Low-code payment infrastructure Primer has scored $50m in its Series B round, which puts its valuation at $425m.

The round was backed by ICONIQ, as part of a new partnership. Commitments to the round also came from Accel, Balderton, RTP Global, Seedcamp and Speedinvest.

With the support of the funds and new partner, Primer hope to bolster its development and capitalise on the market opportunity. Primer is also looking to triple its headcount during 2022.

Speaking on the fundraise, Primer co-founder Paul Anthony said, “Less than 2 years ago my co-founder, Gabs and I were sat in our offices at PayPal struggling to aide merchants with their overarching payments woes.

“The payments landscape is blowing up at a rapid pace, and merchants need to leverage the best products and services from across the web to offer the payments experiences their customers expect when they checkout, no matter where they are.”

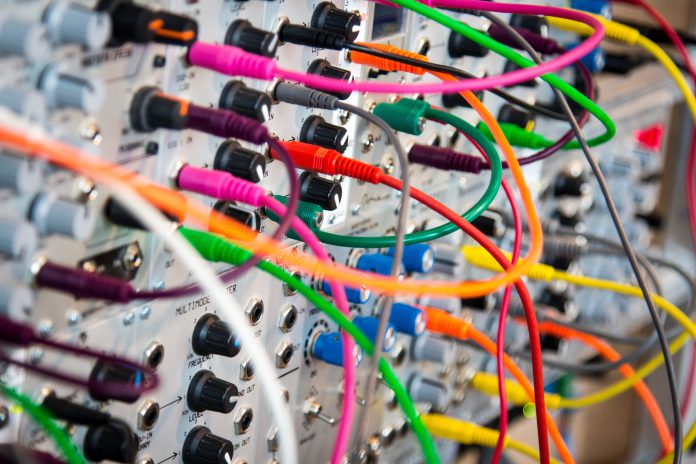

He continued to state that merchants now have complex ecosystems with many products and services, such as multiple payments providers, 3D secure, alternative and local payment methods), fraud platforms, payouts services, KYC tools, loyalty platforms, tax calculation and FX services, chargeback management platforms, and more.

Primer was designed to solve this complex issue by giving merchants an open automation platform for payments. By leveraging Primer, a merchant can connect and maintain their ecosystem through a unified API and checkout.

The FinTech company previously raised $14m in its Series A round back in 2020. Commitments came from Accel, Balderton, SpeedInvest, Seedcamp and RTP Global.

Copyright © 2021 FinTech Global