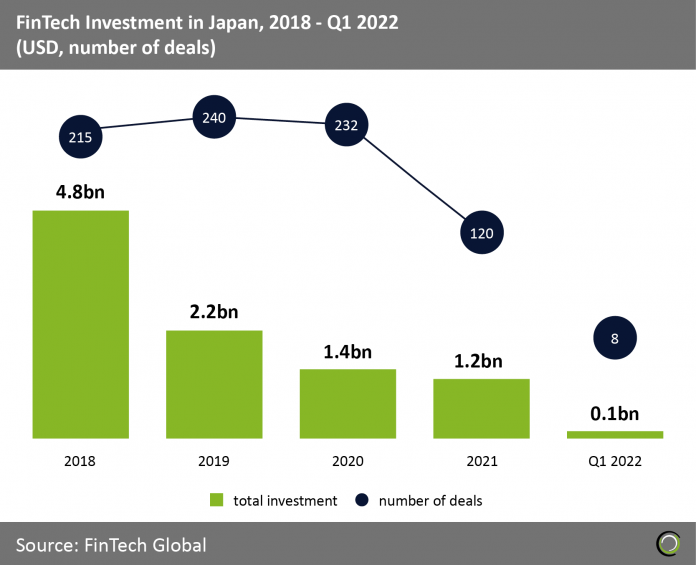

• Japanese FinTech investment reported its lowest quarter for the last five years in 2022 with investment reaching $100m during the first three months of the year. Deal activity also fell significantly from last year’s levels to a total of eight transactions in the first quarter of 2022. During the opening quarter there were major deteriorations in the Japanese stock market, impacting company valuations especially in tech which may have caused VC firms to pull term sheets. This is despite the fact the Japanese government releasing a growth plan strategy in June 2021 which promotes digitisation and proposals for new digital infrastructure.

• Kyash, a challenger bank providing money management and payment services, was the largest FinTech deal in Q1 2022 raising $41m (41% of total Japanese FinTech investment in Q1 2022) in their latest Series D funding round, which included investment from Block (formerly Square). Kyash will use the proceeds to double its headcount and bolster product growth.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global