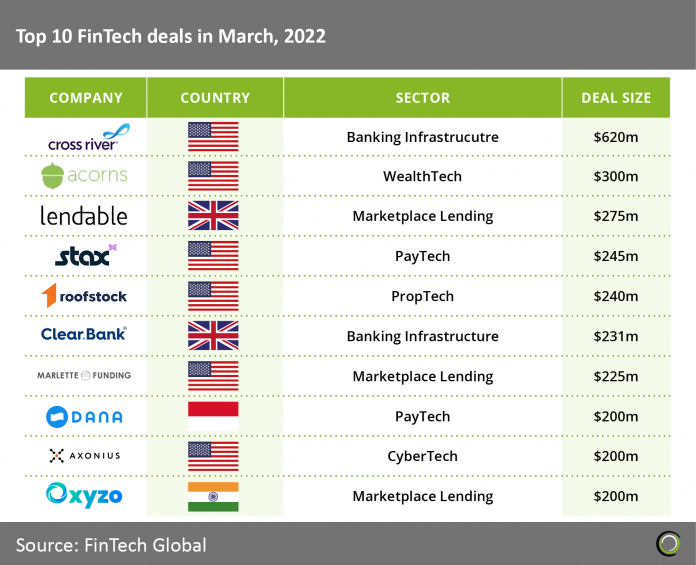

- Global FinTech investment in March decreased 27% from February 2022. If the pace of funding during the opening quarter continues FinTech capital invested in 2022 is expected to be $224bn, a 7% decrease from 2021 levels.

- Cross River, a banking software provider, are the highest valued deal of March 2022 raising $620m in their Series D funding round. This new capital will be used to accelerate Cross River’s ongoing technology-focused growth strategy which includes building out embedded payments, cards, lending and crypto solutions.

- Marketplace Lending is the dominant sector in March accounting for three of the top ten deals on the list. Marketplace Lending is still growing fast as interest rates remain low but the US Federal Reserve has announced it is ready to increase rates at a faster pace which could slow sector growth.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global