Brazil-based digital bank has C6 Bank received an investment from JPMorgan Chase, which sees it take a 40% ownership stake in the FinTech.

The size of the investment was not disclosed.

With the funds from the round, the company hopes to enhance its products on offer.

Founded in 2019, C6 claims to have over seven million customers on its digital platform. Its platform offers a suite of financial tools, including multi-currency checking and savings accounts, debit and credit cards, travel and loyalty programmes, investment and lending products for individuals, and banking and payment products for small businesses.

JPMorgan Chase CEO of international consumer Sanoke Viswanathan said, ?Weve admired C6 Bank, its management team and their strategy for some time. With an impressive platform and product suite, they are well-positioned to sustain their growth trajectory and build a strong franchise. We look forward to supporting C6 Bank in its aspiration to be a long-term winner in the Brazilian banking market.p>

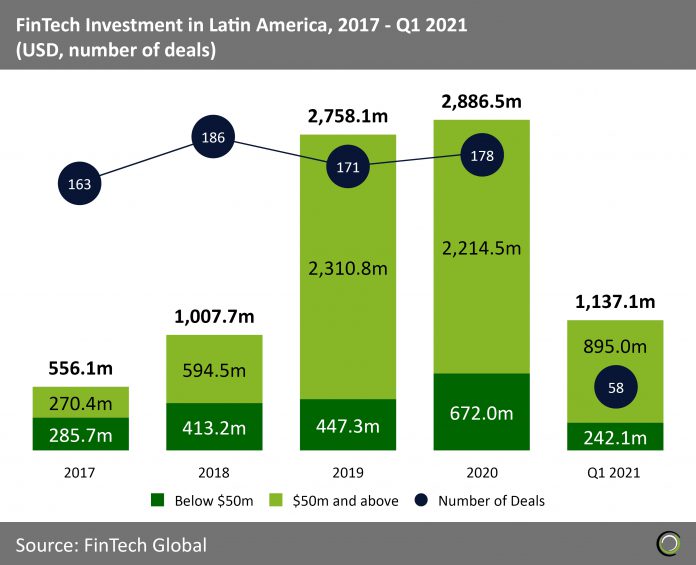

FinTech investment in Latin America hit a new high in 2020, with a total of $2.8bn invested across 178 deals, according to data from FinTech Global. Since 2017, the region has raised a total of $8.3bn has been invested.

In the first quarter of 2021, a total of $1.1bn was invested into Latin American FinTechs. Brazil was responsible for five of the largest deals. Real estate platform Loft, which helps simplify the buying and selling processes of properties, raised the most of the quarter in a $425m round.

Copyright ? 2021 FinTech Global

Copyright ? 2021 FinTech Global