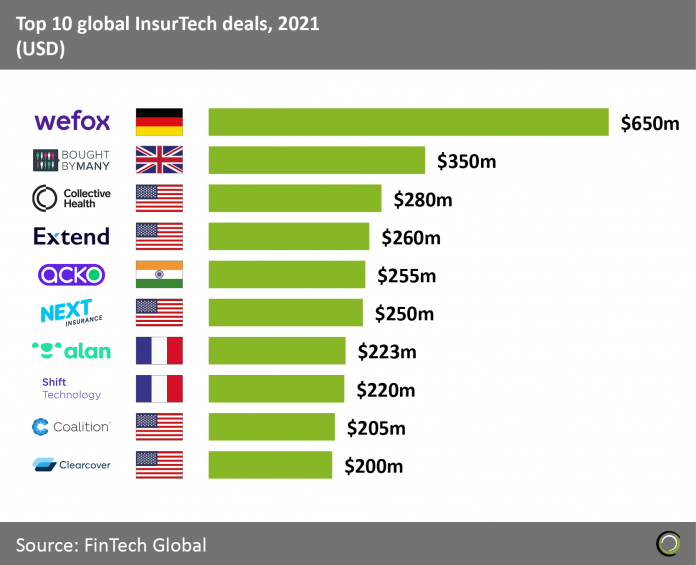

Insurance technology continues to reshape the industry with 74% of insurance companies seeing FinTech innovations as a challenge for their industry. As a result, investors are not afraid to write big cheques to companies leading the way in the sector. Wefox, a European digital insurer, tops the 2021 list of largest deals with a $650m series C funding round led by Target Global, bringing their valuation to $3bn. Global InsurTech investment more than doubled in 2021 to $13.4bn with deals above $100m accounting for 64% of the total capital compared to 57% in 2020. This shows that the industry is maturing as larger, later funding round capital is generally used to expand and offer new products. Innovation in InsurTech is also continuing to grow with pre-seed, seed and angel funding rounds increasing by 81% in 2021. Nearly 40 countries had pre-seed, seed and angel funding rounds last year, a 65% increase from 2020. The majority of these funding rounds belong to the US, Europe and India but this shows that there are more countries fostering strong InsurTech ecosystems.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global