This week saw a humble 28 deals take place across the FinTech sector, in another relatively slow week as markets struggle.

The biggest deal of the week came from InsurTech Carrot. Based in the UK, Carrot is on a relentless mission to advance outdates insurance practices through technology. In a round led by Affirma Capital, the InsurTech raised a strong $250m. The raise will see Carrot inch closer to the ever coveted unicorn status, seeing it secure a valuation of $850m. The company has also declared plans to go public by 2025.

Last week was also a modest week for FinTech, with just 24 deals taking place and $866m invested.

Although in a tough funding environment, some sectors are proving more resilient than others. InsurTech is indeed one such sector, performing consistently week in week out. Other notable deals from the sector this week include Optalitix raising £4m, iCover landing $5m, and German digital health insurer Ottonova closing its Series F round in €34m.

Another such sector is the PropTech industry, with two companies in this industry securing a place in the biggest ten deals of the week.

CyberTech is also performing well, with Bitwarden landing $100m, Cymulate raising $40m, and Huntress bagging $40m, to name a few.

FinTech Global research recently reported that in Europe, the UK is dominating CyberTech deals for the first half of the year. There were a total 28 CyberTech deals or 27% or all deals in the region. The UK is working hard to strengthen their cyber ecosystem and has dedicated £2.6bn via The National Cyber Strategy 2022 which includes incentives and regulation to do so. Currently the government has implemented the General Data Protection Regulation (GDPR) / Data Protection Act 2018 and the Security of Network and Information Systems Directive 2018 to improve cyber security practices.

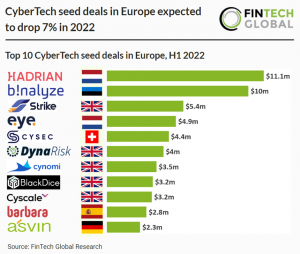

However, FinTech Global research also revealed that CyberTech seed deals are predicted to decline. CyberTech seed deals in Europe reached 31 deals in total for the first half of 2022, a 7% drop compared to 2021 levels. In comparison, European CyberTech deals across all funding stages are projected to drop 17% in 2022 compared to last year’s levels, indicating that investors still have strong appetite for backing new innovative companies in the space.

Here are the 28 deals that took place this week.

Carrot bags $250m

South Korean digital insurance carrier Carrot has raised $250m in a round led by Affirma Capital.

Established in 2019, Carrot is on a mission to advance outdated insurance and deliver coverage that is fair and reliable through the use of technology.

Carrot said the capital will be raised across two connected rounds with wide participation of existing investors. The initial round of $145m was closed in the past week and the remaining $105m will be raised through the extended round during the fourth quarter of this year.

Upon completing its extended round of financing next quarter, Carrot’s valuation will reach 1 trillion won (US $850 million), taking it one step closer to becoming the nation’s first unicorn digital insurer. With the fresh capital, Carrot intends to strengthen its position as a pioneer in the existing market, accelerate its advancement of tech capacity and expansion of in-house pipelines, as well as external open innovation activities. The company anticipates faster rate of growth in coming years and plans to reach break-even by 2024 and go public by 2025.

arrot claims to be the nation’s first fully-licensed 100% digital insurance carrier. The company said it has been disrupting the insurance market and outpaced its global peers in terms of the speed of acquiring customers to its usage-based insurance programme.

Carrot said it offers easy and accessible insurance, transparent premiums, AI automated accident registration and prompt dispatch of help services all made possible via proprietary technology. The company is also pursuing business in pay-as-how-you-drive auto insurance, which assesses the premiums as per customer’s driving patterns and behaviour through sensor data analytics.

VTS raises $125m Series E

VTS, a commercial real estate technology platform that aims to transform how strategic decisions are made and across the asset lifecycle, has raised $125m in Series E funding.

The round was led by existing VTS customer and investor CBRE Group. Other investors included BentallGreenOak, AmTrust, Brookfield Ventures, and Insight Venture Partners, among others.

