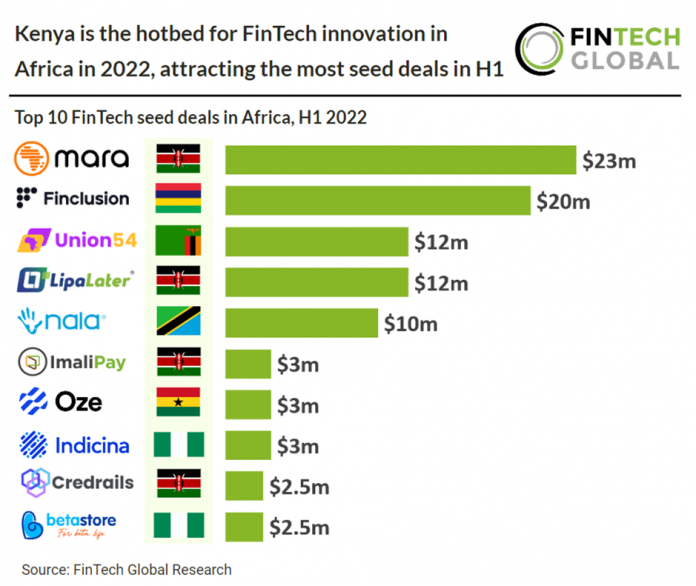

• Kenya was the most active FinTech seed country in the first half of 2022 with 11 deals, a 28% share of total FinTech seed deals in Africa. Nigeria was the second most active with eight deals and South Africa was third with five deals. PayTech was the most active FinTech sector for seed transactions on the continent, accounting for 30% of all seed deals in the region during the first half of 2022. Africa’s domestic e-payments market is expected to see revenues grow by 20% per year, reaching $40bn by 2025, compared with $200bn in Latin America. This outpaces global payments revenue which is projected to grow at 7% annually over the same period.

• Mara, a crypto exchange and wallet, was the largest African FinTech seed deal in the first half of 2022 raising $23m in their seed round which included high-profile crypto and web3 investors such as Coinbase Ventures, Alameda Research (FTX) and Distributed Global as well as eight other investors. Mara plans to invest in a suite of products targeting Nigeria and Kenya, Africa’s two largest countries, before expanding to East Africa and Francophone countries, said CEO Chi Nnandi.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global