- PayTech was the most dominant sector in Africa accounting for 26% of total deals in Q1 2022 at a total of 23 transactions. Since the pandemic, the prospect of a cashless Africa has led to huge investments in the region. For example Flutterwave, a payment infrastructure provider, which has raised $474m as of 18th May 2022. Even though there are large players in the continent, continued investment in the sector is expected due to the digital payments landscape being very fragmented. The variety of payments types and the difficulties surrounding digital payments in local currencies complicate integration. The digital payment landscape will also evolve rapidly as different payment methods and digital currencies become popular.

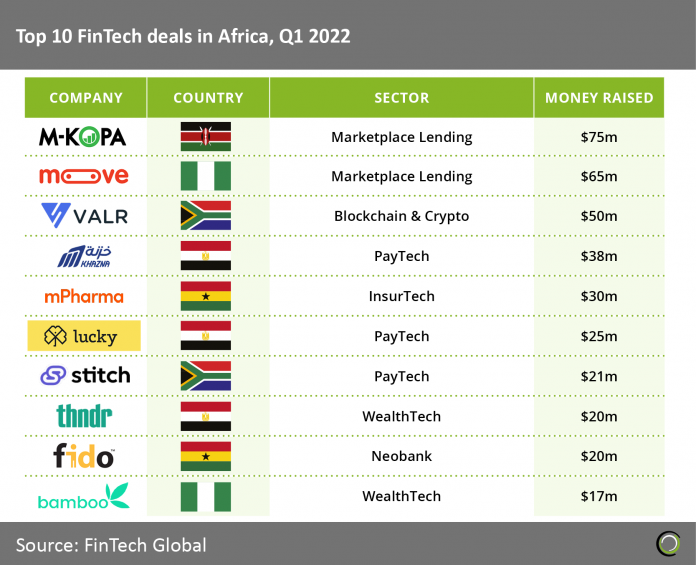

- M-KOPA, a connected asset financing platform, raised the largest African deal in the first quarter via their $75m venture round led by Generation Investment Management and Broadscale Group. M-KOPA will use the fresh funding to expand into additional countries, adding to its presence in Kenya, Uganda, Nigeria and Ghana. The company also plans to go beyond asset financing to boost its offering of financial services products such as health insurance, cash loans and buy-now-pay-later partnerships with merchants.

- Total deal activity in Africa for Q1 2022 rose by 24% compared to 2021 levels to a total of 89 transactions. Overall investment in Africa for Q1 2022 reached $472m, a slight 6.5% decrease from last year’s levels. Overall investment for the year is projected to reach $1.88bn.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global