In 2013, VTS launched the VTS Platform, a first-party data source. The PropTech unicorn said its platform delivers data insights and solutions for everyone in commercial real estate to fuel their investment and asset strategy, leasing and marketing automation, property operations, and tenant experience.

In addition to its capital investment, CBRE will partner with VTS to roll out the VTS Platform, with additional enhancements and integrations. The roll-out will begin in the US.

This partnership, according to VTS, deepens the existing relationship between VTS and CBRE and underscores CBRE’s commitment to giving its brokers and property managers a competitive advantage through innovative technology.

This funding round comes as VTS also recently secured $150m in debt financing from Canadian-based CIBC Innovation Banking, totalling $275m in new funding.

The PropTech unicorn said the capital will ensure that it continues to accelerate its product innovations, source strategic acquisitions, and attract top talent.

Bitwarden secures $100m

Open-source password manager Bitwarden has secured a $100m minority growth investment, which was led by private equity firm PSG.

Existing investor Battery Ventures also joined the round.

With the capital, Bitwarden plans to scale its open-source, flexible solution to offer stronger online security options for individuals and enterprises. It will also look to build new tools and features.

The Open-source password manager platform claims that the decentralisation of work and mixing of personal and work devices has left individuals to create, manage and remember dozens of online credentials. This leads to password reuse and puts end users at risk of password theft.

Bitwarden helps individuals and businesses operate safely online through an open-source and gully customisable password manager. Paid and free versions include features for credential autofill, automatic end-user password generation, password strength scoring, secure credential and file sharing, and flexible cloud and self-hosted deployment options for sophisticated enterprises.

The CyberTech company currently serves tens of thousands of businesses and millions of end users globally.

Zimmer backs Ategrity with $75m

Ategrity Specialty Insurance Company, a specialty property & casualty insurance company focused on the excess and surplus (E&S) lines market, has received $75m investment from Zimmer Financial Services.

Founded in 2018, Ategrity is focused on the excess and surplus lines market, and its offerings include commercial E&S property and casualty on a primary and excess basis. The business serves brokers and wholesale agents across the US on a contract-binding and individual brokerage account basis.

Zimmer has previously participated in a capital raise of $75m for Ategrity in 2021, enabling the company to make significant investments in its underwriting infrastructure and analytics, as well as in best-in-class service delivery for brokers and agents.

Speaking at the time, Mike Miller, Ategrity CEO and executive chairman, said, “Since launching in 2018, Ategrity has done an extraordinary job at building its presence in the marketplace. It is now time to marry our existing strengths with new investments in data and analytics that will position our company for its next phase of growth. We are excited to have raised significant capital to support this plan as we work to deliver the highest level of service to our agents and brokers.”

This investment brings the total amount invested by Zimmer in Ategrity to $300m.

Ategrity said the funding will be used to support growth in its wide-ranging primary and excess insurance lines and expansion in the middle-market space, an area of increased focus for the firm.

Cymulate closes Series D on $70m

Extended security posture management platform Cymulate has closed its Series D round on $70m, bringing its total capital raised to $141m.

Existing Cymulate investor One Peak led the round, with capital also coming from Susquehanna Growth Equity (SGE), Vertex Ventures Israel, Vertex Growth and Dell Technologies Capital.

With the funds, the extended security posture management platform plans to bolster its global expansion efforts. It will also help the company bolster its technological capabilities, further its global growth and expand its team by 75%.

Cymulate more than doubled its ARR in 2021 and grew by over 200% in North America alone. It currently boasts over 500 customers globally.

Cymulate claims to set the industry standard for organisations to use automation to continuously validate their threat exposure and cyber posture, by testing cloud and on-premises networks against the latest threats.

Its extended security posture management platform leverages its security technology and capabilities to support customers’ security and business needs. The platform provides actionable insights into attack surface management, continuous automated red teaming, breach & attack simulation, and advanced purple teaming.

Netradyne secures $65m

Netradyne, a startup that uses AI and data to provide fleet safety solutions, has raised $65m in debt financing from Silicon Valley Bank.

