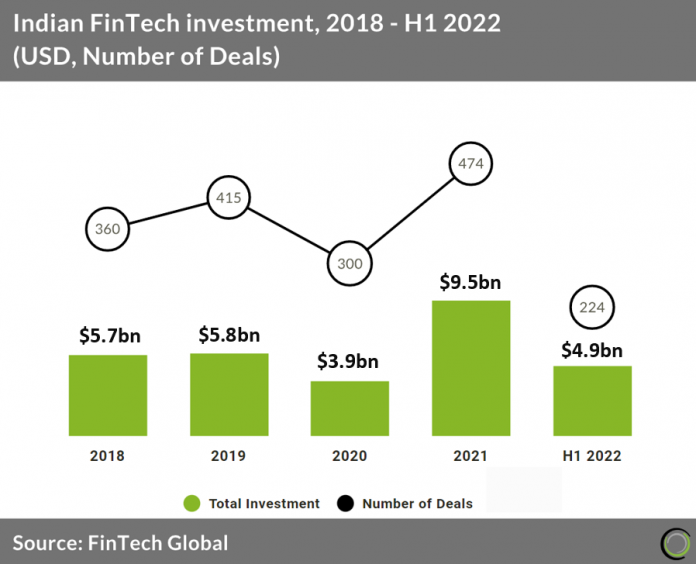

• Indian FinTech investment in 2022 is now projected to reach $9.8bn a 3.1% increase from the previous year, this is based on investment in the first half of 2022. FinTech investment in the second quarter of 2022 reached $1.8bn, 42% lower than the first quarter of 2022. India’s deal activity in Q2 2022 reduced 25% from Q1 to 96 deals in total.

• Bangalore remains the most active FinTech region in India with 42 deals in Q2 2022 and accounted for 43% of total deals in the country. Mumbai was the second most active region with 14 deals and New Delhi was third with 9 deals.

• India may have another troubling quarter in Q3 2022 as the Reserve Bank of India has informed dozens of FinTech start-ups in June 2022 that it is barring the practice of loading non-bank prepaid payment instruments (PPIs). This is a primary way that Indian start-ups facilitate lending, now Non-Banking Financial Companies (NFBCs) can’t give credit lines to merchants and their money should only be routed to regulated bank accounts of customers, bypassing the current payment gateways to merchants. FinTech start-ups are speculating that banks have lobbied the RBI to reach this decision.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global