This week was another busy week in the world of FinTech, with FinTech Global reporting on 32 funding rounds over the past five days.

Leading the way this week was digital lending platform auxmoney, who pulled in €500m in a funding round.

Central bank digital currencies also got a big bump this week, when a paper by the European Central Bank said CBDCs could be the ‘holy grail of cross-border payments’.

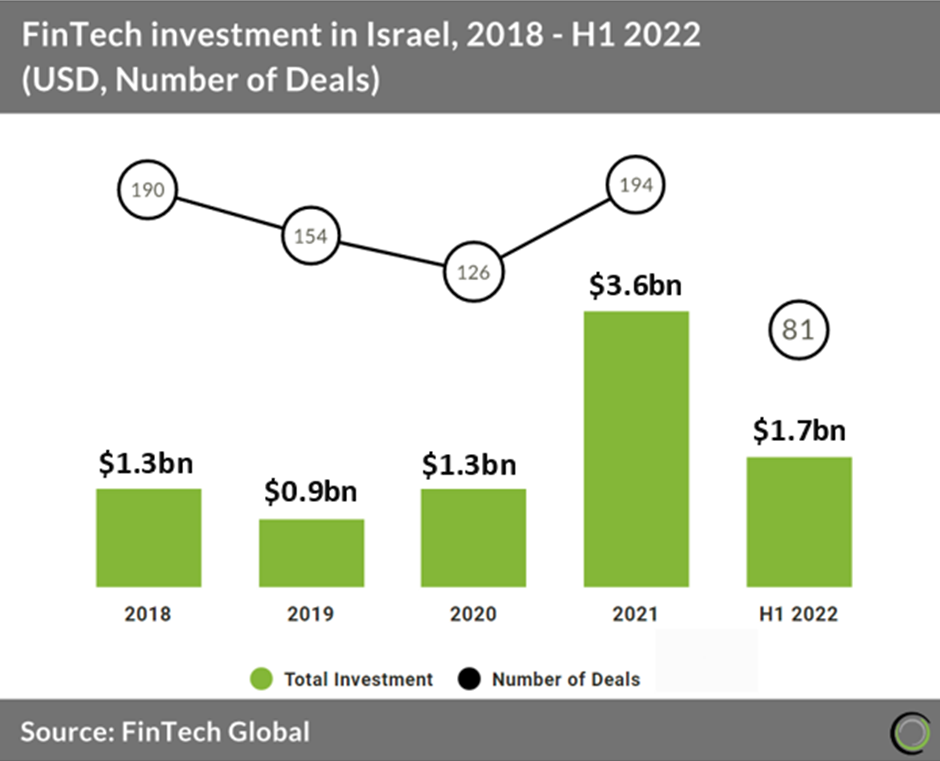

Research from FinTech Global this week found that investment in the Israeli FinTech market is set to drop in 2022, with a 5.5% drop anticipated based on current predictions.

Israeli FinTech has resisted the global 24% drop in FinTech investment from Q1 to Q2 2022 instead increasing by 7.6% due to its dominating CyberTech industry.