Netradyne leverages AI and edge computing with the aim of revolutionising the modern day transportation ecosystem. The company, through its technologies, works to improve driver behaviour and fleet performance.

The company said the funding will help accelerate its business momentum, further develop its product suite and fuel global corporate expansion.

Netradyne recently teamed up with Munich Re to provide its Driver•I technology within Munich Re’s Smart Mobility Program.

Powered by AI and edge computing, Netradyne’s Driver•i is a fleet safety camera platform built to reinforce good driving behaviour. It provides actionable data to automatically coach and improve safety performance across a fleet. The system can assess speed, traffic sign compliance, following distance, aggressive driving, distracted driving, and more.

Netradyne said the platform has analysed more than 5 billion dirving miles and analysed over 20 billion minutes.

Mesh Payments lands $60m

Mesh Payments, a finance automation platform, has secured $60m in new funding to push forward its go-to-market efforts and continue its product innovation.

According to PYMNTS, the new backing comes after the company tripled its revenue growth in the first half of the year, with 1,000 mid-market firms now using Mesh and close to $1bn in annualised payment volume following through the platform.

The company attributed the growth to companies moving their focus from growth to cost and spend reductions, and looking for solutions that will assist them.

Mesh allows finance teams to automate, control and optimise their corporate spend. The platform integrates with NetSuite to reduce the need for manual data entry and enables numberless Visa physical cards that sync with virtual cards to give finance teams more flexibility and control.

Clip receives $50m

Mexico-based commerce and digital payments platform Clip has received a $50m credit facility from Morgan Stanley, JP Morgan and HSBC.

This is a three-year, unsecured revolving credit facility.

With the funds, Clip plans to expand its efforts to meet businesses’ demand for innovative payments solutions and improve access for Mexican businesses and consumers.

The credit line also follows the launch of new products. Clip recently released three point-of-sale terminals, Clip Mini, Clip Pro 2 and Clip Stand. It also released two hardware accessories – Clip Cashbox and Clip Printer – and three remote payments software features – QR Code, Payment Link and URL Link.

Last month, the company received the approval for an Institution of Electronic Payment Funds license from the National Banking and Securities Commission. With this, Clip can open and hold customer accounts with electronic balances, offer wire transfers, and issue, market and manage forms of payment.

Dealpath closes $43m Series C

Deal management platform Dealpath has closed its Series C round on $43m, as it looks to accelerate its global expansion efforts.

Morgan Stanley Expansion Capital served as the lead investor, with commitments also coming from Blackstone, 8VC, JLL, Nasdaq Ventures as well as GreenSoil PropTech Ventures.

Capital will also be used for rapid global expansion, increased product sales, customer success and executive leadership capabilities and drive operational excellence to meet the growing needs of their clients.

Dealpath has experienced a strong period of growth, having recently surpassed $10trn in transactions supported on its platform. It has also nearly doubled the size of its team to 100 professionals in San Francisco, NYC and expanded offices to Toronto.

The deal management platform claims to be the only enterprise ready software that offers vetted, real-time deal information, together with integrated workflows of associated documents, tasks and communications, empowering smart investment decisions with data-driven insights and digital collaboration.

Dealpath enables investment managers to operate at scale with speed as well as precision through easy access to data and effective internal and external collaboration and controls across teams, partners and vendors.

Isovalent lands $40m

Isovalent, a developer of open-source technologies, has closed its Series B funding round on $40m, with Thomvest Ventures leading the investment.

Other commitments to the round came from M12, Grafana Labs, Andreessen Horowitz, Mango Capital and Mirae Asset Capital, as well as existing strategic investors Google and Cisco.

With the capital, Isovalent plans to expand its team and cement its position in the market.

Isovalent was founded by Dan Wendlandt and Thomas Graf in 2017.

The FinTech company’s products are Cilium and Cilium Enterprise. Isovalent claims Cilium has become the de-facto standard for secure cloud native connectivity and has been picked as the default in several managed Kubernetes offerings of major public cloud providers including Google Kubernetes Engine, Google Anthos, and Amazon EKS Anywhere.

