Billions of dollars are invested into FinTech companies each year and 2021 was no different. The sector has seen eye watering amounts of capital deployed into the sector, but what companies made out with the most?

While it is a little early to get the total amount of capital raised by FinTech companies in 2021, it is certain to have capped $1trn. After just the first three quarters of the year, $91.5bn was invested in FinTech companies, almost twice as much as what the sector amassed in 2020, according to a report from Forbes.

With so much capital flooding into the sector, it comes as little surprise that 151 companies joined the unicorn club in 2021. Making this impressive feat even more so, is that the FinTech sector was responsible for a third of all new unicorns in 2021, according to data from FinTech Global.

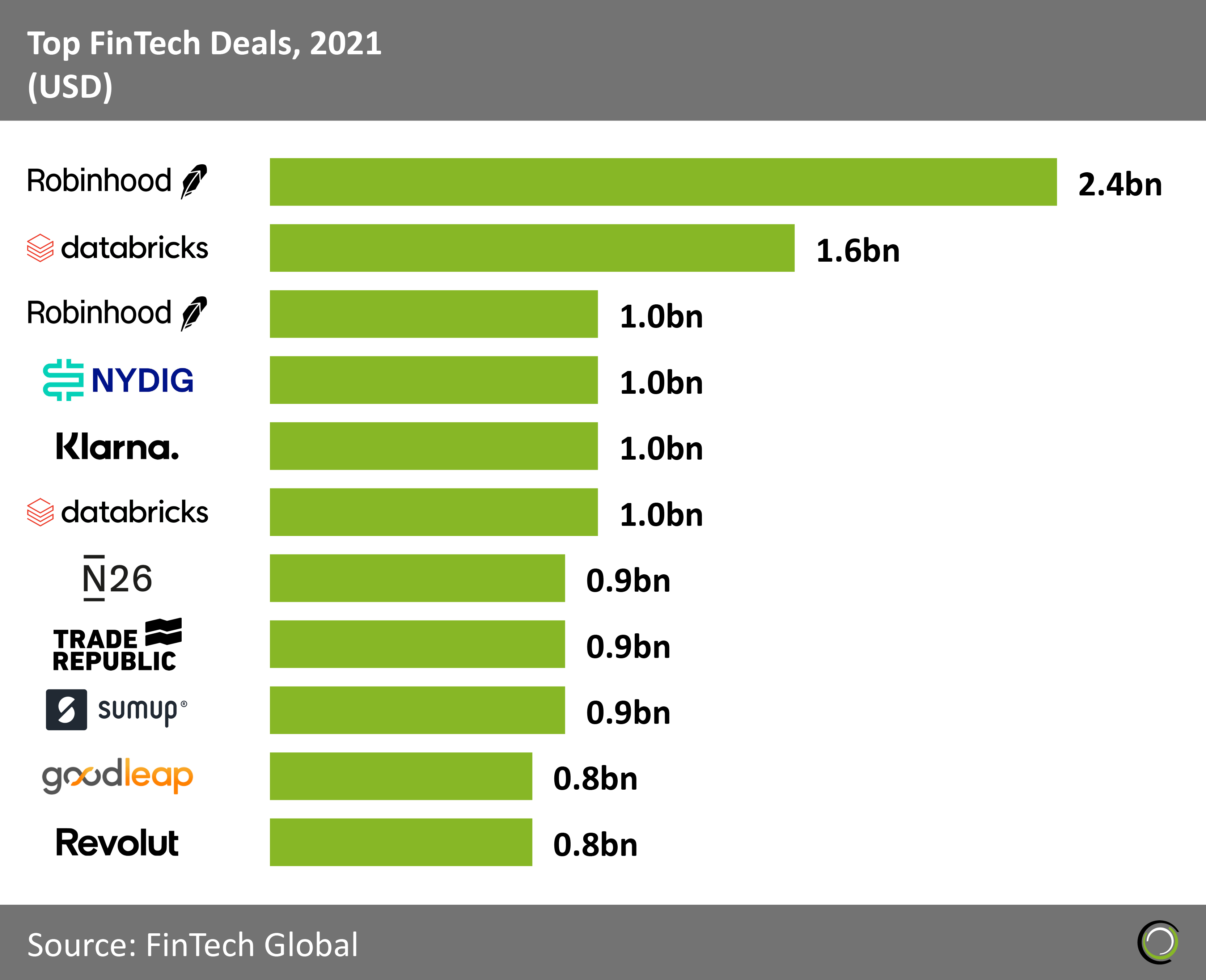

While so many companies topped up their coffers these are the biggest 11 deals of the year.