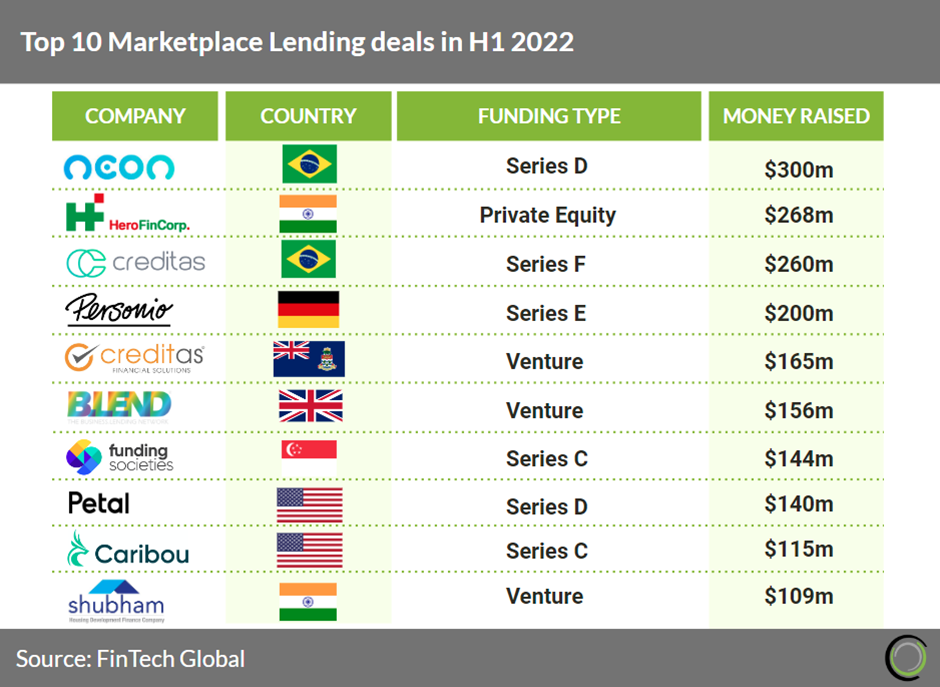

Elsewhere, Brazilian FinTech Neon led the way in marketplace lending funding for the first half of the year, raising a considerable $300m in their Series D round earlier this year.

Overall, there were 310 deals in the first half of 2022 indicating that deal activity in 2022 will surpass 2021 by 83% to 620 in total.

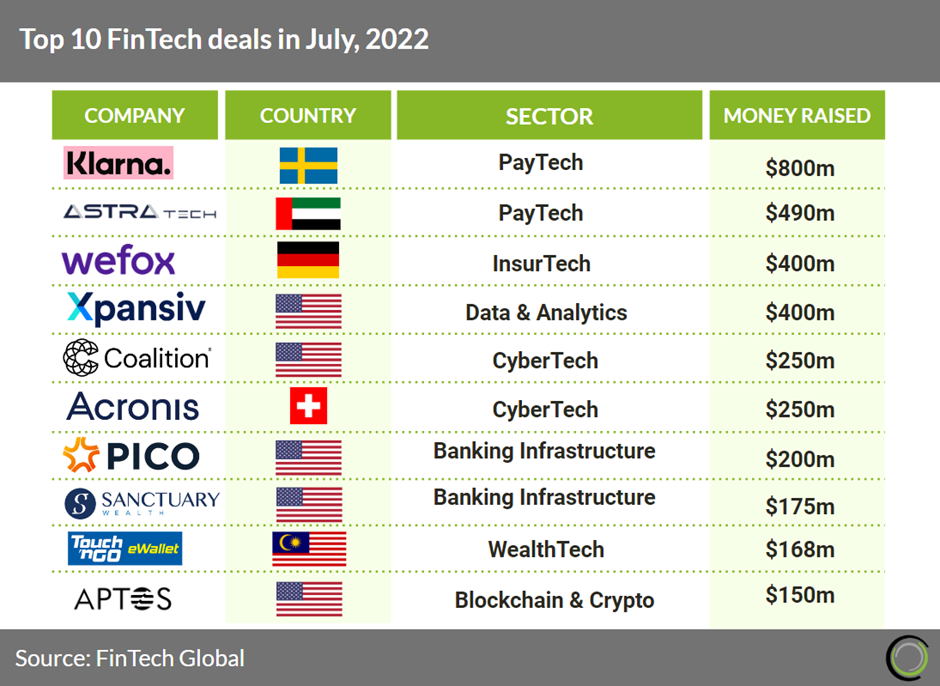

Lastly, FinTech giant Klarna led the way for the biggest FinTech funding round in the last month, after it scored $800m in its most recent venture funding round.

