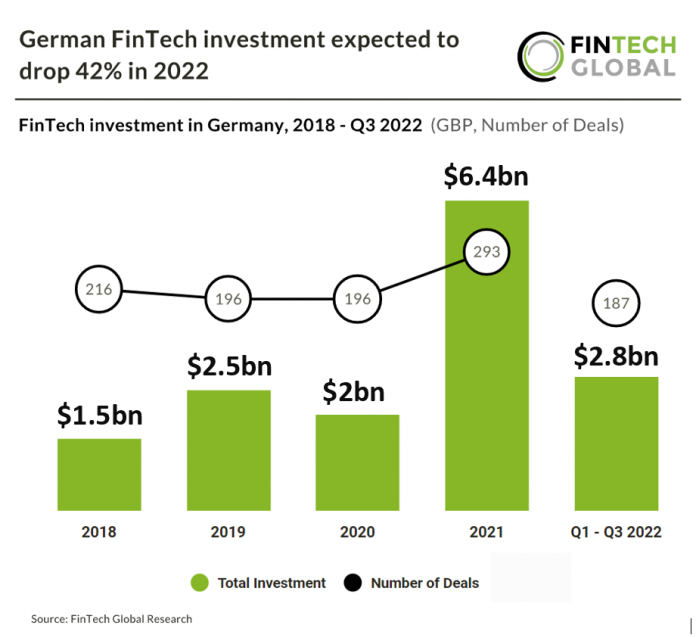

• German FinTech investment is expected to reach $3.7bn in 2022, based on investment pace during the first nine months of the year. This would be a 42% drop from 2021 when funding reached $6.4bn. Deal activity in Germany is also expected to drop although by a less significant 15% which in contrast is better than the most active FinTech country in Europe, the UK, which is expecting a 24% drop.

• wefox, a fully digital insurer, was Germany’s largest FinTech deal in the third quarter of 2022 raising $400m in their latest Series D funding round led by Mubadala and included seven other investors. This deal represented 60% of Germany’s FinTech investment in Q3 and pushed wefox’s valuation to a huge $4.5bn. wefox intends to use the funding for product development and expand across Europe and thereafter Asia and the US. wefox generated more than $200m in the first four months of business in 2022 and is well on target to reach more than $600m revenues by the end of the year.

• Of the 51 German FinTech deals in Q3, Berlin was the most active city with 22 deals, a 43% share of total deals and Munich was second most active city with seven deals in total.

• WealthTech was the most active FinTech sector in Q3 2022 with 11 deals, a 22% share of total deals. PropTech and RegTech were the joint second most active FinTech sectors during the third quarter with seven deals each.

German FinTech investment expected to drop 42% in 2022

Investors

The following investor(s) were tagged in this article.