Key Australian FinTech investment stats in Q2 2023:

• Australian FinTech deal activity reached 17 transactions in Q2 2023, a 62% drop when compared to the same period last year

• Australian FinTech funding ended the second quarter at $60m, the lowest reported quarterly figure in the past five years

• CyberTech was the most active Australian FinTech subsector in Q2 2023 with four funding rounds

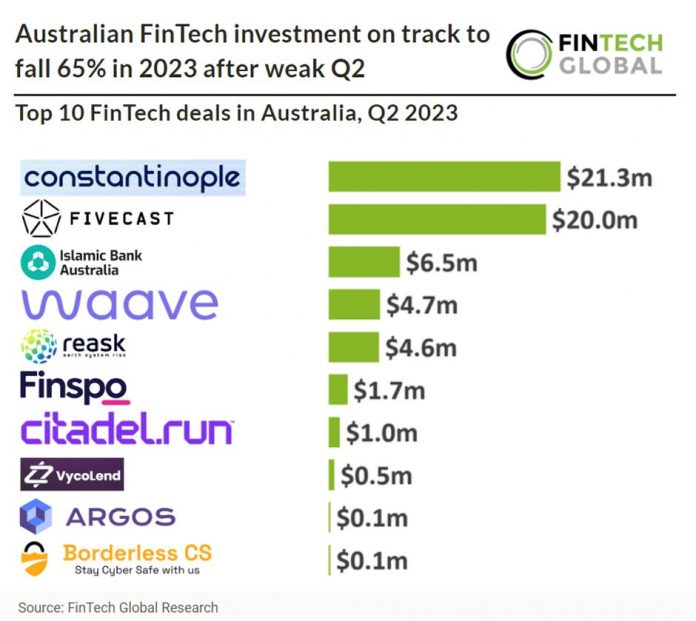

Australian FinTech has fallen to the sectors lowest levels in terms of deal activity and investment in the past five years. Australian FinTech deal activity reached 17 transactions in Q2, a 62% drop from the same period in 2022. This is also a decline from Q1 2023 which had 22 deals. In Q2 2023, Australian FinTech companies raised a combined $60 million, marking the lowest amount reported in the last five years.

Constantinople, a SaaS banking platform, completed the largest Australian FinTech deal in Q2 2023, raising $21.3m in their seed round, led by Square Peg Capital. Constantinople introduces a novel category of software-as-a-service designed to streamline and simplify banking operations. It offers a comprehensive platform that fully automates various critical but repetitive tasks for banks, such as infrastructure management, servicing, operations, and compliance. By adopting this model, banks can escape the burden of expensive infrastructure and manual processes, enabling them to focus on their core banking functions and prioritize customer needs. Constantinople’s platform caters to both retail and business banking, offering a wide range of products like mobile and web apps, transaction and savings accounts, payment services, debit and credit cards, and various lending options. Additionally, the platform supports essential operational services, including onboarding and KYC (Know Your Customer), AML (Anti-Money Laundering) measures, fraud prevention, payments and lending operations, regulatory reporting, and customer service.

CyberTech was the most active Australian FinTech subsector in Q2 2023 with companies in the sector completing four deals, a 23% share of total FinTech deal activity. Lending Technology was the second most active with three deals, an 18% share of deals.

The Australian Treasury released the ‘Token Mapping Consultation Paper’ on February 3, 2023, to assess the applicability of existing regulations to the crypto sector and guide future policy decisions. Token mapping involves categorizing crypto assets based on their core code and technological features, aiming to understand their interaction with the country’s financial services regulatory framework and establish an appropriate regulatory system. The proposed grouping includes four product types under two token systems: intermediated token systems (crypto asset services and intermediated crypto assets) and public token systems (network tokens and public smart contracts). The Treasury seeks feedback, with responses to the Consultation Paper due by March 3, 2023.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global