The latest funding has dramatically changed Klarna’s valuation from $45.6bn to $6.7bn, an 85% drop as higher interest rates, growing inflation and competition affect the company.

Here are this week’s funding rounds.

Digital lender auxmoney lands €500m funding

Auxmoney, a leading digital lending platform for consumer credit in Europe, has secured €500m in funding.

According to auxmoney, Citi initially started lending to auxmoney in 2021 and is now extending its lending to a second facility with Natixis joining a senior lender.

auxmoney claims it provides investors with the possibility to invest in truly digitial consumer lending.

Payments firm Tabby rakes in $150m credit facility

Tabby, a Middle Eastern payments and shopping app, has raised $150m in debt financing from Atalaya Capital Management and Partners for Growth.

Following Tabby’s Series B extension earlier this year, Tabby’s total capital raised to date amounts to $275 million.

According to Tabby, the investment fortifies its balance sheet and supports its sustained growth in transaction volumes and product expansion. Tabby will continue to provide MENA’s consumers with access to credit otherwise unavailable to them, without charging any interest or other fees.

Talon Cyber Security rakes in $100m Series A

Talon Cyber Security, a secure enterprise browser provider, has scored $100m from a Series A funding round headed by Evolution Equity Partners.

The round was also backed by Ballistic Ventures, Merlin Ventures, SYN Ventures and Crowdstrike’s Falcon Fund amongst others. Following the raise, Richard Seewald, founder and managing partner of Evolution Equity Partners, is joining Talon’s board of directors.

Talon claims its TalonWork browser simplifies security by allowing secure access to corporate applications and data on any device, managed or unmanaged, and on any operating system.

The investment will be used to speed up the company’s go-to-market efforts to meet the increasing global demand for TalonWork, and deliver new product enhancements to continuously improve security for modern workforces.

Parafin collects $60m Series B funding round

Parafin, a FinTech infrastructure platform, has collected $60m in its Series B funding round, which was led by GIC.

With the funds, Parafin plans to launch new products for small businesses, such as business change cards. It also plans to establish its market leadership in embedded financial services.

Parafin is a full-stack embedded financial infrastructure that serves small businesses, and helps marketplaces, payment processors and software providers bridge their cash flow needs, invest in their growth and run their business.

It claims to power embedded capital offerings of companies with over $100bn in payments volume, including DoorDash Capital and Mindbody Capital. Companies that use Parafin serve a combined total of 700,000 small and medium-sized businesses around the world.

Munich-based RegTech platform IDnow secures €60m debt facility

Munich-based identity proofing and digital identity provider IDnow has received a €60m debt facility.

With the capital, IDnow plans to scale investments across a range of strategic initiatives, including the introduction of new identity proofing solutions, continued geographic expansion and potential acquisitions.

Founded in 2014, IDnow offers a comprehensive suite of identity proofing solutions addressing a variety of use cases. It currently serves over 900 enterprise customers across 195 countries.

Companies gain access to a suite of unified methods that meet every identity verification and document signing need, as well as tools for identity management.

Xion Finance closes $50m investment from GEM Digital

Xion Finance, which removes the manual process of investing into initial DEX offerings, has collected $50m in funding.

Its V2 platform includes a 1:1 swap solution that enables users to perform zero slippage transfers, removing hidden costs associated with AMMs, which it claims will make it easier to bridge assets between chains backed by their native XGT token.

XGT is primarily used as a staking, payments, loyalty and rewards token within both Xion Finance and the Xion Global Web3 payments gateway, bringing fundamental utility to DeFi and Web3 payments.

Xion Finance claims to remove the manual process of investing into initial DEX offerings through subscription plans. By utilising one of four monthly IDO plans, investors’ allocations are automatically split into the top tier metaverse and gaming IDOs on a monthly basis.

Financial software dev Savana collects $45m in Series A

Savana, which develops financial software for banks and FinTechs, has collected $45m in its Series A funding round.

