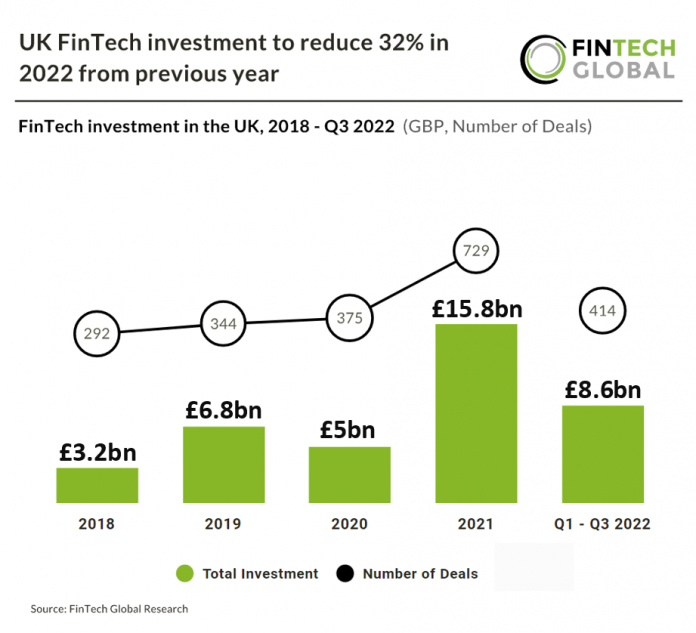

• UK FinTech investment in 2022 is expected to reach £10.75bn in 2022 based on investment from Q1 – Q3 2022, representing a 32% drop from 2021. In total £1.59bn was raised in Q3, which was the lowest quarter so far in 2022, although deal activity grew by 5% from the previous quarter. This shows that deal sizes have decreased, rather than a downtrend in the sector, which follows the global trend of company valuation drops. Overall, there were 127 deals in Q3 and the WealthTech sector accounted for the most with 34 deals, a 27% share of total deals this quarter.

• 5ire, a scalable decentralised and sustainable open-source blockchain with smart contract & ESG ranking services, was the highest valued FinTech deal in Q3 following its latest Series A funding round. The round was led by SRAM & MRAM and saw a total $100m raised, bringing the company’s valuation to $1.5bn. The funds raised will be used for business expansion and extending 5ire’s footprint across three continents including Asia, North America and Europe, with India as the hub of operations and core area of focus.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2022 FinTech Global