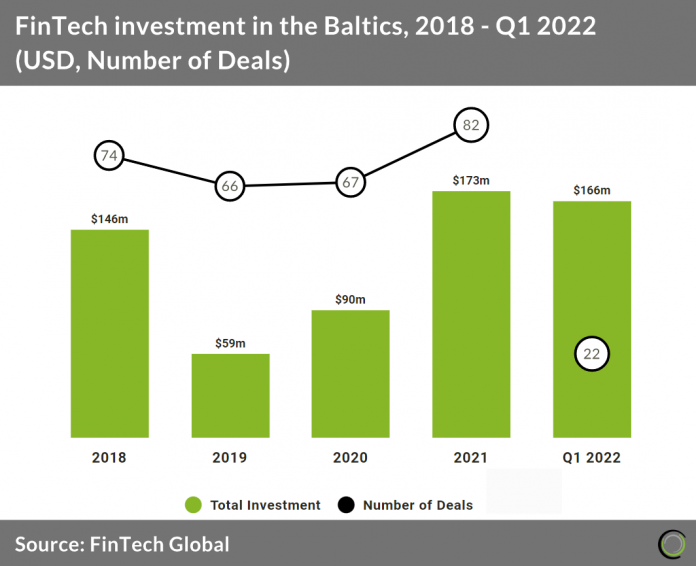

FinTech investment in the Baltics is expected to reach $664m in total for 2022 based on investment in the first quarter of 2022, more than three-fold from 2021. Deal activity is also expected to increase slightly by 7% with total deals reaching 88 for the year.

Veriff, an Estonian online identity verification company, had the largest deal in the first quarter of 2022 raising $100m in their latest Series C funding round from Accel, Alkeon Capital, IVP and Tiger Global Management. The funding round valued the company at $1.5bn and Veriff will use the funds to expand its global customer base. This deal may skew overall investment projections for the region as the deal accounted for 60% of FinTech investment in Q1 2022.

The Baltics have fostered favourable FinTech ecosystems via supportive regulatory regimes in recent years. Lithuania’s central bank set up a regulatory sandbox in 2018, which allows start-ups to test their offering in a live environment for up to six months. The Latvian financial regulator launched an Innovation Hub and Regulatory Sandbox to provide guidance about current and upcoming regulations. Estonia introduced its e-residency programme in 2014. The programme gives entrepreneurs a digital identity and allows them to set up an Estonian-registered company from anywhere in the world with full access to the country’s financial system, including banking, payments and taxes.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global