With the funds, Savana plans to bolster its go-to-market activities, accelerate the development of its features and bolster its Digital Delivery Platform.

Its Digital Delivery Platform supplies channel and product agnostic engagement, account servicing and automated bank operations. Its system works with Gen3 and traditional cores to unlock universal digital delivery across all bank-assisted and consumer-direct channels.

Digital bank Grasshopper raises $30.4m

Digital commercial bank Grasshopper has closed a $30.4m in a funding round, which brings its total capital raised to $160m.

It has also added deposit gathering business lines, which include banking-as-a-service and SMB banking, launched a BaaS platform, and developed a suite of digital banking tools for SMBs, including debit card, instant-issue virtual debit cards, and seamless payment options.

Other notable milestones include increasing the team by 82% and partnerships with industry-leading FinTech companies.

Mexican BNPL solution Kontempo closes $30m seed round

Mexico-based buy now, pay later platform Kontempo has closed its seed round on $30m, with a mixture of debt and equity.

The round comprised $6.5m in equity and $25m in debt, according to a report from TechCrunch.

Kontempo will use the capital to hire staff, grow its merchant network and further the development of technology. It plans to double its team of 11 by the end of the year.

The company provides e-commerce sites with BNPL services. Through the technology a client can offer interest free instalments to their B2B customers.

ZayZoon closes debt, equity round for early wage access service at $25.5m

Voluntary benefits platform ZayZoon has raised $25.5m in a mixture of debt and equity.

The company raised $12.5m in equity, which was led by Carpae Investments and Alpenglow Capital.

With the capital, ZayZoon will expand its product offering with new products and services that improve financial outcomes and wellness of employees. The company will also hire staff for key roles.

Its flagship product Wages On-Demand gives employees access to wages that they have earned but would normally have had to wait until payday to receive. An employee can sign up and access earned wages instantly for little or no cost.

Businesses partner with ZayZoon to improve their employee recruitment, retention and overall workplace productivity. It boasts over 100 payroll integrations and 60% of businesses can activate the service in under an hour.

Cybrary scores $25m in financing raise

Cybrary, a company that sells access to a platform focused on cybersecurity workforce education and training, has raised $25m from a Series B round.

Cybrary claims it has 2.5 million registered users globally and over 1,000 expert contributors on a subscription platform that helps businesses diagnose cybersecurity skill gaps and pinpoint the kinds of classes needed for employees.

The company’s platform also includes tools for hands-on virtual labs, curated training plans that align with industry standards, integrations with corporate learning management systems and customised visibility into a team’s strengths and weaknesses.

According to Cybrary, the new funding will be used on research and development efforts across its engineering, product and marketing teams. It will also help provide a longer runway for the firm in a highly competitive market for online training and workforce education products.

Bizongo lands $25m to ease supply chain pinpoints in India

Bizongo, a tech-enabled B2B platform based in India, has reportedly raised $25m in funding led by Israeli VC Liquidity Group.

Many thought that the supply chain challenges brought about by the pandemic would ease once we returned to ‘normal, but this has not been the case, Tech Funding News said.

Founded in 2015 and headquartered in Mumbai, Bizongo aims to solve these problems.

It is an online B2B marketplace catering to the diverse packaging and material handling industries. It strives to make packaging sourcing, distribution, inventory management, and design hassle-free for enterprises.

The company’s automated supply chain platform ensures availability of packaging for business with lower inventory, tackling challenges such as inventory stock out, excess inventory, and obsolescence that are common for enterprises.

Axio bags $23m in Series B financing

Axio, a provider of SaaS cyber risk quantifications solutions, has scored $23m in a Series B funding round.

As part of the Series B, chief technology officer of ISTARI – the firm who led Axio’s Series A – Mark Malecki and managing director of the Americas Curt Dalton will join the Axio board.

According to FinSMEs, Axio provides a SaaS based platform – Axio360 – which helps organisations centrally manage their cyber risk posture through cybersecurity assessments, risk quantification and insurance stress testing.

