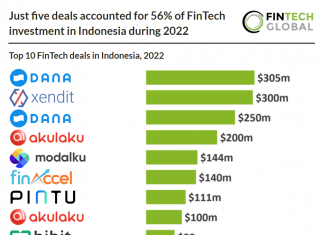

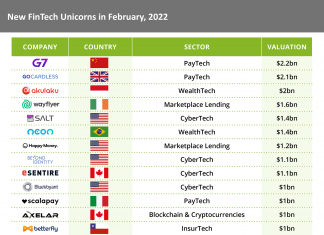

Indonesia-based digital finance platform Akulaku is considering a merger with special purpose acquisition company (SPAC) Catcha Investment Corp, according to a report by PYMNTS.

The merger with the blank-check company would reportedly value Akulaku at almost $2bn. Catcha Investment Corp was launched by internet entrepreneur Patrick Grove. The merger could take place later this year.

Founded in 2014, Akulaku is a banking and digital finance platform in Southeast Asia that operates in four major countries: Indonesia, Philippines, Vietnam and Malaysia. Akulaku’s most recent funding round, a Series D round, took place in February 2021 in which the amount raised was not disclosed.

The company targets an emerging market with an underserved but creditworthy and fast-growing consumer group, Akulaku currently provides users with digital banking, consumer credit, digital investment and insurance brokerage services, fulfilling financial needs for a wide range of customers.

The company expected annual revenue of $619m and gross merchandise value of about $5bn in 2021, according to an internal document from October seen by Bloomberg News.

Copyright © 2022 FinTech Global