Robinhood tops the list after a monumental year

The retail trading giant had a busy 2021, filled with highs and lows. Not only does the company account for two of the biggest FinTech deals, but it also held a relatively successful IPO.

It got off to a rocky start in 2021, with it coming under fire for how it handled the GameStop saga. The GameStop trading surge saw people bet against mega hedge funds and support the floundering company, as well as several others. While the trend was in full swing, Robinhood stepped in and prevented consumers from trading shares in companies like GameStop that had been part of the trading movement. As a result, the FinTech company was hit with major criticism from traders and governments, with other companies named after the mysterious hero getting caught in the crossfire. Robinhood’s CEO and co-founder Vlad Tenev eventually had to apologise in front of a congressional hearing on the situation.

This trading debacle was behind Robinhood’s big funding rounds this year. It initially raised $1bn in emergency funds in January after it was strained by high volumes of trading. A week later it closed an additional $2.4bn to support its operations.

In August, Robinhood went on to hold its IPO and closed its first day on a valuation of $32bn. However, despite being one of the biggest IPOs of the year, it fell short of its $35bn prediction. It even earned the title of the worst first day of trading for a company that raised high amounts of capital.

Near the end of 2021, Robinhood was hit by a data leak incident, where an unauthorised third party obtained a list of email addresses for five million users and the full names of a further two million.

Databricks bags pair of colossal funding rounds

Another FinTech company to double dip in the fundraising market this year was data management company Databricks.

The company’s first funding round of 2021 was a $1bn Series G round, which valued the business at a staggering $28bn. The investment was led by Franklin Templeton and was supported by Canada Pension Plan Investment Board, Fidelity Management & Research and Whale Rock, among others. The investment capital was raised to accelerate its growth plans and support the rapid adoption of its services.

Just months after this impressive fundraise, Databricks bagged an additional $1.6bn in capital. The Series H round upped its valuation to $38bn, making it one of the highest valued FinTech companies in the world. The capital infusion was led by Counterpoint Global, with commitments also coming from Baillie Gifford, ClearBridge Investments and UC Investments, as well as several existing Databricks backers. It raised the additional capital to accelerate the adoption of its services.

The FinTech company claims to be the world’s first lakehouse platform in the cloud. A lakehouse platform is an environment that combines elements of data warehouses and data lakes. Its platform offers open and unified architecture for data and AI, which it claims brings the strong governance and performance of a data warehouse directly to the data lakes.

Databricks is looking to give back to support the startup community. In December, the company revealed its first strategic fund which will invest into technology startups across data, analytics and AI spaces.

Databricks co-founder and CEO Ali Ghodsi said, “Databricks has thrived thanks to the entrepreneurial spirit of our founders, and we intend to support the next wave of innovative startups and founders building the future of data, analytics, and AI, especially those within the open-source community.

“We look forward to working more closely with cutting-edge founders and teams that share our view of the future and our commitment to the lakehouse ecosystem.”

NYDIG raises $1bn in less than a year after launch

Last year was another big year for cryptocurrency. Bitcoin prices continued to hit new highs – its highest value reached $68,000 – and other cryptocurrencies took the limelight. Dogecoin was the standout one for the year, while it didn’t hit the heights of Bitcoin, people flocked to buy the currency.

The cryptocurrency market is still shrouded in mystery and governments are continuing to experiment with how they handle the digital currency. Many FinTech companies around the world are trying to take the complexity and worry out of using or trading the assets. One of those at the forefront is NYDIG, which describes itself as a gateway to a new era of financial products. It offers financing and loan servicing, bitcoin donations, consumer products and sub-custody.

