Financial planning and having an investment strategy in place is far from straightforward, but Kidbrooke explains how technology can make it a seamless journey.

In a new video, the WealthTech100 company, which is part of Sweden’s FinTech ecosystem, outlined how its solutions can benefit people to have a seamless financial experience.

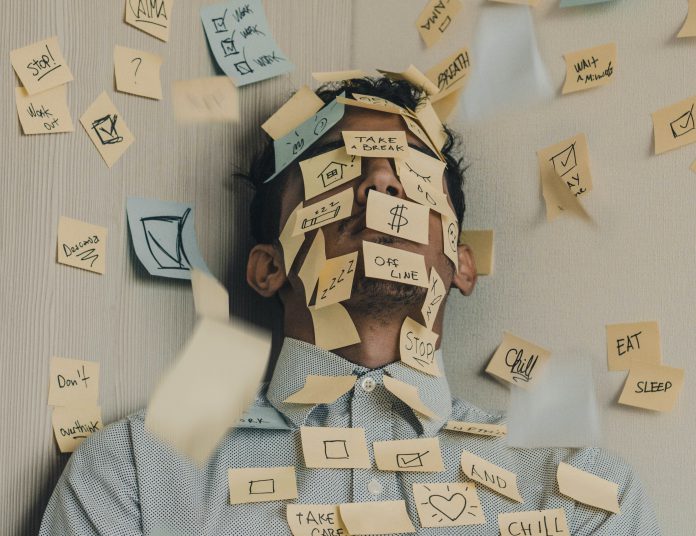

The video kicked off by acknowledging that executing a financial decision is an activity fraught with uncertainty, anxiety and worries.

The lack of support has created seams making the financial services industry a fragmented one where only the wealthy were able to afford an asset manager. However, with the advent of modern technology, banks and insurers can take the weight of uncertainty off customers’ shoulders and guide them through financial decisions considering the big picture. Yet, most people have to cope with a limited supply of low quality, generic or biased financial decision support. “The financial services industry and their current solutions lack scalability or relevance,” it said.

To better financial wellbeing, the solution is using tools that don’t require people to have endless spreadsheets but an easy-to-use cloud-based API solution.

That’s where Kidbrooke’s OutRank comes in, which aims to help people build the financial future they desire and lay the foundations for a world where everyone can make educated financial decisions.

Its API helps users in a range of financial experiences such as pension planning, investment advice and guidance, credit, mortgages and insurance journeys. It also stitches all these concerns together. OutRank guides customers through the intricacies of their pension planning while also considering their mortgage situation and overall financial health.

Alongside fixing its customer’s financial health, it also ensures regulatory compliance. “Depending on your ambition regarding compliance, we offer both regulated advice or guidance capabilities, and we can quickly adapt to the regulatory frameworks of the countries of your choice,” the video showed.

Indeed, it’s time to leave inconsistent, inaccessible or siloed financial guidance or advice in the past, it said.

Copyright © 2021 FinTech Global