Indian neobank Open has reportedly become the 100th unicorn in India, after it closed a Series D.

The funding round was led by IIFL, with commitments also coming from Tiger Global, Temasek and 3one4 Capital, according to a report from TechCrunch.

While the sum of the funding round was not disclosed, TechCrunch reports it closed on $50m. These new products are revenue-based financing Flo, early settlement card offering Settl and working capital lending Capital.

Its plans are to release $1bn in lending through the new products over the course of a year.

Open, which is now valued at $1bn, is now looking to release three new products.

The FinTech company previously raised $100m in a funding round in October 2021, which had put its valuation at $500m.

Open offers business banking services, including a Visa card. Its platform is designed to combine banking, payments, accounting, payroll, expense management, taxes and more.

Its services are allegedly used by two million companies across India.

Open co-founder and CEO Anish Achuthan told TechCrunch, “We are excited to partner with IIFL and existing investors Tiger Global, Temasek and 3one4 Capital for our series D round.

“We see a lot of synergies with IIFL especially on leveraging the lending book, as we are getting ready to launch innovative products like revenue-based financing, early settlement, working capital loan and business credit cards to SMEs on our platform.â€

Earlier in the year, CredAvenue joined India’s list of unicorns. The company, which helps businesses and entrepreneurs secure debt from lenders, reached the milestone following the close of a $137m Series B.

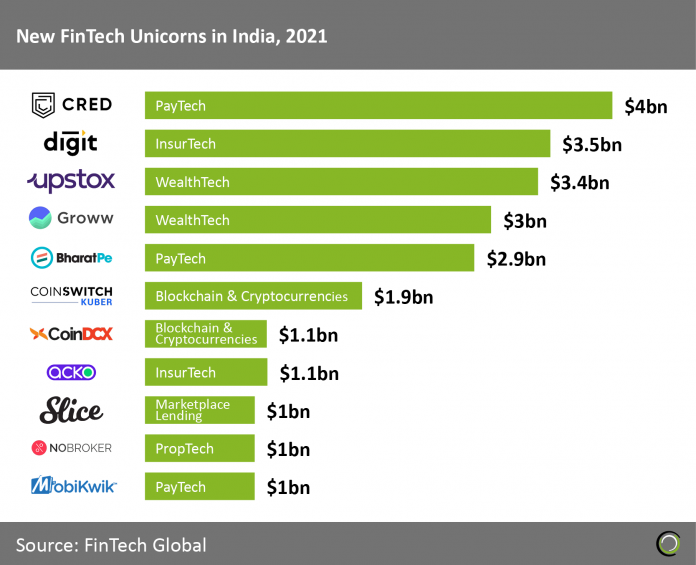

India has been producing a lot of FinTech unicorns. The country was responsible for 7% of all new FinTech unicorns in 2021.

Copyright © 2022 FinTech Global

Copyright © 2022 FinTech Global