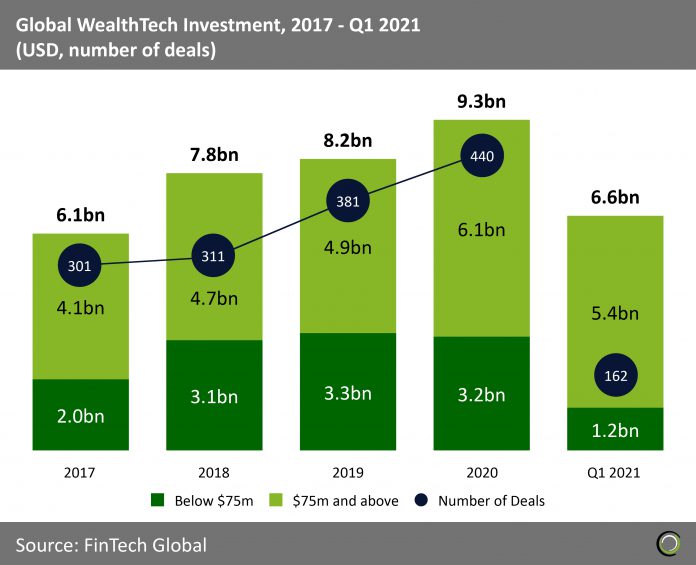

WealthTech companies raised $6.6bn across 162 deals in Q1 2021 with Robinhood completing a massive $3.4bn funding round

- The global WealthTech industry saw strong growth in investment between 2017 and 2020 as investors backed new digital services to manage personal finances, open online bank accounts and invest money with low fees. Total funding grew at a CAGR of 15.1% from $6.1bn to nearly $9.3bn at the end of last year.

- Deal activity also consistently increased during the period, reaching 440 transactions in 2020 compared to 301 deals in 2017. The trend is on track to continue as the first quarter of 2021 saw 162 transactions completed in the sector, a figure nearly double the 86 funding rounds raised in Q1 last year.

- Investment in the sector had a strong start to 2021 with $6.6bn. The funding was driven by large deals over $75m which made up 81.8% of the total capital raised during the quarter.

Robinhood raised the largest WealthTech deal in the first quarter as demand for retail trading services grows

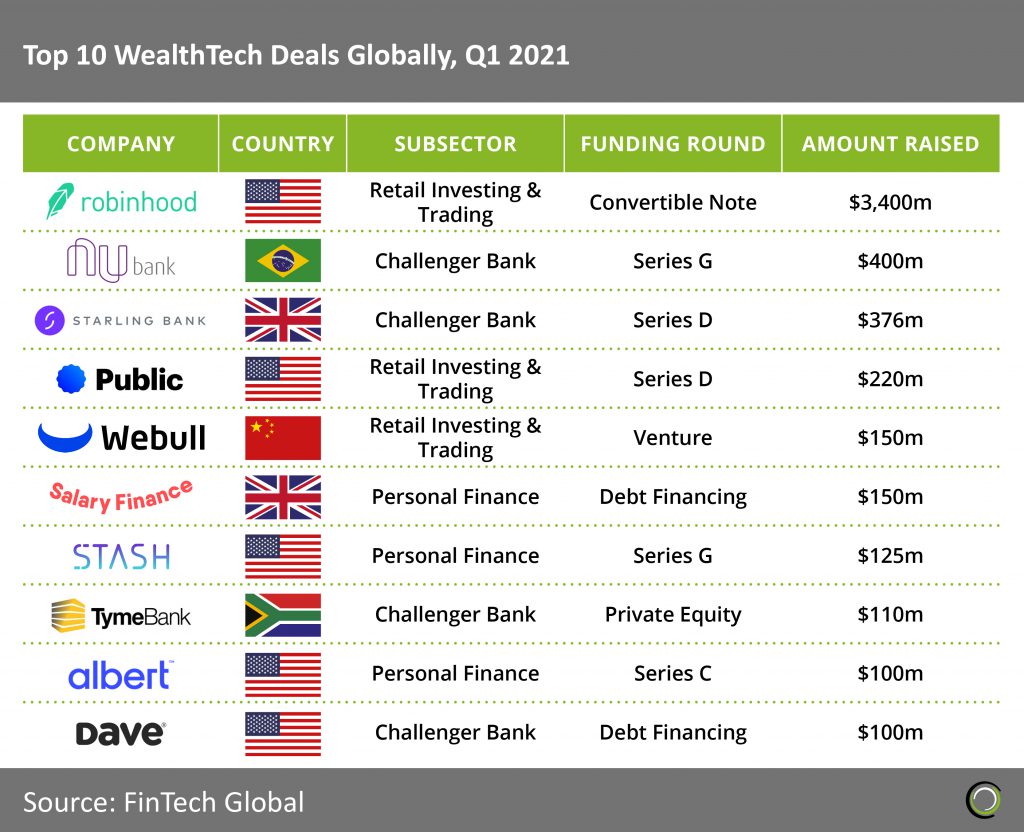

The top ten WealthTech deals in the first three months of the year collectively raised just over $5.1bn, making up 77.2% of the overall investment in the sector during the quarter.

The top ten WealthTech deals in the first three months of the year collectively raised just over $5.1bn, making up 77.2% of the overall investment in the sector during the quarter.- The high concentration of capital is mainly due to Robinhood mammoth $3.4bn fundraise in February. The company needed a big capital injection as a response to the surge of activity on the platform amid a huge wave of investors buying stocks during the Gamestop chaos. Ribbit Capital served as the lead investor and the capital injection will be used to scale the company platform and as well as invest into its financial literacy tools to help those new to investing better understand the ecosystem.

- During the same period Robinhood came under criticism when it stopped people from buying stocks in several companies seeing a lot of trading activity. This boosted prospects of their competitors and investors followed suit by backing Public.com, an investing social network, and Webull, a stock trading mobile application, with $220m and $150m in the first three months of 2021.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

Copyright ? 2021 FinTech Global

The top ten WealthTech deals in the first three months of the year collectively raised just over $5.1bn, making up 77.2% of the overall investment in the sector during the quarter.

The top ten WealthTech deals in the first three months of the year collectively raised just over $5.1bn, making up 77.2% of the overall investment in the sector during the quarter.