NYDIG, which only launched in December 2020, raised $1bn in a funding round that put its valuation to $7bn. The round was led by Westcap, with commitments also coming from Bessemer Venture Partners and FinTech Collective. It raised the funds to deepen its institutional-grade bitcoin platform using recent upgrades to the bitcoin protocol with capabilities such as bitcoin and lightning payments, asset tokenisation, and smart contracts. It also hopes to hire more staff.

WestCap partner Scott Ganeles said, “We are leading the investment round in NYDIG because of a shared belief in the industry-reshaping power of bitcoin and WestCap’s conviction in the NYDIG team to continue to execute on the incredible opportunity in front of them. NYDIG plays a unique role in the industry, empowering companies of all types to incorporate bitcoin in a secure and compliant way.”

The $1bn round was not NYDIG’s only fundraise of the year. In April 2021, the FinTech company secured $100m.

Klarna reclaims crown for Europe’s most valuable FinTech

The Swedish online financial services platform Klarna reclaimed its crown of Europe’s highest valued private FinTech company. The company earned the title following the close of a $1bn funding round, which put its valuation at $31bn.

Klarna has been in a battle for the title over the past couple of years. It originally earned the top spot in September 2020, after a $650m investment put its valuation at $10.5bn. It soon lost the accolade, when Checkout.com achieved a $15bn valuation in January 2021. Klarna took to title back in March 2021 with the $1bn funding round and cemented its position at the top just months later, with a $639m private investment from SoftBank boosting its valuation to $46bn.

The FinTech company announced it would pledge 1% of the capital raised in the $1bn funding round to an initiative focused on key sustainability challenges around the world.

Klarna co-founder and CEO Sebastian Siemiatkowski said, “At Klarna, we solve problems – that is the heart of what we do for both consumers and retailers. Consumers want transparent products to help them bank, shop and pay that reflect the way they live their lives, not just outdated traditional models.

“Each and every one of us at Klarna will continue to work hard on this, but it is also time for us, with our culture of change, disruption and innovation, to focus on tackling bigger, more complex issues. I believe our industry has a responsibility to help in some way solve global sustainability issues and I hope others will join Klarna in our ambition.”

The FinTech company has had a busy year. Some of its notable developments include: launching in Poland, acquiring price comparison solution PriceRunner, partnering with Marqeta and releasing an interest-free shopping app.

N26 breaks record for digital bank fundraises

Another company to break a record was German digital bank N26, which secured the largest funding round of a European digital bank. The FinTech company raised $900m, which valued the business at $9bn.

The investment round was led by New York-based investors Third Point Ventures and Coatue Management, with commitments also coming from Dragoneer Investment Group. With the capital injection, expand its employee equity pool, while broadening Employee Stock Ownership Plan (ESOP) participation to 100% of employees. N26 also plans to scale its global team, with its goal to hire 1,000 new members in the coming years. Positions will be aimed at product, technology and cybersecurity.

Valentin Stalf, CEO and co-Founder of N26: “This recent financing round solidifies the fact that retail banking as we know it has changed. With our fresh capital, we are in pole position to become one of the biggest retail banks in Europe, all without a single branch.”

It was not all good news for N26 this year. It was forced to pay a €4.5m fine from the Federal Financial Supervisory Authority (BaFin) for its delay in submitting reports around AML. The German regulator allegedly issued the financial penalty due to N26 having delayed submission of less than 50 suspicious activity reports related to AML between 2019 and 2020.

Trade Republic reaches $5bn valuation

Fellow German FinTech company Trade Republic also raised $900m in an investment round this year. The Series C, which was led by Sequoia, extended its valuation to $5bn – more than eight-times higher than its former valuation of $600m in April 2020.

The investment was also supported by TCV and Thrive Capital as well as existing investors Accel, Founders Fund, Creandum and Project A. Capital from the round will be used to expand its operations and business reach.