Its Cilium Enterprise solution offers scalable multi-cloud networking, dynamic service load-balancing, service identity-aware network firewalling, network and API-layer observability, transparent network encryption, runtime security observability and enforcement.

Its services are used by Adobe, Bell Canada, Capital One, Datadog, Palantir, IKEA, and Sky.

Ottonova bags Series F

Ottonova, a German digital private health insurer, has raised €34m in Series F funding.

Founed in 2017, ottonova describes itself as “the private health insurance for the mobile age.”

The round was led by Cadence Growth Capital (CGC), with participation of a German family office and existing investors.

Through its digital services, the company aims to help its customers to get and stay healthy.

In addition to private full health insurance and supplementary health insurance, ottonova’s portfolio also includes software solutions for the insurance industry.

21.co lands $25m

21.co, a company that provides access to crypto, has landed $25m in a funding round headed by Marshall Wace.

Also participating in the round were Collab+Currency, Quiet Ventures, ETFS Capital and Valor Equity Partners. Following this round, 21.co is valued at $2bn – making it Switzerland’s biggest crypto unicorn.

21.co was founded with the mission to ‘build bridges into the crypto world’. Since its founding, the company claims it has been on a journey to stay at the forefront of the market by providing investors with crypto ETPs, token solutions and a decentralised software platform to create, list and manage ETPs globally.

The round was raised during what 21.co called the ‘crypto winter’ and was the firm’s first raise in over two years. The company ended 2021 on a nine-figure revenue run rate and has seen sustained inflows, even during down markets.

Own up raises $25m, partners with Realtor.com

Own up, a digital mortgage shopping service, has raised $25m in funding and partnered with Realtor.com, a real estate marketplace.

Founded in 2016, Own Up aims to change the way Americans shop for and secure mortgages, creating more transparency in what is otherwise an opaque process.

The funding round was led by Brand Foundry Ventures with participation also from Realtor.com. Past investors Link Ventures and Listen Ventures also backed the round.

Own up said the capital will allow it to continue to build out its innovative technology platform, expand its novel shopping experience and product offerings, and invest in the company’s people and culture.

The partnership between Own up and Realtor.com will give users direct access to Own Up’s mortgage shopping service, including personalised loan offers from its exclusive lender marketplace and real-time advice from the industry’s only mortgage shopping concierge.

Moreover, Own up said the integration with Realtor.com will allow homebuyers to gather detailed information about their home financing options as they search listings and find real estate agents.

Plurall nets $20m

Columbian FinTech Plurall has raised $20m in a round of debt financing from UK-based Fasanara Capital.

Plurall claims it delivering ‘mission-critical’ financial services to the solopreneurs & SMEs that have been left out of the FinTech revolution.

According to FinTech Futures, Plurall began its initial beta testing phase three months ago and claims to have provided access to credit and digital accounts to over 140 entrepreneurs from various sectors across Columbia.

Plurall said the funding will bolster the financial inclusion of micro-businesses in Columbia, which are currently underserved by the financial industry.

It also plans to use the debt facility to partner with LatAm’s largest distribution partners across verticals that serve entreprenuers.

The debt funding will be complemented by a seed equity round that Plurall claimed ot is currently raising.

Open Raven pulls in $20m

Open Raven, a business that specialises in data security, has pulled in $20m from a Series B round headed by Pelion Venture Partners.

Also taking part in the round was Kleiner Perkins and Upfront Ventures. Following this round, Open Raven has raised a total of $40m since inception.

Established in 2019, Open Raven claims it is the modern data security platform that brings visibility and control to an organisation’s data protection program.

From mapping data stores in clouds and corporate networks to identifying the data within, Open Raven claims it lays the foundation for assessing and managing data risk.

The Los Angeles-based firm emerged from stealth back in February 2020 in order to provide data security tools designed to prevent leaks, breaches and compliance issues.

