Amsterdam-based DataSnipper, which claims to be transforming the financial audit industry, has received a minority growth equity investment from Insight Partners.

With the funds, DataSnipper plans to accelerate its market expansion, attract talent, and bolster the development and enhancement of its automation platform. It is currently to expand operations in the US and across Europe.

The RegTech company claims that the audit process involves countless manual and repetitive tasks, and auditors are seeking technology that can improve it. DataSnipper is doing this through its automation platform that increases the quality and efficiency of common audit procedures.

The platform’s automation features, which are embedded into Excel, empower external auditors around the world to do their work quickly and accurately. Its technology is also being used for internal audit, financial control, accountancy and tax.

DataSnipper claims to have tripled its customer base in the past year and served more than 300,000 auditors across 85 countries.

DataSnipper founder and Co-CEO Maarten Alblas said, “It is the perfect moment to team up with a partner that strongly believes in our mission. This minority investment from leading software investor Insight Partners enables us to deliver on our promise to make every auditor in the world more successful and impactful.

“DataSnipper’s value isn’t limited to auditors. As we continue to expand globally, early customers in these new markets are excited about the value DataSnipper delivers, and we’re looking to continuously improve our platform and service offerings. The time is now. We´re proud to collaborate with Insight Partners in this exciting journey to come.”

Insight Partners investor Alessandro Luciano added, “Without any investment, DataSnipper has built one of the most valued products we have seen. We are convinced that DataSnipper will make a tangible difference not only for auditors, but for many other finance, accounting and tax professionals as well.”

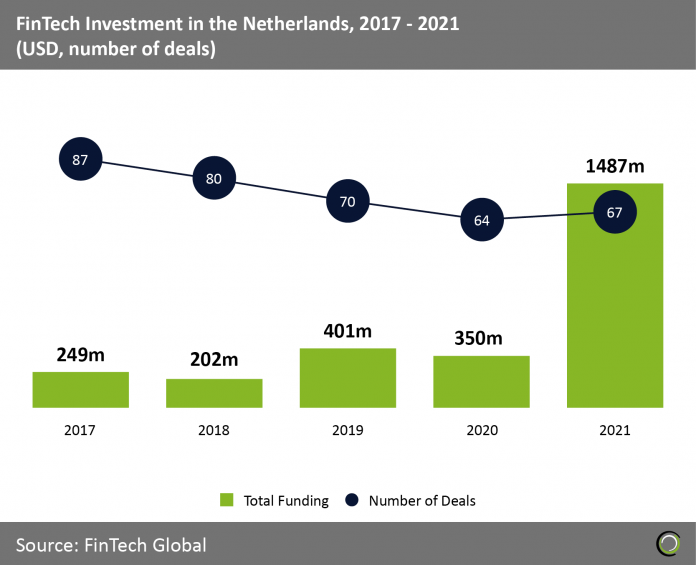

The Netherlands experienced a stellar 2021 in FinTech. A total of $1.4bn was invested through 67 deals – a huge jump from the $350m raised in 2020.

Copyright © 2022 FinTech Global

Copyright © 2022 FinTech Global