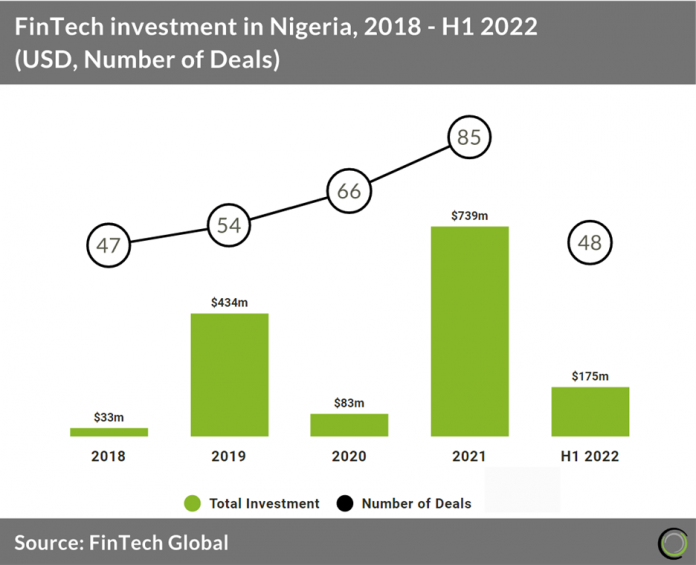

Nigerian FinTech deal activity is set to reach 96 deals in 2022 based on deals in the first half of 2022, a 13% increase from the previous year. Total capital invested in the country is predicted to fall in 2022 based on H1 funding activity. However a $400m deal from OPay, a payment platform, accounted for 54% of total funding in 2021 and when excluded, 2022 FinTech investment pace is on par with last year figures. The Marketplace Lending sector was the most active FinTech sector in H1 2022 with 12 deals, a 25% share of total deals in the country.

Interswitch, a robust payments platform and network, was the largest FinTech deal in Nigeria in H1 2022 raising a substantial $110m in their most recent private equity funding round, which included investment from Tana Africa Capital and LeapFrog Investments. The investment will assist in supporting the company drive to advance the payment ecosystem across Africa.

There is currently no specific regulation for FinTech in Nigeria although In July 2020, the Central Bank of Nigeria (CBN) released a draft framework for a regulatory Sandbox operation aimed at establishing a controlled environment where disruptive technology in the financial services can be tested under the supervision of the CBN. The framework allows for CBN licensees and local companies (including financial sector companies and telecom companies) to participate in the sandbox operations. Innovators whose proposed payment solution involved technologies that are currently not covered under existing CBN regulations are also welcome to participate.

Latest African research here

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.??2022 FinTech Global