Open Raven plans to use the new funding to expand its engineering, sales and marketing operations to speed up its roadmap and support the large organisations.

RentSpree closes $17.3m Series B

RentSpree, an end-to-end rental management software provider, has raised $17.3m in Series B funding.

Based in Los Angeles, RentSpree provider rental software aimed at seamlessly connecting real estate agents, owners and renters to simplify and automate the entire rental process, from listing to lease.

The round was led by Green Visor Capital, with participation also from Rally Ventures, Venture MLS, ECG-Research, KEC Ventures, and Gaingels, with participation from existing investors 645 Ventures and Vesta Ventures.

This brings the company’s total amount raised to nearly $28m.

According to RentSpree, these investments will help the company expand product offerings for both renters and agents and secure additional strategic partnerships, furthering its mission to help the real estate industry embrace a growing nation of renters.

With rising mortgage rates making it more expensive to buy a home, the demand for rentals has been skyrocketing, according to RentSpree. As such, the company plans to use the funding to further empower renters, agents, and landlords with new tools, such as rent payment.

Ark Kapital doubles its equity funding to €30m

Ark Kapital, a precision finance firm enabling startups to grow faster through non-dilutive loans, has doubled its equity funding to €30m.

This comes only six months after the company closed one of Europe’s biggest ever seed rounds at €165m.

The round was headed by Annika Falkengren with participation from seed investors LocalGlobe and Creandum and angels such as Supercell CEO Ilkka Paananen, Zettle founder Jacob de Geer, EQT Ventures founding partner Hjalmar Winbladh and founder of Embark Studios Patrick Söderlund.

This brings up the total equity raised to €30m and total capital pool available for founders to lend from to €300m.

Ark claims it offers a new model for tech firms to grow their companies, offering non-dilutive loans and access to ‘world-class’ growth analytics.

Founders are able to plug into Ark’s machine learning platform with all of their growth-related accounts and get access to 5-year forecast in return, which allows them to access customised funding.

Credix lands $11.25m

Credix, a decentralised credit marketplace, has secured $11.25m in a Series A funding round headed by Motive Partners and ParaFi Capital.

Also taking part were Valor Capital, Victory Park Capital, Circle Ventures, Abra, Fuse Capital and MGG Bayhawk Fund.

The Credix platform connects together institutional investors such as banks and hedge funds with credit FinTechs and non-bank lenders in emerging markets who are looking to raise capital.

The company manages the underwriting, and institutional investors are able to gain access to higher lending rates with less risk. Currently, Credix is only available in Brazil, but plans to expand to new markets soon.

The firm said the new funding will be used toward platform development, hiring and integration with other Web3 projects.

Scribble raises €10m

Switzerland-based electronic signature platform Skribble has raised €10m in its Series A funding round as it gears up for geographic expansion.

The investment was led by Acton Capital Partners, an international venture capital firm aimed at digital businesses. Commitments also came from VI Partners. Bitcoin Suisse chairman of the board of directors Luzius Meisser also joined the round.

With the funds, the electronic signature platform hopes to boost its geographic expansion, grow the office in Karlsruhe and the German team, and more. It hopes to boost its presence in more European markets and is looking to accelerate the development of its product.

According to Skribble, employment and supplier contracts, along with delivery notes or tenders, have needed a replacement to printer, paper and physical signatures. Skribble is a digital method to do this.

Founded in 2018, the electronic signatures platform offers all e-signature standards from a single source and supplies the legally appropriate electronic signature for every type of contract.

HyperComply secures $6.4m seed funding

HyperComply, which automates security reviews and accelerates due diligence, has closed its seed round on $6.4m.

The investment was backed by FirstMark Capital and Golden Ventures.

HyperComply helps companies verify and maintain compliance in a fraction of the time. It claims that customers spend 34 minutes on average completing questionnaires, compared to the days of efforts manual processes take.

Its platform leverages AI technology and learns from past security questionnaires and documentation, and autofill’s answers instantly. Clients have a vendor dashboard to assess risk. The solution also boasts questionnaire templates, security review workflows, audit-ready vendor details and automated schedules.

