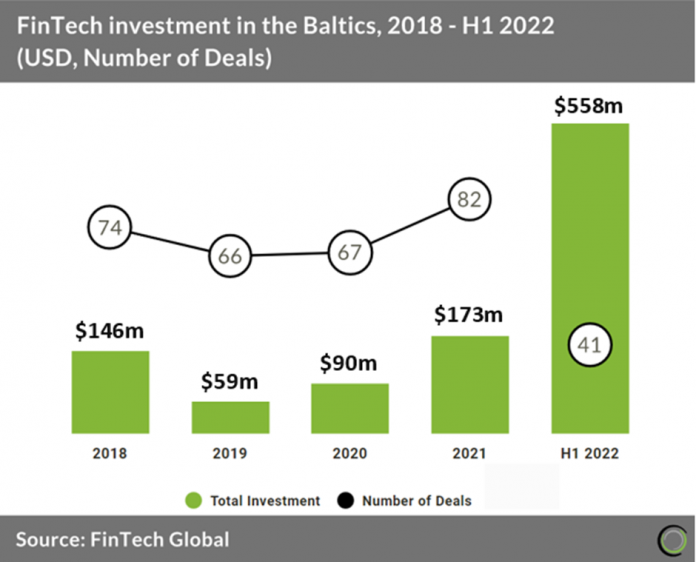

• FinTech investment in the Baltics is expected to increase more than six-fold in 2022 based on funding activity in the first half of 2022. Estonia was the most active FinTech country in the Baltics, accounting for 83% of the deals in the first half of 2022 although investment in the region was dominated by Lithuania which accounted for 53% of total capital invested in the Baltics.

• Venice Swap, a crypto exchange platform based in Lithuania, was the joint largest FinTech deal along with Veriff, an online identity verification company, and Nord Security, an internet privacy and security provider, raising $100m in their initial coin offering led by The Global Emerging Markets Group. Venice Swap intends to use the funds for global expansion and product development. Venice Swap launched the first release of its Crypto Exchange on March 2022 with spot, margin and P2P crypto trading functionalities for the top cryptocurrencies. Other features will be released in the following days and weeks, from the listing of the top cryptocurrencies and of new ERC20 and BSC BEP-20 tokens, to IEO features, referral system and much more.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global