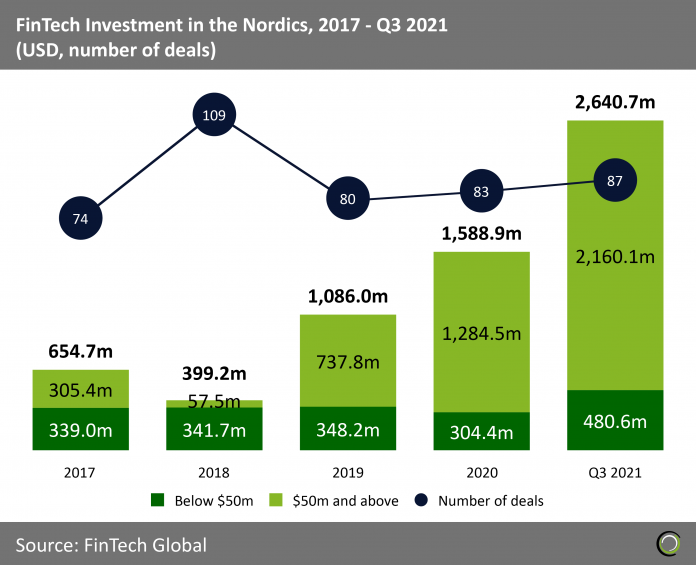

FinTech companies in the region raised more than $2.6bn across 87 deals during the first nine months of the year

- The FinTech industry in the Nordics recorded strong funding growth between 2017 and 2020 as investors backed innovative startups in the region developing digital solutions to tackle some of the pressing legacy challenges financial institutions and customers in the region were facing. Total capital invested grew at a CAGR of 34.4% from $654.7m to nearly $1.6bn at the end of last year.

- Deal activity also increased during the period, peaking at 109 transactions in 2018 before slowing down to 80 in 2019. However, with 87 FinTech deals completed in the first nine months of 2021 the sector is on track for a new record if the pace continues.

- At the same time, FinTech funding growth in the region continued its strong upward trend in 2021 as it only took six months to set a new funding record. FinTech companies raised $1.99bn in the first half of the year and that figure increased to $2.6bn in the third quarter, going above the $2bn mark for the first time ever. That being said, 62.1% of that funding came from two large deals completed by Klarna, which raised $1bn and $639m in March and June, respectively.

FinTech funding growth in the Nordics doesn’t seem to be slowing down as five of the top 10 FinTech deals in 2021 were completed in Q3

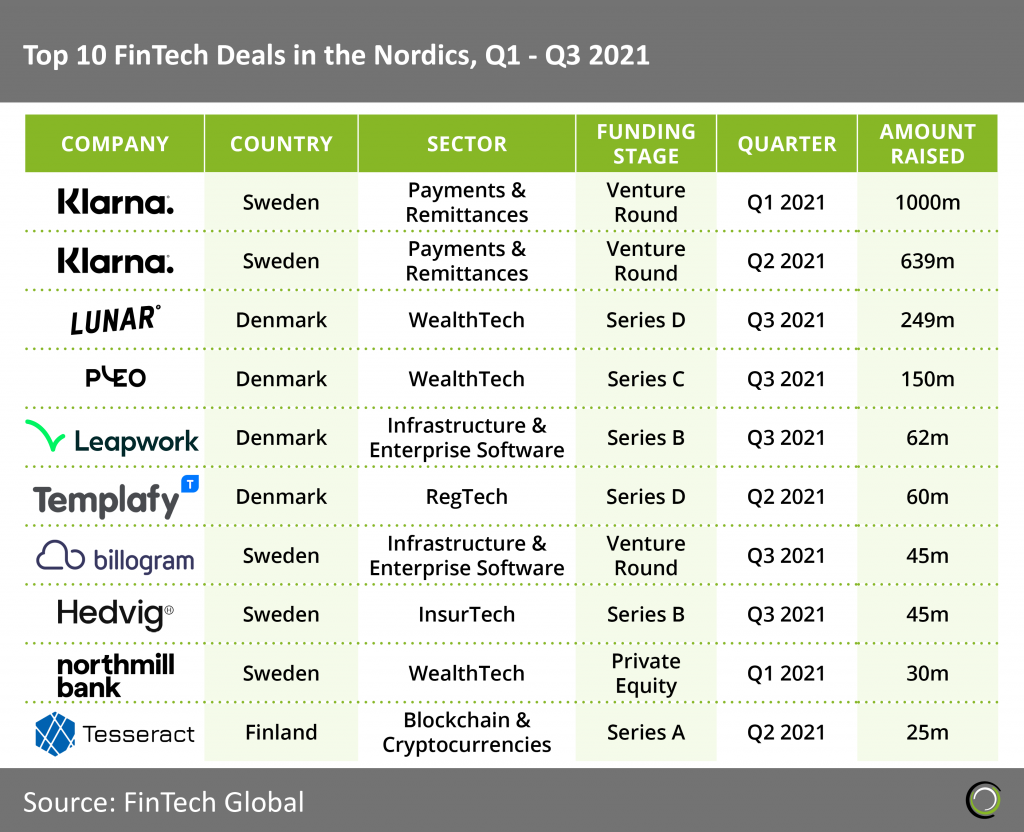

The top ten FinTech deals in the Nordics completed so far in 2021 raised in aggregate $2.3bn, making up 87.3% of the overall investment in the region during the quarter. The high levels of concentration of capital in large deals is to be expected given the massive deals raised by Klarna so far this year.

The top ten FinTech deals in the Nordics completed so far in 2021 raised in aggregate $2.3bn, making up 87.3% of the overall investment in the region during the quarter. The high levels of concentration of capital in large deals is to be expected given the massive deals raised by Klarna so far this year.- Deals completed in Q3 took five spots on the list with Lunar, a digital bank that offers a mobile-based banking app that helps consumers manage their personal finances, raising the largest deal of the period. The company completed a $249m Series A round led by Heartland, the largest of its kind for a Nordic challenger bank. The company serves over 325,000 customers in the region and the bank received applications from over half of the newly established Danish SMEs during 2021 – adding €130m in deposits in June. This funding will help Lunar fast track the rollout of its digital-first financial offering in all Nordic countries, as well as accelerate its strong momentum, grow its business offering and support potential future acquisitions.

- The only company outside of Sweden and Denmark to make the list was Finland-based Tesseract, a provider of digital asset lending solutions to institutional clients, such as hedge funds and retail trading platforms, which raised $25m in Series A funding led by Augmentum Fintech. The funding will be used to develop the company’s industry-leading institutional offerings, hire new talent to develop new and existing partnerships, and to boost innovation in new undisclosed financial products.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global

The top ten FinTech deals in the Nordics completed so far in 2021 raised in aggregate $2.3bn, making up 87.3% of the overall investment in the region during the quarter. The high levels of concentration of capital in large deals is to be expected given the massive deals raised by Klarna so far this year.

The top ten FinTech deals in the Nordics completed so far in 2021 raised in aggregate $2.3bn, making up 87.3% of the overall investment in the region during the quarter. The high levels of concentration of capital in large deals is to be expected given the massive deals raised by Klarna so far this year.