Wave Mobile Money, a FinTech company that operates in Senegal and Côte d’Ivoire, has reportedly raised €90m debt funding.

Of the funds, IFC supplied a €25m loan, while Symbiotics, Blue Orchard, responsAbility and Lendable deployed a combined total of €41m in B loans, according to a report from Tech Moran. The remaining €24m came through parallel loans from Finnfund and Norfund.

This capital will help Wave Mobile Money boost financial inclusion and support economic growth in Senegal and Côte d’Ivoire.

Wave Mobile Money offers an app that lets consumers deposit, withdraw and pay bills for free, as well as send money to others for a 1% fee.

Coura Sene, Wave Mobile Money’s regional director for the West African Economic and Monetary Union, said, “Wave’s vision of making Africa the first cashless continent, by building affordable and user-centric solutions, matches IFC’s ambitions of universal financial inclusion.

“This investment by IFC and other lenders helps us offer a diversity of financial products, encouraging users to stay within the formal financial sector, deepening financial inclusion in the region.”

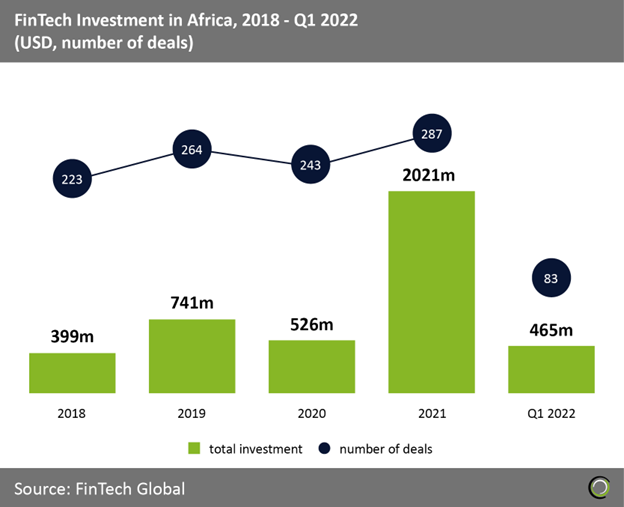

FinTech funding in Africa experienced huge growth in 2021. A total of $2bn was invested through 287 deals last year, a significant jump up from the $526m raised through 243 deals in 2020.

Copyright © 2022 FinTech Global

Copyright © 2022 FinTech Global