Key Indonesian FinTech Statistics in 2022:

• Indonesian FinTech companies raised $2.5bn in 2022, a 56% increase from 2021

• Overall, there were 79 FinTech deals announced, a 19% drop from the previous year

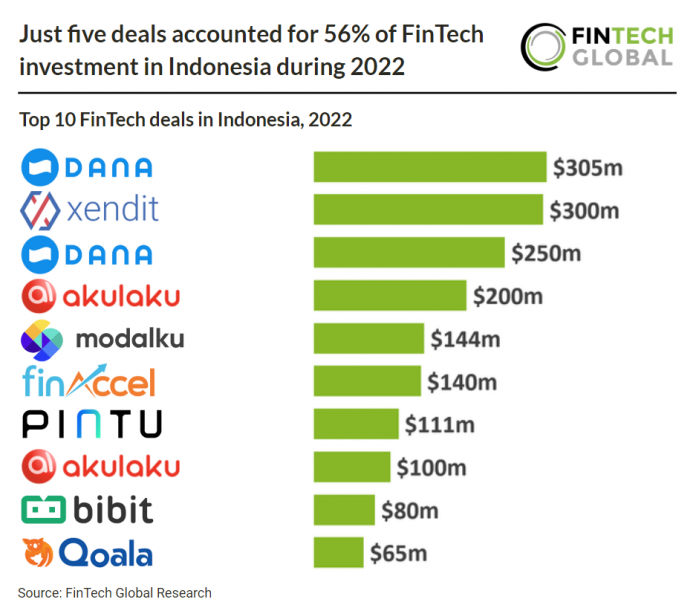

• Five companies raised $1.4bn combined, accounting for 56% of total investment in 2022

FinTech deal activity in Indonesia has seen a drop in 2022 reaching 79 deals in total, a 19% reduction from 2021 levels. FinTech investment on the other hand has set a new record reaching $2.5bn in total, a 56% increase from 2021. This increase in investment can be accredited to large deals in the country with eight deals over $100m during the year. Not only does this break global FinTech trends which saw an average investment decrease of 46%, it signals a maturing sector. Indonesian FinTech in Q4 2022 did see a downturn however with only 13 deals announced, a decline of over 50% compared to Q1 levels.

Dana, a digital wallet, had the largest Indonesian FinTech deal in 2022 raising $305m in their latest Secondary Market funding round led by Lazada Group. At the same time Dana raised $250m from Sinar Mas Group via a Venture round. The funding gives Dana unicorn status at a $1.13bn valuation and the company will use the fresh capital to invest in new technology and debut new financial services. The company has acquired more than 115m users and processes over 10m transactions per day. Dana has forecasted that its total payment volume and gross transaction value at the end of 2022 will double from the same period in 2021.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global