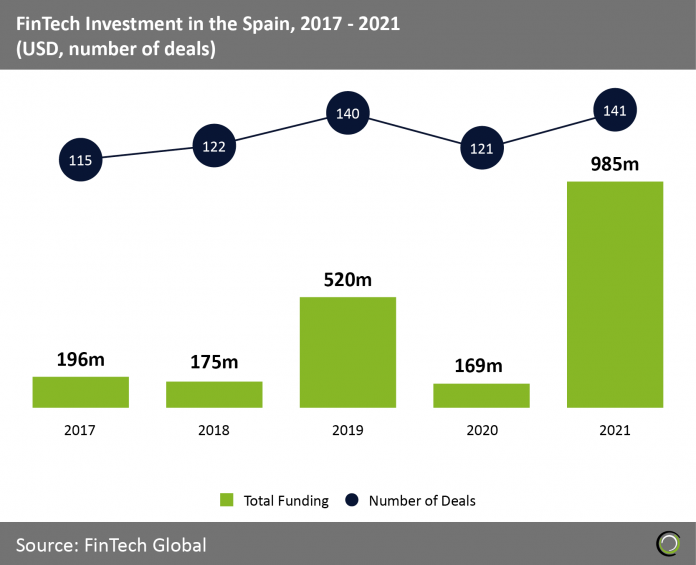

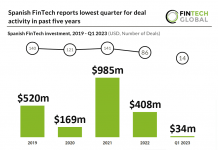

- Spanish FinTech deal activity last year surpassed 2019’s levels to hit new high of 141 deals showing a strong rebound from its 2020 slump due to Covid-19. Total capital invested nearly doubled from the previous record of $520m in 2019 to reach $985m.

- Spain has a relatively low (compared to which countries) FinTech adoption rate of 56% which ranks it 21st in the world and 7th in Europe. Open banking has been a key driver for FinTech investment in Spain and enables financial institutions to build and offer FinTech solutions easily to their customers. Open banking had a total volume of €35m in 2013 and has grown to €300m in 2021.

- Spanish FinTech regulation is mostly directed by the EU with regulation such as PSD2 and GDPR but Spain has established its own FinTech sandbox. Sandbox is an unregulated testing area that identifies projects that will improve financial services. Sandbox is an initiative within the framework of the Digital Transformation Law for the Financial Sector and was approved on November 4th, 2020. Successful cases from the Sandbox include Mooney, a personal finance manager and Bankia, who are generating a national market to facilitate the exchange of carbon credits in Spain.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global