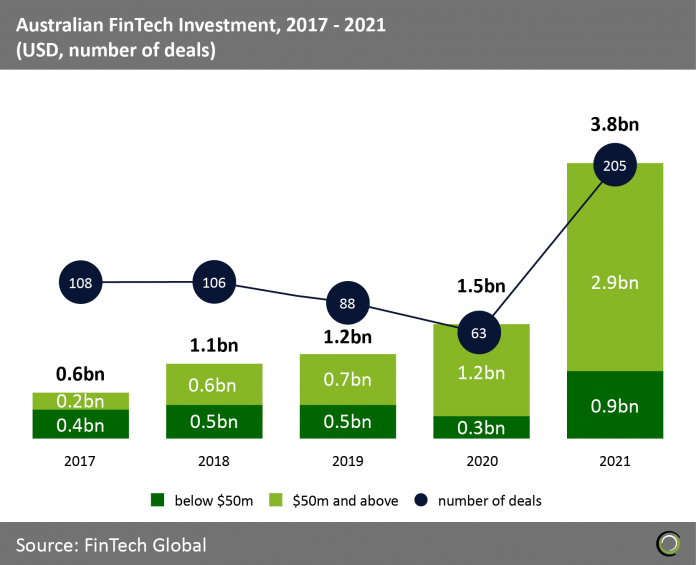

Australian FinTech deal activity more than tripled last year to 205 transactions

- Australia’s FinTech industry rocketed in 2021 with deals over $50m accounting for 76% of capital invested. A record number of deals were recorded in 2021 at 205, more than triple the deal activity seen in 2020 showing a major uplift in Australian FinTech investment activity. Between 2017 and 2020 FinTech deal activity declined at a -12.6% CAGR and this rebound in investments comes as a result of Covid-19 which changed consumers’ financial behaviour. Individuals now prefer contactless payments and managing finances online rather than in person. Key drivers also include established institutions increasing the adoption rate of FinTech solutions to stay competitive which has attracted more investments into the space.

- Comparing Australia’s growth in FinTech funding of 253% to the global average of 45%, it is clear the ecosystem in the country stands out. In 2018 the FinTech bridge was formed connecting Australia and the UK, this bridge allows for greater regulatory and policy collaboration. The FinTech bridge has also been engineered to allow Australian FinTech firms easier access to the UK market. Other factors for Australia’s growth include tax incentives. FinTech start-ups in Australia are entitled to tax offsets, and early-stage start-ups can claim a rebate of 62 cents for every tax dollar they spend on R&D. In contrast this is a much better deal than what UK SMEs get where they can only claim up to 33p for every £1 spent on qualifying R&D expenditure.

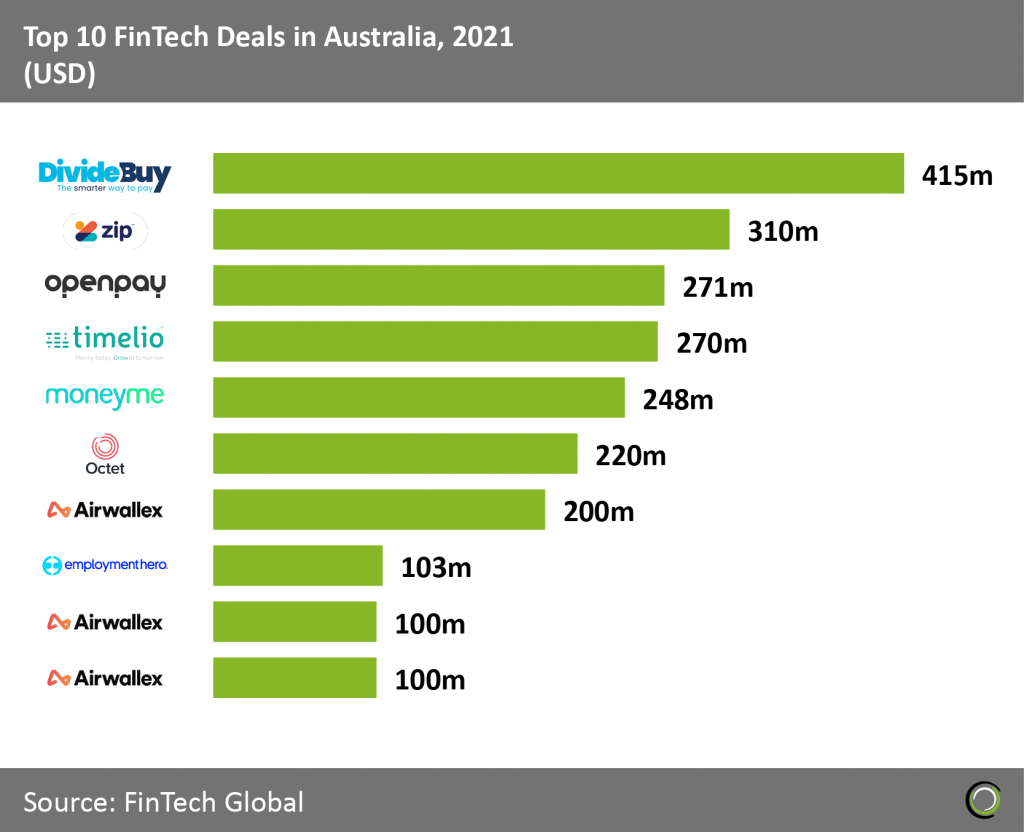

DivideBuy is the largest deal in 2021 at $415m capital invested

- DivideBuy, a buy now pay later (BNPL) platform that spreads the cost of purchases at 0% interest, tops the Australian FinTech scene with a huge funding round of $415m. This funding round was solely funded by Davidson Kempner and will maintain DivideBuy’s high levels of growth and keep up with the demand it is experiencing from retailers across many retail verticals. BNPL has been rapidly growing in recent years with companies such as Klarna becoming big players in the sector, driving the estimated worth of the industry to $97 billion with outlook for further increases.

