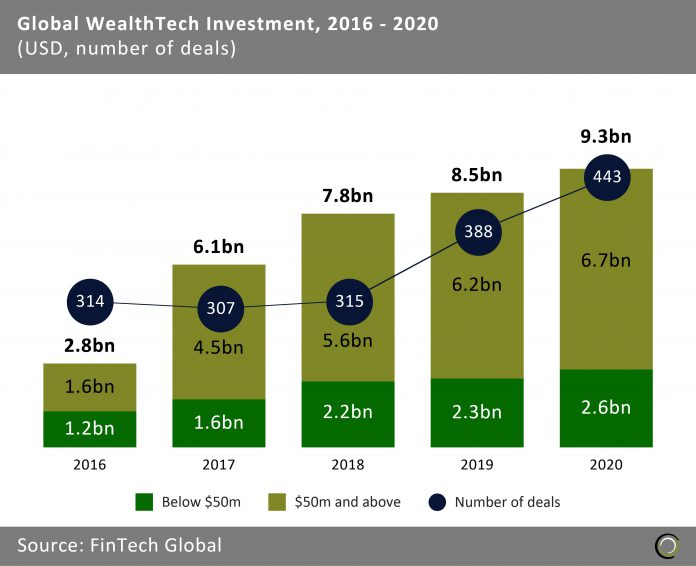

Investment into the WealthTech sector has more than tripled over the past five years, growing from $2.8bn in 2016 to $9.3bn in 2020. Despite last year’s market uncertainty, there was a 9.6% year-on-year growth compared to the amount of capital raised in 2019, according to data by FinTech Global.

As the sector continues to grow rapidly, this year’s process to identify the leading 100 companies was more competitive than ever. A panel of experts voted from a list of more than 1,000 businesses.

As the sector continues to grow rapidly, this year’s process to identify the leading 100 companies was more competitive than ever. A panel of experts voted from a list of more than 1,000 businesses.

Successful companies were selected based upon their innovative use of technology to solve a significant industry problem or generate cost savings, or efficiency improvements across the investment value chain.

FinTech Global director Richard Sachar said, “Established banks and investment firms need to be aware of the latest innovations to remain competitive in the current market, which is heavily focused on digital distribution and increased use of customer data, and even more so post Covid-19.

“The WealthTech100 list helps senior management filter through all the vendors in the market by highlighting the leading companies in sectors such as client acquisition, financial planning, portfolio management and digital brokerage.”

Among the 100 companies in the list were TelosTouch, which elevates client experiences with digital tools and empowers advisors with actionable insights; WealthObjects, which helps firms launch modern fully automated or hybrid digital business models in investing and savings as a B2B financial technology partner; and Movius, а unified cloud-based communication solution used by leading financial institutions for compliant voice, text, and WhatsApp messaging.

Many of the companies on the list have recently featured in the news. For example, European open banking platform TrueLayer recently closed a $70m Series D funding round. The capital was supplied by a group of investors, including Addition, Anthemis Group, Connect Ventures and NorthZone, and will be used to fuel its global expansion.

Similarly, AlgoTrader, which offers institutions and professional traders with quantitative trading solutions, secured CHF 5.2m ($5.6m) in funding. The equity, which was supplied by Credit Suisse Entrepreneur Capital, investiere, Blockchain Valley Ventures and NeueCapital, will help the WealthTech support its scaling efforts.

Another company recently in the headlines was Wealth Dynamix. The company recently launched its new feature CLMi, a cloud-based SaaS solution for wealth managers. This tool is designed to meet requirements and budgets of mid-tier discretionary fund and investment managers.

Smarsh, a provider of capture and archiving technology and services, hit the news at the end of last year following the acquisition of Digital Reasoning. The deal enabled Smarsh to extend its capabilities and help customers spot risks before they happen.

HUBX also hit the news after it partnered with Finastra. The deal will see HUBX Arranger, a digital front-office solution, integrated with Finastra’s back-office loan software Fusion Loan IQ to create an end-to-end offering that boosts efficiency and leverages data insights and automation to improve customer experiences.

Other worthy mentions on this year’s WealthTech100 are customer communications and engagement technology provider Doxim; tactical robo advisory platform supporting financial advisors Strategy Marketplace; digital wealth planning platform PaxFamilia; and FinTech Automation, which automates financial institution’s front, middle and back-office.

Moreover, Kidbrooke is also among the latest WealthTech100. The company offers B2B financial analytics APIs, which helps organisations create the seamless financial services of tomorrow.

Ortec Finance was among the companies thanks to its leading technologies and solutions that enable financial institutions to manage the complexity of investment decision-making.

GBST provides the global wealth sector with technology that enables them to streamline operations to rapidly launch new products and engage customers.

Etops offers an ecosystem for the financial industry which includes operational services, multi-bank reports, interactive dashboards, compliance solutions, PMS and CRM systems.

SwissQuant earned its spot for being the first wealth management platform to fully integrate ESG systematically throughout the entire portfolio construction and advisory process.

Finally, Tindeco VISION enables wealth managers to implement highly scalable operating models so that they can efficiently offer customised investment solutions.

The full list of the WealthTech100 can be found at www.WealthTech100.com.

Copyright © 2021 FinTech Global