Singapore-based ADDX, a mobile app for private market investing, has closed its pre-Series B funding round on $58m.

The capital injection received investments from SET Venture Holding, a subsidiary of the Stock Exchange of Thailand, UOB, Hamilton Lane and Krungsri Finnovate.

With the capital, ADDX hopes to scale its operations as it solidifies its position in Asia. Funds will also help ADDX expand into new business areas, geographies and market segments.

Some of the strategic initiatives the fresh funds will support include the recent launch of private market services for wealth managers, dubbed ADDX Advantage.

Founded in 2017, ADDX is regulated by the Monetary Authority of Singapore as a digital securities exchange. It leverages blockchain and smart contract technology to tokenise and fractionalise private market opportunities such as pre-IPO equity, private equity, hedge funds and bonds.

Minimum investment sizes into these assets have been reduced from $1m to $10,000, providing access to more individuals.

ADDX CEO Oi-Yee Choo said, “ADDX is on a mission to democratise the private markets. The sizeable investment from SET, UOB, Hamilton Lane and Krungsri serves as a ringing endorsement for ADDX’s business model, the team we have assembled and the broader vision we have for transforming the capital markets and the wealth management industry.

“The new shareholders aren’t just capital partners, but strategic partners too. They have much to contribute in the form of expertise, ideas, market experience and business networks, and ADDX looks forward to adding value to their businesses in return. This Pre-Series B round sets ADDX up strongly for long-term success.”

With the close of the round, the company has raised a total of $120m in funding. Its existing shareholders include Singapore Exchange, Heliconia Capital, Development Bank of Japan, Japan Investment Corporation, Tokai Tokyo Financial Holdings, Kiatnakin Phatra Financial Group and Hanwha Asset Management.

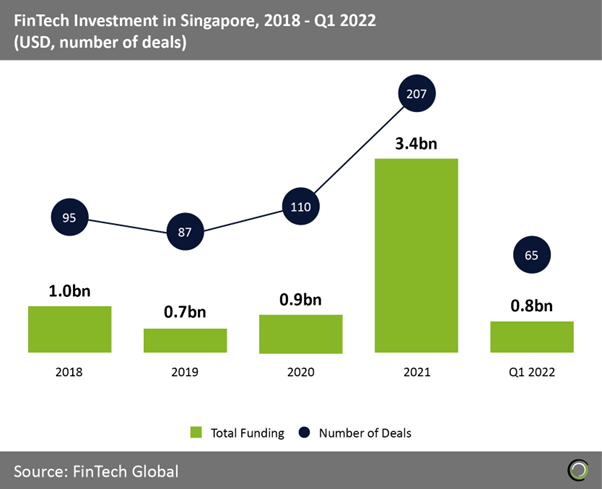

Singapore’s FinTech sector had a stellar 2021, with total funding reaching $3.4bn in 207 deals.

Copyright © 2022 FinTech Global

Copyright © 2022 FinTech Global