RegScale bags $20m Series A

Continuous compliance automation software platform RegScale has closed its Series A round on $20m.

With the funds, RegScale plans to bolster its sales and marketing initiatives, with a focus on financial institutions, energy and utilities, and government sectors. RegScale also plans to accelerate its product development efforts and operational support to meet the needs of customers globally.

Founded in 2021, RegScale originally launched as an offshoot of digital transformation services company C2 Labs to help organisations in heavily regulated industries continuously manage the massive year-over-year growth in their compliance burden.

Based in Virginia, RegScale offers a continuous compliance automation platform that moves organisations from manual compliance approaches and processes to an API-centric, automated approach. Its governance, risk and compliance platform integrates with existing security and compliance platforms, providing evergreen compliance documentation, whilst simultaneously visualising compliance and operational risk to decision makers in real-time.

Employee benefits company Ben bags $16m

Ben, an employee benefits platform, has secured $16m from a Series A funding round headed by Atomico.

Ben claims it is the all-in-one platform for any company to personalise benefits and reward. It does this by bringing together a SaaS platform with per-employee Mastercards and financial infrastructure.

The business said its technology cuts out cumbersome admin for HR managers integrating accounting, HR and payroll systems to streamline all onboarding, enrolment, management and offboarding processes.

The per-employee Ben Mastercard and flexible allowance function lets companies set budgets and spending rules to put decision-making in the hands of the employee to choose what suits them.

Ghost Security emerges from shadows after $15m funding round

US-based application security platform Ghost Security has closed a $15m funding round as it emerges out of stealth.

The funds will enable Ghost to hire more staff.

Ghost Security stated there is a problem with exponential expansion in the development and usage of applications and APIs, leaving many unaccounted for and unsecured.

Ghost Security enables technology leaders to benefit from rapid application development without disrupting existing processes.

Leapfin closes Series A on $12.2m

Leapfin, a financial data management solution, has closed its Series A funding round on $12.2m, which was led by Crosslink Capital.

With the capital, Leapfin plans to accelerate product development, as well as hire more sales and marketing staff.

Leapfin is a financial data management solution that supplies chief financial officers with tools to improve strategic decision making.

Its solutions augment ERPs and enable finance teams to consolidate financial data from siloed sources, maintain compliance with accounting rules and laws, and produce detailed financial data and reports in real-time.

Twid bags $12m for loyalty and reward payments

India-based Twid, which is on a mission to revolutionise how loyalty and rewards are used, has raised $12m in Series A funding.

Founded in 2020 by Amit Koshal, Rishi Batra, and Amit Sharma, Twid is a network effect platform that combines multiple loyalty/reward points across issuers such as banks, FinTech firms, and retail/e-commerce brands. It allows consumers to pay at offline and online stores with a ‘one-click-checkout’ experience using their reward points.

Twid will deploy the capital to scale and build its merchant and issuer network, expand product roll-outs and build tech capabilities.

Employee benefits startup Jify bags $10m

Jify, an employee benefits startup, has raised $10m in funding to scale up its offering in the Indian market.

Founded in 2021 by Anisha Dossa Aibara, Anusha Ramakrishnan, and Aditya Mehta, Jify aims to enable employees to access their earned salary on-demand in real-time and at zero cost.

The company provides a platform to its partner companies. Employees at those companies can log into the platform, view their accrued income and withdraw a portion of their salary for the days worked.

Additionally, Jify also offers ‘smart spend’ and ‘smart save’ tools to help employees track their spending, set practical saving goals, facilitate smart budgeting, and access to simplified financial advice on the Jify app, accompanied by its digital card.

ZSuite closes Series A on $11m

ZSuite Technologies, which powers financial institutions with unbound digital accounts encompassing escrow, subaccounting, sub-ledgering, FBO and trust accounts, has closed its Series A on $11m.

