India-based neobank Niyo Solutions has reportedly received $30m in funding, just months after closing its Series C on $100m.

The fresh equity burst was supplied by Multiples Alternate Asset Management, a Mumbai-based private equity firm, according to a report from Your Story.

With the capital, Niyo plans to expand its product capabilities and increase its customer base via organic and inorganic opportunities. Additionally, funds will help the company build its brand and hire more staff.

Speaking on the funding, Niyo co-founder and CTO Virender Bisht told Your Storym “With this fundraise, our focus is on enhancing product development, improving our product suite to have more consumer-focused products like credit cards, remittances, loans etc.

“Our foray into new product categories will help us leverage the massive tailwinds for digital financial products the market is seeing today.”

Niyo offers digital savings accounts and other banking solutions through partnerships with banks. It currently has four million customers and processes $3bn in transactions.

With the close of the fresh round, the WealthTech company has raised a total of $180m in funding.

Last week, FPL Technologies, which offers metal credit cards under the OneCard brand, became India’s newest FinTech unicorn.

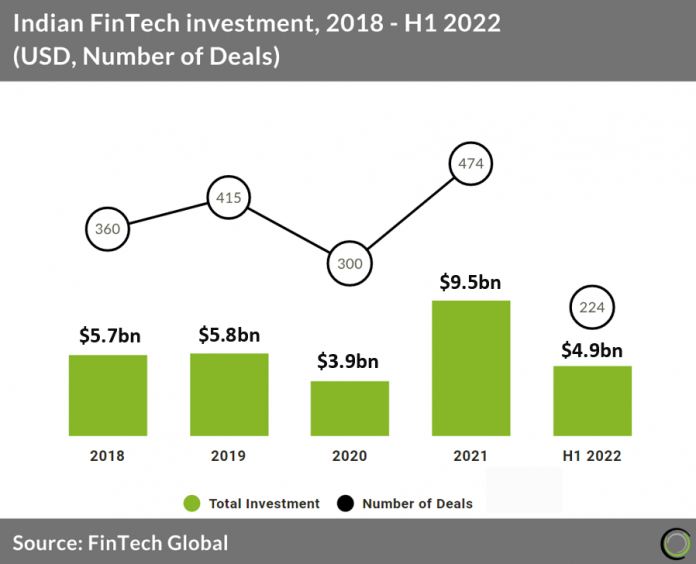

Funding in India’s FinTech sector had a strong start to 2022. In the first six months of the year, $4.9bn has been raised through 224 deals.

Copyright © 2022 FinTech Global

Copyright © 2022 FinTech Global