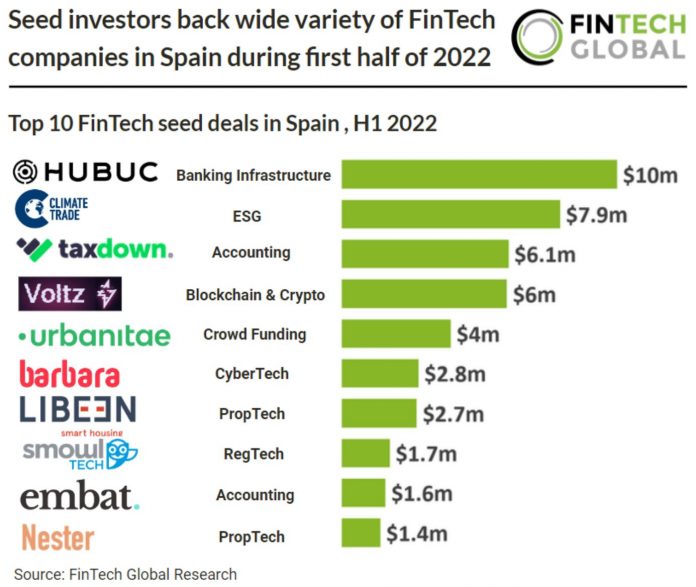

• HUBUC, an embedded finance API, was the largest FinTech seed deal in Spain for the first half of 2022 raising a considerable $10m in their seed round which was led by Runa Capital and WndrCo and included 19 other investors. HUBUC will use the funds to build a compliance team and expand its current presence in Europe. The additional capital will also help further product development, streamline customer implementation processes and focus on boosting the go-to-market strategy.

• In total there were 16 Spanish FinTech seed deals in H1 2022 and the WealthTech sector accounted for the most with three in total. Overall, there were deals raised across 11 FinTech subsectors indicating a diverse FinTech ecosystem in Spain.

• Apart from EU directives, as of 5th September 2022 there are no specific regulations or tax incentives for FinTechs although Cyber Security and data protection regimes exist and some tax incentives include FinTechs. The Spanish “patent box” regime and the research, development and innovation tax credit is applicable to FinTech activities and the draft “Start-up Law” adopted in December 2021 is also applicable to FinTechs, which is expected to be approved in 2022, includes important tax incentives, such as a CIT reduction from 25% to 15% during the first four years, as well as interest and deposit free tax debt deferrals.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global