S3 Ventures led the round, with participation also coming from JAM FINTOP private banks.

ZSuite will use the funds to scale its platform, grow the organisation, expand into new markets and support the rising demand of its platform.

Founded in 2019, ZSuite is a bank-born advocate for the technological and financial growth of banks through SaaS solutions. It offers a suite of all-digital product offerings that enable financial institutions to increase low-cost, core deposits, improve customer experience and reduce internal costs.

Vori bags $10m for inventory management

Vori, which describes itself as a “revolutionary digital B2B inventory management platform”, has raised $10m in Series A funding.

According to Vori, while grocery shopping is the most common consumer shopping behaviour in the world, the grocery industry is the largest undigitized retail segment. Independent grocers make up a third of the US grocery market but cannot afford the same technology and solutions that grocery corporations such as Walmart, Kroger, and Amazon utilize to tackle supply chain and inventory management issues. This is the problem Vori has set out to solve.

Vori enhances the retailer’s inventory management workflows by digitizing traditionally manual labour-intensive processes, undocumented knowledge, and colossal amounts of analog data.

The company said the capital will be used to bolster its talent acquisition pipeline, expand its US operations, and broaden its product offering, including its upcoming Vori Back Office solution, enabling more independent grocery retailers nationwide to benefit from its transformative supply chain technology.

MerQube closes $8m round for its indexing services

MerQube, which offers technology for indexing and rules-based investing, has raised $8m in funding.

Laurion Capital Management served as the lead backer, with commitments also coming from Citi, J.P. Morgan, Morgan Stanley and UBS.

The funds will enable MerQube to invest in the development of its platform as it expands into key markets.

US-based MerQube, which launched in 2019, leverages disparate data sources spanning equities, futures, options, crypto, and other alternative data sets, to build complex strategies and leverage the advantages of cloud-native technology.

Continuous cybersecurity platform Lumu nets $8m

Lumu, which develops a continuous compliance assessment cybersecurity model, has closed its funding round on $8m.

The capital will enable Lumu to bolster its sales and marketing initiatives. Funds will also help Lumu attract more staff.

Based in Florida, Lumu’s Continuous Compromise Assessment model enables any organisation to measure and understand compromise to close the breach detection gap from months to minutes continuously and intentionally.

Teams receive actionable information about who was impacted, when it happened and how to respond. Currently, 3,100 organisations use the platform.

RegTech startup Compliance.ai lands $6m in funding

Compliance.ai has landed $6m in funding from existing investor Cota Capital and first-time backer JAM FINTOP.

Compliance.ai offers a regulatory change management platform that helps mitigate risk, reduce costs and increase confidence in compliance status for the banking, financial services and insurance industries.

It claims to give compliance teams tools to automate the monitoring and reaction to regulatory updates, helping to quickly identify obligations and ensure required changes are completed in a timely manner.

Alongside the funding round, Compliance.ai has named Asif Alam – previously the chief strategy officer at ThoughtTrace – as its new CEO. Kayvan Alikhani will continue his role in innovating the product as co-founder and chief product/strategy officer.

Bengaluru startup Tartan scores $4.5m

Indian payroll and work management startup Tartan has raised $4.5m in pre-Series A funding.

Founded in June 2021, Tartan provides white-labelled application programming interface (API) suite to financial institutions to help them access their consumers’ payroll data their consent to verify their income and employment status.

The Bengaluru-based company has also launched an employee benefits marketplace, Batik, which is being used by HR management software providers to offer simplified benefits to their employees at a discounted cost.

The funding, which brings the company’s total raised to $6m, will be used to expand go-to-market operations, expand the in-house engineering team, and improve the product offering.

Anthemis backs parametric InsurTech Raincoat with $4.5m

InsurTech Raincoat, which develops parametric embedded climate insurance products, has raised $4.5m in a seed funding round led by Anthemis.

