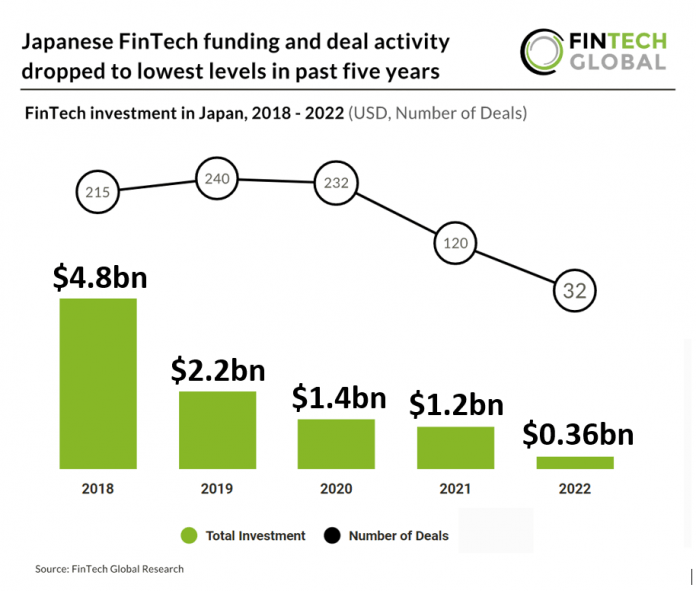

Japanese FinTech investment stats in 2022:

• Japanese FinTech investment reached $360m in 2022, a 70% drop from 2021’s levels

• Japanese Fintech companies completed 32 transactions in 2022, a 74% reduction from 2021

• Blockchain & Crypto was the most active Japanese FinTech subsector in 2022 with nine deals, a 27% share of total deals

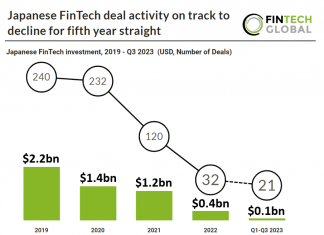

Japanese FinTech investment continued its decline in 2022 after Japanese companies raised a combined $360m during the year, a 70% drop from 2021’s levels. Japanese FinTech investment peaked in 2018 at $4.8bn and 2022’s investment figures represent a 92.5% drop from this peak. Deal activity has also considerably reduced in the past five years with FinTech activity in 2022 reaching 32 deals, a 74% reduction from 2021 and a 87% drop from 2019’s peak.

Opn, a financial services provider that offers a payment gateway for e-commerce businesses, was the largest FinTech deal in 2022 raising a sizeable $120m in their latest Series C funding round which included investments from MUFG Bank, Mars Growth Capital and JIC Venture Growth Investments. The latest funding pushes Opn to unicorn status and the company will use the funds to expand its product line-up. The funds will also allow Opn to push further into Southeast Asia as it rides the growth of digital payments in the region. This investment accounted for over a third of Japan’s total FinTech investment in 2022.

Blockchain & Crypto was the most active FinTech subsector in 2022 with 9 deals, a 27% share of total deals in 2022. Cryptocurrency adoption in Japan has grown to 13% in 2022 up 9 percentage points from 2021. PropTech was the second most active FinTech subsector with 6 deals in 2022, a 19% share of total deals and WealthTech was third with a 15% share.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global