Commercial motor insurer Zego is launching in the Netherlands and ramping up its operations in France.

The company, which became the UK’s first InsurTech unicorn last year after securing $150m in a Series C round, will target the European fleet insurance market.

Zego said that its product rewards better, safer driving, empowering customers to save up to 20% on premiums at renewal through proactive risk management. By adopting Zego’s insight-driven approach, fleet companies can also cut the number of insurance claims they make annually by up to 10%, the company added.

Founded in 2016 by ex-Deliveroo directors, Sten Saar and Harry Franks, Zego has grown to support businesses in the UK and across Europe and has forged partnerships with businesses such as BP, Aon and Voi. Zego has also raised over $280m in funding

Zego’s tech-led proposition centres around a fully automated fleet portal, harnessing telematics to unearth behavioural insights that empower fleet managers to improve performance and take control of the price of their premiums. As well as offering fleet managers the ability to save up to 20% on premiums at renewal, Zego said its fleet portal saves fleet customers up to 40% on admin time, while also helping to improve route efficiency, minimise vehicle and driver downtime, reduce fuel costs, reduce wear and tear, slash maintenance bills, and ease road congestion.

Sten Saar, CEO of Zego, said, “Telematics and data science have proven that they can improve driving behaviour, and when combined with a financial incentive, they have great potential to make fleets safer and cheaper to run.

“At Zego we are using this data to understand risk better than traditional insurers and other InsurTechs, so we can offer more accurate pricing and more control; both of which have halo effects that improve life for everyone.”

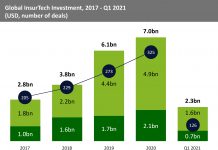

Zego became the UK’s first InsurTech unicorn in March 2021, during what was a record year for funding in InsurTech. The industry set a new annual record only nine months into the year, raising $9.1bn across 364 deals, driven by large transactions over $100m.

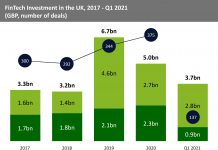

The increasing value of deals in the InsurTech space has been reflected by the growing number of unicorns. In the UK, since Zego gained unicorn status other UK companies seemingly followed suit. Digital motor insurer Marshmallow joined the unicorn club in September, raising $85m. Tractable also joined the billion-dollar club after raising $60m in a Series D round, and pet insurer Bought by Many became a unicorn after its $350m Series D round.

Indeed 2021 was an exciting year for InsurTech deals, you can find the biggest deals of the year here.

Copyright © 2022 FinTech Global