According to a report by Artemis, the round received backing from SoftBank Group’s SB Opportunity Fund, Puerto Rican banking leader Banco Popular, Chilean financial group Consorcio, Miami-based 305 Ventures, and first check investor Divergent Capital.

Raincoat is building a suite of scalable climate insurance solutions that are parametric trigger based to enable individual claims to be instantly processed. The company said this will allow financial institutions, governments, and insurers to provide immediate payouts in the wake of climate events and natural disasters to individuals small to medium sized businesses.

The company is already working with international reinsurers and governments worldwide, on initiatives to protect farmers and individuals from catastrophic weather conditions.

Kenyan InsurTech Lami extends seed round with $3.7m

Kenya-based InsurTech startup Lami Technologies has collected $3.7m in its seed extension round as it looks to expand across Africa.

Funds from the round will help Lami bolster its business, product and technology development, as well as expand into Egypt, Nigeria and Uganda.

Lami initially raised $1.8m in its seed round last year. The capital was supplied by Accion Venture Lab, Consonance, P1 Ventures, Acuity Ventures, The Continent Venture Partners and Future Africa.

Founded in 2018, Lami aims to address the problem of low insurance uptake in Africa, which it claims is driven by the slow pace of innovation in the sector, which has left the continent with sluggish and traditional paper-based systems.

Its goal is to bridge the gap through technologies that make insurance affordable through bitesize premiums.

Stackwell pulls in $3.5m seed

Stackwell, a digital investment solution looking to eliminate the racial wealth gap, has raised $3.5m from a seed funding round.

According to Stackwell, its robo-investing app is designed to meet users where they are and promote accessibility, education and support throughout the investment process.

It claims it will provide its users with automated investment portfolios that are recommended based on user specific goals, in-app educational content that demystifies investing so users can grow their knowledge and their wealth, and science-based nudges to help users stay committed, consistent and achieve their long-term wealth building goals and objectives.

Stackwell plans to use the new funding from this round to support the imminent release of its robo-investment app this fall.

B9 scores $2.6m in funding raise

B9, a payroll solution platform, has raised $2.6m in a funding round headed by Sky Light Invest.

B9 was designed to provide an alternative for unbanked people – often first or second-generation immigrants – who are often targeted by predatory lenders.

The firm claims it can help eliminate predatory lending with a no-interest pay advance offer. This helps customers that are outside the traditional banking system get bank-grade services on great terms, providing financial inclusion.

Quotech scores £1m

Quotech, the underwriter-led InsurTech that creates practical systems for specialty insurers, brokers, and MGAs, has raised £1m in a funding round.

The funding came from a number of angel investors and Convex Group Limited, the international specialty insurer and reinsurer.

Quotech was founded by Guillaume Bonnissent, an experienced London underwriter as well as programmer.

Quotech said the capital will be used to increase staff levels and provide additional resources to support the creation of custom-built technology platforms for underwriters and distributors in the global commercial and wholesale insurance sector.

Openull bags funding for BNPL platform in South Korea

South Korea-based FinTech Openull has raised an undisclosed amount in a pre-Series A funding round.

Founded in 2017, Openull created the first buy now pay later (BNPL) platform in the South Korean market.

The company is gearing up to launch its mobile app on the Google Pay and Apple stores in September.

Openull said it will use the capital from this round to expand its team, develop its technology and grow its user base.

Auto lending software platform DigniFi collects funding

DigniFi, which helps the automotive industry with simplified loan application processes, has raised funding from Brigade Capital Management.

With the funds, DigniFi hopes to execute its three-year growth strategy, which is centred on operational stability, product development and commercialisation, and expansion into transportation-adjacent markets and ecosystems.

DigniFi gives auto dealers and small businesses with tools to grow their revenue and offer inclusive financing. Its technology simplifies the loan application process and enables small businesses to offer on-the-spot financing for auto repairs, parts and accessory purchases and maintenance packages.

Copyright © 2022 FinTech Global