The RegTech company’s mission is to remove the need for questionnaires. It believes that companies should be able to assess risk in a single click, instantly seeing whether another company meets security and compliance requirements.

HyperComply aims to be the source of trust for third party management, enabling companies to quickly and easily digest SOC 2, HIPAA, PCI and other compliance information. Through HyperComply, companies will have access to continuous monitoring across all the tools their team uses.

Codenotary extends Series B

Codenotary, which offers tamper-proof, immutable data protection, has secured an additional $6m in funding, extending its Series B which closed on $12.5m in January.

This fresh capital will help the RegTech company scale its sales in the US and Europe, as well as enter the Asian market.

The company was founded in 2018 by Moshe Bar, CEO, and Dennis Zimmer, CTO. Codenotary provides tools for notarisation and verification of the software development lifecycle attesting to the provenance and safety of the code.

It provides an indelible solution for processing millions of transactions per second, on-premises or in the cloud, and with cryptographic verification. Developers have a way to generate and attach a software bill of materials for development artifacts that include source code, builds, repositories and more.

Codenotary offers end-to-end cryptographically verifiable tracking and provenance for all artifacts, actions and dependencies.

The company is also the primary maintainer of immudb, the first and only open-source enterprise-class immutable database with data permanence at scale for demanding applications — up to billions of transactions per day.

Edda Edda, a collaborative software for professional investors, has raised $5.8m in funding to support the launch of its design-led product.

Its product combines dealflow, portfolio, LPs and business community management into a single product. It enables members of investment teams, from analysts to CFOs and partners, to collaborate through an online platform or a mobile app.

Its services are currently used by more than 100 investment firms across 26 countries. Its clients include Plug&Play, BPI France, Future Shape LLC, Headline JP and more.

The funding round was backed by Mucker Capital, Plug&Play, FJ Labs, Tony Fadell’s Future Shape and angel investor, Arnaud Bonzom.

With the capital, the company plans to hire more staff and deepen its product offerings.

Edda secures $5.8m

Edda, a collaborative software for professional investors, has raised $5.8m in funding to support the launch of its design-led product.

Its product combines dealflow, portfolio, LPs and business community management into a single product. It enables members of investment teams, from analysts to CFOs and partners, to collaborate through an online platform or a mobile app.

Its services are currently used by more than 100 investment firms across 26 countries. Its clients include Plug&Play, BPI France, Future Shape LLC, Headline JP and more.

The funding round was backed by Mucker Capital, Plug&Play, FJ Labs, Tony Fadell’s Future Shape and angel investor, Arnaud Bonzom.

With the capital, the company plans to hire more staff and deepen its product offerings.

InsurTech Optalitix bags £4m

Optalitix, an InsurTech that claims to add value to insurers with low code SaaS products, data analysis and AI models, has raised £4m.

Up to £2.5m of that funding was raised by Calculus, which will be used primarily to expand the sales capacity, invest in marketing and speed up product development by expanding the engineering team.

United Trust Bank also subscribed for new equity following an earlier investment and support for the company.

Established in 2013, Optalitix allows business processes currently based on Excel to be transformed into robust online systems. It currently has two key products: Optalitix Models, which turns spreadsheets into systems; and Optalitix Quote, which creates a digital underwriting platform for insurers.

Optalitix said these products are ‘transforming the insurance sector where underwriters currently work with many models which are often manually run without proper systems and governance’.

DoxyChain pulls in €2.2m

Poland-based DoxyChain, which aims to fix traditional document management, has raised €2.2m from international investors to support its growth.

Level2 Ventures served as the lead investor, with commitments also coming from CV VC, Polish Satus Starter, and a German family group of companies: Müller Medien.

Capital from the round will help DoxyChain bolster its product development, hire more staff and expand across the European and US markets.

DoxyChain’s mission is to become the best global infrastructure for documents, combining traditional front ends with web 3.0 features.

