Pace, a Singaporean FinTech company offering buy now, pay later services, has collected $40m in its Series A funding round.

The round was backed by investors from across Asia, including Singapore’s UOB Venture Management, Japan’s Marubeni Ventures, South Korea’s Atinum Partners and Taiwan’s AppWorks. Investments also came from family offices in Japan and Indonesia.

Previous Pace backers Vertex Ventures Southeast Asia, Alpha JWC, and Genesis Alternative Ventures also committed capital to the Series A.

Pace claims this funding round makes it the fastest growing multi-territory BNPL player from Singapore.

Funds from the investment have been earmarked for expanding technology, operations and business development. It plans to reach a gross merchandise value run rate of $1bn in 2022 and grow its user base by 25-times in the next 12 months.

Launched in 2021 by Turochas ‘T’ Fuad, the platform allows consumers to split their purchases into three interest-free payments across a 60-day period. It aims to foster financial inclusion by helping people control their purchases to meet their financial positions. To date, the company has over 3,000 point-of-sales across Asia.

Pace founder and CEO Turochas ‘T’ Fuad said, “This investment from some of the most successful and established investors signals confidence that Pace is a leading BNPL player in Asia.

“The region is expected to become the world’s fastest-growing BNPL market, and this funding supports Pace in achieving its mission of democratizing financial services for all, by helping us pave our expansion into Japan, Korea, and China Taiwan.”

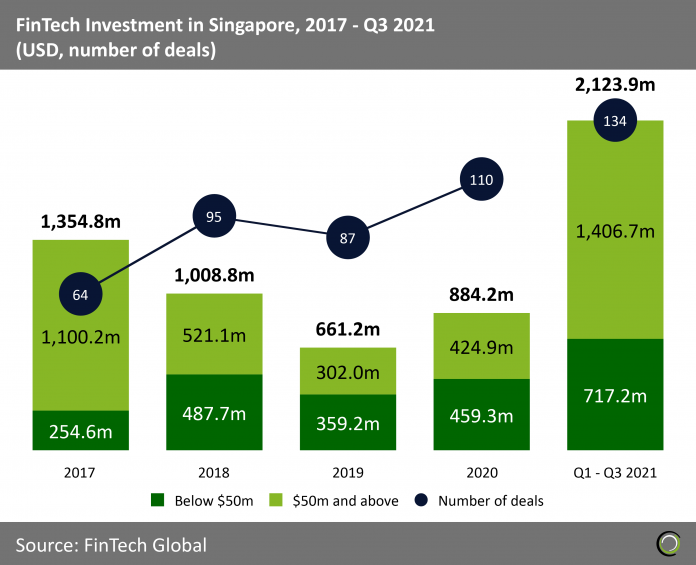

FinTech investment in Singapore reached a major milestone this year. Total funding has exceeded $2bn for the first time, achieving this goal after just three quarters.

Copyright © 2021 FinTech Global