• Global WealthTech deal activity is projected to have a record-breaking year, reaching 908 deals in 2022 based on investment pace in the first nine months of the year. That’s a 41% increase from the previous year and in contrast to the overall FinTech funding slowdown. Total capital invested however has been affected and is expected to fall considerably to $12.9bn, a 49% decrease from 2021 levels and average deal size is expected to change from $38m to $14m. Investment in Q3 2022 only reached $0.9bn, an 83% drop from Q1 2022.

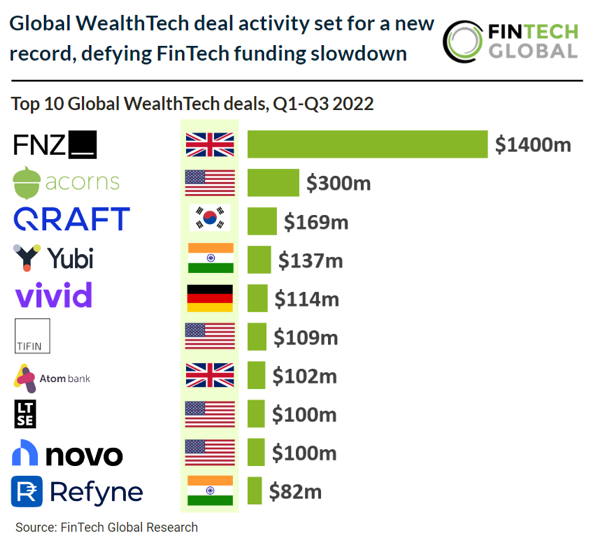

• FNZ, a wealth management platform, was the largest WealthTech deal in the first three quarters of 2022 raising $1.4bn in their latest Private Equity round led by CPP Investments and Motive Partners. The capital will help FNZ further accelerate its growth through increased R&D, as well as driving growth in markets that FNZ have recently entered, in particular North America. CPP Investments is investing a total of $1.1bn. The fundraising values FNZ at over US$20bn as it continues its record of innovation and geographical expansion.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global