In October, the document management company will launch DoxyCert and DoxyConnect. The former is a toolkit that allows clients to issue blockchain certificates, also as NFTs, which will be used as undeniable proof of authenticity or ownership.

DoxyConnect will serve like a data room. It is built on the blockchain and lets the parties of a document exchange transact in a secure and easy way.

Koba Insurance reaches half of crowdfund target so far

Koba Insurance, a Melbourne-based pay-as-you-go car InsurTech, has raised $500,000 so far in its latest crowdfunding round.

According to a report from Insurance News, Koba raised $1m during an earlier crowdsourcing round in September, as well as $700,000 from angel investors and insurance specific funds, including Hunter Equity Group and Insurtech Gateway.

The recently raised $500,000 is half of its $1m target.

Koba, which launched in November, charges drivers according to their usage of their car, which it says it’s a more fair and accurate way of paying for car insurance.

Payments are split into two. There is a fixed premium to cover drivers while parked, and a per-kilometre rate, typically between 3-10 cents, while driving.

In real-time, Koba measures the distance driven via a usage matchbox-sized device called KOBA Rider that attaches to a car’s On-Board Diagnostics (OBD) port, connected with the KOBA smartphone app to automatically calculate driving distances and charge a per-kilometre rate for each trip.

Koba said the capital will help it build partnerships with car manufacturers to offer connected insurance, evolve the app and build new data-driven insurance products to open doors to new markets.

InsurTech Paper raised £152,615 in a crowdfund campaign

InsurTech Paper, which provides a B2B software suite for small and medium-sized insurance companies, has raised £152,615 in a crowdfund campaign.

According to a report from Crowdfund Insider, the raise exceeds the company’s target of £152,000 and was secured from 102 investors. There are still 15 days of the campaign.

The UK-based company reports a pre-money valuation of £3,080,000.

Founded in 2019, Paper aims to provide insurance agents and brokers an easy-to-use SaaS product that digitises the process end-to-end. The paper app allows customers to take photos of their asset and then Paper’s customized AI will select the relevant details in order to help build an insurance policy.

These customers can easily apply for and manage their insurance policies, paper-free.

As well as the environmental benefits, Paper has been designed for agencies to process policies much more quickly – and analyse their customer data more effectively.

The company’s B2B software suite enables small- to medium-sized insurance companies to digitalise their processes. Paper said this leads to greatly improved customer experience, a removal of paperwork, accurate data collection and savings of time a removal of paperwork, accurate data collection and savings of time and money.

Drawbridge gets backing

Cybersecurity software and solutions platform Drawbridge has received a strategic growth investment from Francisco Partners.

Following the close of the deal, existing Drawbridge backer Long Ridge and Drawbridge’s leadership team will remain significant equity holders in the company.

The fresh capital will help Drawbridge expand its services and boost product development.

Founded in 2018, the CyberTech company has established an all-in-one platform that allows financial services firms to rapidly deploy, manage and optimise a holistic cybersecurity platform.

Its technology empowers teams to navigate the evolving regulatory and threat landscape, manage governance, risk and compliance (GRC) requirements, and combat sophisticated cyber threats.

The cybersecurity software and solutions platform is used by over 900 funds in the alternative investment industry.

DataSnipper receives investment

Amsterdam-based DataSnipper, which claims to be transforming the financial audit industry, has received a minority growth equity investment from Insight Partners.

With the funds, DataSnipper plans to accelerate its market expansion, attract talent, and bolster the development and enhancement of its automation platform. It is currently to expand operations in the US and across Europe.

The RegTech company claims that the audit process involves countless manual and repetitive tasks, and auditors are seeking technology that can improve it. DataSnipper is doing this through its automation platform that increases the quality and efficiency of common audit procedures.

The platform’s automation features, which are embedded into Excel, empower external auditors around the world to do their work quickly and accurately. Its technology is also being used for internal audit, financial control, accountancy and tax.

DataSnipper claims to have tripled its customer base in the past year and served more than 300,000 auditors across 85 countries.

Copyright © 2022 FinTech Global