Founded in 2015, Trade Republic helps people across Europe to invest money into capital markets with a commission-free offering. Users can invest into stocks, ETFs, and derivatives – mobile and commission-free. It also recently added the option to trade cryptocurrencies.

Trade Republic co-founder Christian Hecker said, “Within just 24 months, we have empowered over one million people to put their money to work. For many Germans, French and Austrians, Trade Republic is the home screen app to manage their wealth.”

SumUp raises $900m ahead of M&A efforts

A PayTech company to raise a major funding round was SumUp, which secured $900m in funding. It raised the funds to support its merger and acquisition plans and refinance its debt facilities.

The investment was backed by Goldman Sachs, Temasek, Bain Capital Credit, Crestline, and funds managed by Oaktree Capital Management.

SumUp is currently looking to release a selection of new solutions that will help businesses better navigate challenges brought on by the lockdown. These new tools will include payment links and invoicing options, online selling functionalities and gift card collaborations.

Headquartered in the UK, SumUp enables businesses to accept card payments at the point-of-sale or on the go. It provides businesses with an end-to-end EMV card acceptance solution and is used by 32 markets around the world.

SumUp co-founder Marc-Alexander Christ said, “As one of the fastest growing technology companies in the world, this cash injection – in addition to having the built-in option to expand the financing – will significantly accelerate the growth of our customer base, enhance SumUp’s technology leadership position, and drive the development of new services to support our merchants globally.”

GoodLeap reaches decacorn status for sustainability platform

Sustainability was a major talking point of 2021. The world came together at COP26 to discuss ways to combat climate change. FinTech companies have also stepped up to the plate to help tackle the crisis, whether it is planting trees for spending money or environment-focused investment apps.

GoodLeap, which claims to be the US’ number one point-of-sale platform for sustainable solutions, raised $800m in a funding round. The investment put its valuation at $12bn. MSD Partners served as the lead investor, with commitments also coming from funds managed by BDT Capital Partners, LLC, Davidson Kempner Capital Management LP and additional investors.

The company offers a marketplace that helps consumers easily find different payment terms to make sustainability improvements for their home. GoodLeap has deployed over $9 billion in capital to empower homeowners to upgrade their homes with modern, carbon-reducing solutions.

GoodLeap founder and CEO Hayes Barnard said, “GoodLeap has an unprecedented opportunity to accelerate the adoption of sustainability products while creating mission-driven jobs. Our technology is fundamentally reshaping how the sustainable improvement industry can operate by removing friction between consumers, installers, manufactures, and financial institutions. We’re honored to partner with world class investors who share our mission to connect a world in which everyone can live more sustainably.”

Revolut becomes UK’s most valuable FinTech

UK challenger bank giant Revolut became the UK’s highest valued FinTech company after its $800m Series E round puts its valuation at $33bn. The round was backed by first-time Revolut investors SoftBank Vision Fund 2 and Tiger Global Management.

With the funds, the company plans to grow its services and release new features to meet the needs of its clients. Additionally, Revolut plans to support its expansion in the US and move into new countries, including India.

Revolut, which was founded in 2015, is on a mission to become a financial superapp. It already offers a whole host of services, including banking accounts, budget and analytics, cryptocurrency investing, international remittances, payments, group bills, early salary, savings, and rewards. It is continuing to add to its services, having recently launched an earned wage service that lets employees track their earnings and get instant access to it. It also launched a tool to transfer funds from Bitcoin holdings to their own digital wallets.

Revolut founder and CEO Nikolay Storonsky said, “We want our global superapp to offer our customers 10x better value and 10x better service and security than they can achieve anywhere else. We are building a full financial product suite in a single app, where you will always find the product that best meets your needs.

“Our services will be increasingly personalised, responding to our customers’ daily needs, always with low and transparent fees. As we expand into new markets we are encouraged by our customers’ enthusiasm for Revolut and we look forward to using this investment to further our mission.”

To see how 2021 compared to 2020, find the biggest deals of 2020 here.

Copyright © 2022 FinTech Global