GoHealth, a health insurance marketplace and Medicare-focused digital health company, has closed a $50m private investment.

GoHealth’s mission is to improve access to healthcare in America.

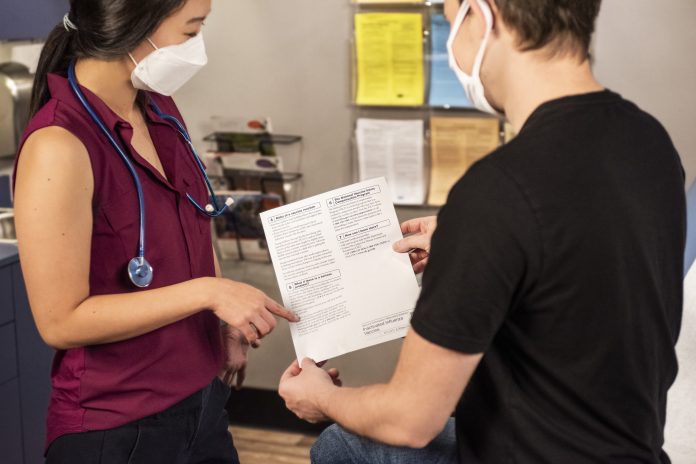

Enrolling in a health insurance plan can be confusing for customers, and the seemingly small differences between plans can lead to significant out-of-pocket costs or lack of access to critical medicines and even providers.

Using technology and data science, GoHealth matches customers with the healthcare policy and carrier to suit their needs.

The company said the funding will expand its shareholder base, enhancing its balance sheet as the it focuses on driving strong cash flow in the near term. This will also enable further investment in new technologies and strategic initiatives, enhance its multi-payer marketplace, and expands its Encompass platform, a technology-driven approach to purchasing Medicare Advantage plans.

Vijay Kotte, CEO of GoHealth, said, “We are pleased to receive this investment from two significant partners who are sophisticated investors. As we continue our Encompass-driven business transformation, this additional funding will empower us to deliver higher quality customer-service and enhance the differentiated value we bring to the market. We look forward to strengthening our multi-payer marketplace and further improving our ability to help millions of Medicare beneficiaries understand an ever-growing range of coverage alternatives.”

Kotte continued, “GoHealth is extending the role of the broker beyond traditional enrollment by driving continuous, high-quality engagement with beneficiaries and aligning incentives around retention. We are going to market in unique ways, and by making health insurance more accessible and easier to understand, GoHealth has established itself as a top choice for insurance advice in the US We look forward to building on our position for the benefit of all our valued stakeholders.”

Earlier this year, Spot, a startup offering on-demand injury insurance in the US, raised $33m in fundingcomprising $25m in equity and $8m in debt.

Copyright © 2022 FinTech Global