Japanese FinTech investment stats in Q1-Q3 2023:

• Japanese FinTech deal activity reached 21 deals in Q1-Q3 2023, a 9% drop from the same period in 2022

• Japanese FinTech investment totalled at $91m in Q1-Q3 2023, a 60% decrease YoY

• Blockchain & Digital asset technologies was the most active FinTech subsector with a 48% share of deals

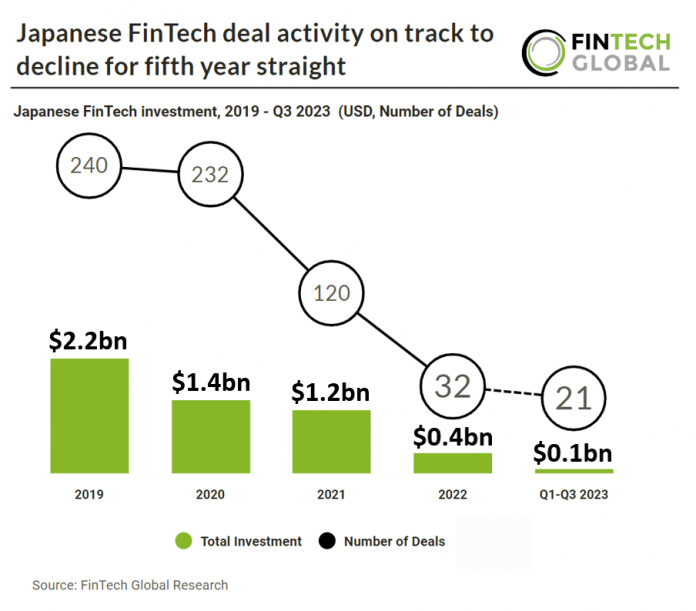

Japanese FinTech deal activity is on track to decline for the fifth consecutive year after reporting underwhelming Q1-Q3 results. In the first three quarters of 2023, Japanese FinTech deal activity recorded 21 transactions, marking a 9% decline compared to the same period in 2022. Japanese FinTech deal activity is on track to reach 27 transactions in 2023 based on investment activity during the first nine months of the year, a 12% drop from 2022. Investments in Japanese FinTech companies during Q1-Q3 2023 amounted to $91m, representing a significant 60% YoY decrease. Japanese FinTech investment has dropped 98% from its $4.8bn peak in 2018.

Funds, an online marketplace for lending funds, had the largest Japanese FinTech deal in Q1-Q3 2023 after raising $26.7m in their latest Series D funding round, led by Anri. Currently, Funds’ registered user base has reached 73,000, surpassing 280 public funds, and the cumulative amount raised has exceeded 30 billion yen. In terms of fundraising accomplishments, Money Forward Co., Ltd. has successfully launched the “Money Forward Fund ME Fund #1” and fully achieved its target of soliciting 1 billion yen through an application-based approach. Among the growth-oriented startups aiming to become publicly traded companies, Gojo & Company Co., Ltd., operating in the microfinance sector, has raised a cumulative total of 1.3 billion yen as of the end of February 2023, providing direct debt to fulfil the capital requirements for their growth.

Blockchain & Digital asset technologies was the most active FinTech subsector with 10 deals, a 48% share of total deals. Lending Technology and RegTech were the joint second most active FinTech subsectors with three deals each.

Japan is considering allowing startups to raise funds from venture capital firms using digital assets like cryptocurrencies instead of traditional stock. This move aims to provide more funding options for blockchain technology-related startups. Currently, limited partnerships in Japan are restricted to conventional assets like shares and stock options, as well as security tokens defined by Japanese securities law. The proposed change would include other tokens and crypto assets, expanding investment opportunities in an area that has been relatively underdeveloped in the country. The government intends to submit legal revisions to parliament in 2024 to implement this change.