- Timelio, a lending company enabling growing businesses to improve cash flow by receiving early payment from customers, is 4th on the list as their latest debt financing round hits $270m. The funding round was led by Goldman Sachs and backed by Thorney Investment. The $270m in funding provides enough headroom for almost $2 billion in annual lending, compared to $1.5 billion it has lent since its inception in 2015. “It enables us to be aggressive in this market, and that is what we are targeting” said Timelio co-founder and CEO Charlotte Petris.

- AirWallex, a payments platform for businesses to move and manage money globally, now sits at a $5.5bn valuation (as of November 17) compared to a $4bn valuation in September after its latest funding round of $100m in November. The funding round was led by Lone Pine Capital and joined by 1835i Ventures and Sequoia Capital China. This additional capital will be used to add more services and some of the funds will be used for M&A activity.

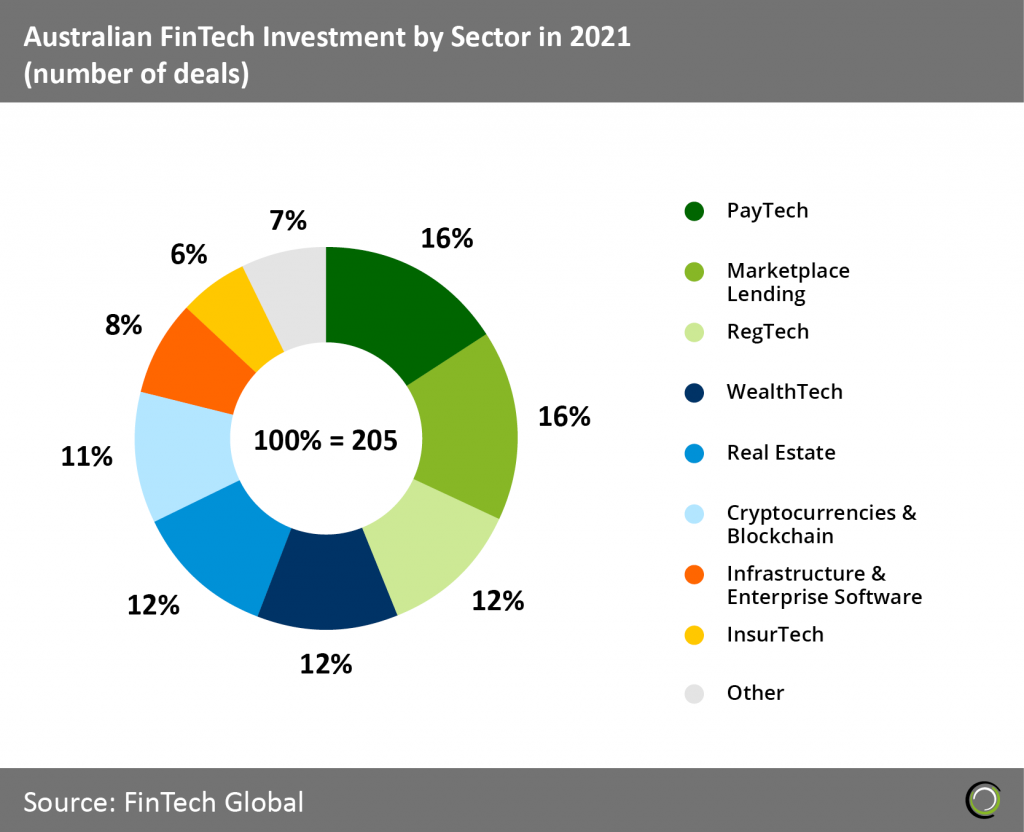

Investors are backing Australian companies working across all FinTech subsectors

- PayTech along with Marketplace Lending have the highest proportion of deals for 2021. PayTech saw an increase of 3 percentage points (pp) in 2020 while Marketplace Lending increased 6pp. This is due to the impact of Covid 19 causing a shift in consumer’s financial behaviour, preferring online services which has directly befitted FinTech companies .

- It is important to note that this deal activity is evenly spread with smaller sectors such as Cryptocurrencies & Blockchain still seeing large increases in deal activity of 5pp compared to 2020. This trend could be due to deals rolling over to 2021 as impacts from Covid-19 may have slowed these transactions.

- The Real Estate sector has seen the largest increase in deal activity at 1200% from 2020 showing a strong surge in investment interest. This comes as the property market becomes very hot rising 21.9% in 2021 which could be a result of people working from home and re-evaluating what property they want. This rise in property value during a pandemic means companies rely more on PropTech and consumers prefer it because there is less tedious paperwork and easier ways to apply for mortgages.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global