Neon, a FinTech and digital bank driven by the vision of improving the lives of working Brazilians, has raised $80m.

The capital was raised in the company’s first Credit Rights Investment Fund (FIDC) focused on credit cards. The investment increased the total fund to $170m in equity.

This is the second fundraising made by Neon in the private credit market this year, having previously raised just over $40m for its private payroll deductible FIDC at the beginning of 2022.

Neon believes it can create a conscious path to credit with solutions and innovations that can help the customer to obtain credit in a simple and fair way. For example, it recently launched the elastic limit, which makes it possible to expand credit for one-off purchases, based on credit assessment.

Jamil Marques, CFO of Neon, said, “The funding endorses the strength and positive history that we have been building in the management of the credit portfolio over the last few years. Today our credit engine is mature and the FIDC resources will give us the strength to continue expanding our portfolio in a sustainable and balanced way in the med-long term. The focus continues to be on the Brazilian worker, and always with the mission to reduce inequalities by building paths to credit.”

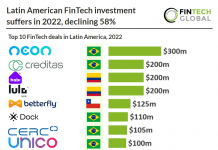

Earlier this year, Brazilian digital bank Neon received a $300m investment from Spanish multinational financial services provider.

Copyright © 2022 FinTech Global