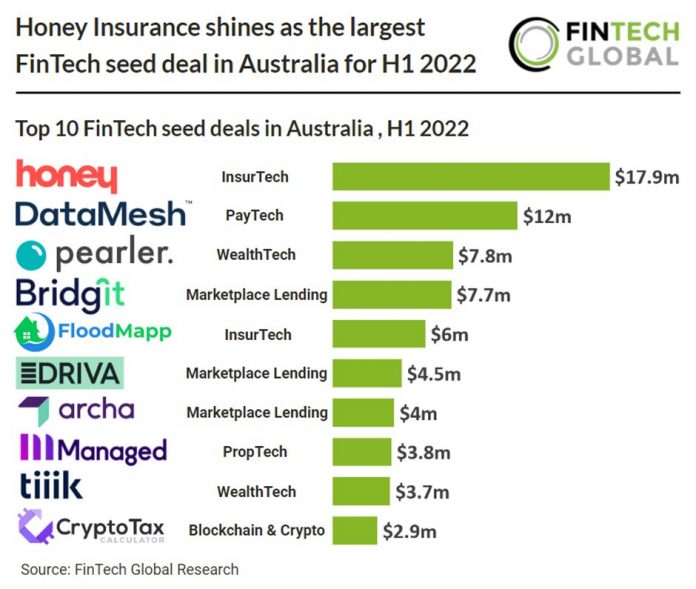

• Honey Insurance, a home insurance provider which helps customers prevent avoidable accidents, was the largest Australian FinTech seed deal in the first half of 2022 raising a considerable $17.9m in their seed round, led by RACQ. The company intends to use the capital to expand operations and its development efforts. Joffee, Honey’s CEO, is hoping to disrupt the insurance sector with technology, giving customers smart home sensors as part of their premium to monitor for problems such as fire, water leaks or intrusion.

• Overall, there were 29 FinTech seed deals in Australia during H1 2022 with the WealthTech and Blockchain & Crypto sectors being the most active with five deals each, accounting for 34% of all FinTech seed deals in aggregate. Sydney was the most active city for FinTech seed deals accounting for eight in total closely followed by Melbourne which recorded six transactions.

• Australia has been driving their financial services innovation and technology by supporting two blockchain pilots to reduce business compliance costs as well as offer incentives for FinTechs. FinTech startups are currently entitled to tax offsets, and early-stage startups can claim a rebate of 62 cents for every tax dollar they spend on R&D.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global