Nigerian B2B payments platform Duplo has raised $4.3m in its seed round, which was supplied by a coalition of investors and angels.

A total of 45 investors joined the round, including Liquid2 Ventures, Soma Capital, Tribe Capital, Commerce Ventures, Basecamp Fund and Y Combinator. Existing Duplo investor, Oui Capital, also joined the seed round.

This capital injection comes after a strong period of growth for the company, having increased the number of businesses on its platform by 1,000%. In the last five months, total payment volume has increased by 4,200%.

The Nigerian B2B payments platform offers an end-to-end solution that automates the back-office processes of generating and processing invoices, receiving and approving bills, collecting and disbursing funds and completing account reconciliation. Duplo is aimed at helping African businesses grow through simplified payments.

It works with all major accounting and ERP platforms, including Microsoft, Dynamics, SAP, QuickBooks and Sage, and payments processed through Duplo are automatically synced in real-time.

Duplo claims businesses can reduce admin tasks by up to 50% and reduce payment-related costs by up to 85%.

The Nigerian B2B payments platform recently released a report, which included the surveyed opinions of over 1,000 business owners from Kenya, Nigeria, South Africa and Egypt. It found that 44% of businesses still have to wait more than 24 hours to receive payments from business customers and partners.

It also found that 34% take up to seven days to receive payments, 17% take up to 30 days and 3% take more than 30 days to receive business payments.

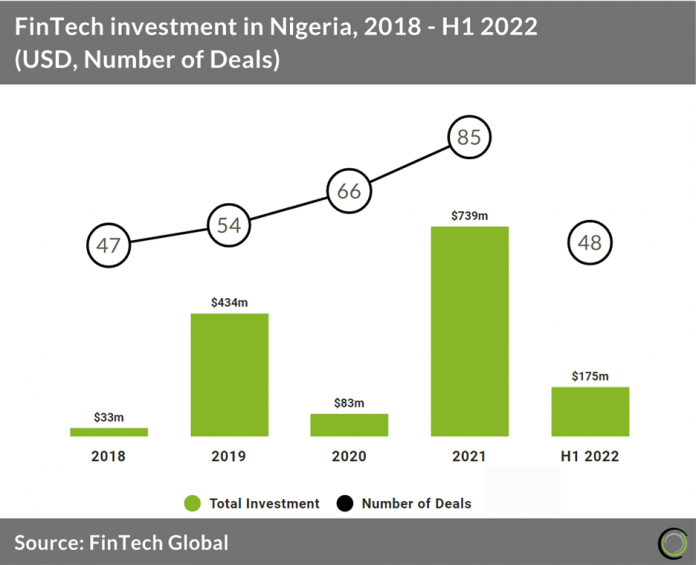

The FinTech sector raised a record amount in 2021, according to data from FinTech Global. A total of $739m was raised through 85 transactions, a major jump from the previous year where $83m was raised through 66 deals.

As for 2022, a total of $175m has been raised through 48 deals, in the first six months of the year.

Copyright © 2022 FinTech Global

Copyright © 2022 FinTech Global