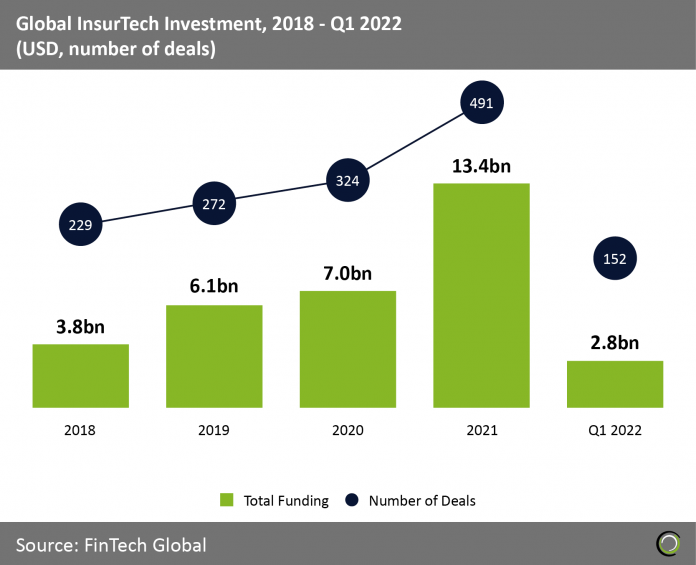

- InsurTech deal activity is on track to grow 24% this year if the pace of investment seen in Q1 carries on, showing continued faith by investors in the sector. InsurTech growth is supported by a large shift in the industry to digitise legacy systems as incumbents feel pressure from new challengers. The digital insurance platform market was valued at $102bn in 2020 and is expected to rise to $169bn in 2026.

- Large deals over $100m account for 70% of deals on average during the period 2018 – 2021. This trend is likely to continue in 2022 with large deals occurring in Q1 2022 from Accelerant ($193m), an insurance platform provider, Policygenius ($125m), an online insurance marketplace and Betterfly ($125m), a dynamic life insurance provider based on habits.

- The US continues to dominate InsurTech funding, accounting for 41% of InsurTech deals in Q1 2022. Notably Brazil had 4% of InsurTech deals in Q1 2022, and if that pace of investment continues at this level it will result in a 71% increase in InsurTech deals in the country compared to 2021 levels.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2021 FinTech Global