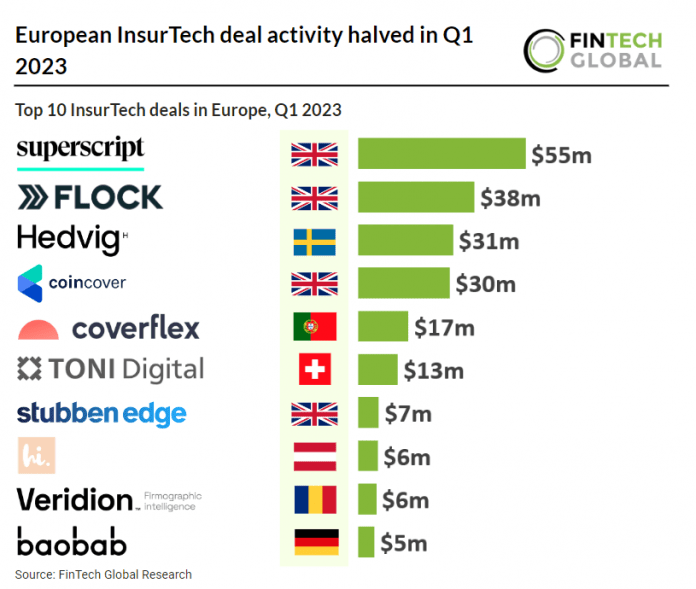

Key European InsurTech investment stats in Q1 2023:

• European InsurTech deal activity reached 37 deals in Q1 2023, a 51% drop from 2022 levels

• European InsurTech deals accounted for 26% of global InsurTech transactions in Q1

• The UK was the most active InsurTech country in Q1 2023 with a 38% share of total deals

European InsurTech saw a disappointing start to the year with deal activity and average deal size dropping YoY. In the first quarter of 2023, the number of InsurTech deals in Europe declined by 51% compared to the levels recorded over the same period in 2022, with a total of 37 transactions. The average European InsurTech funding round reduced 39% YoY to $6m. European InsurTech deals accounted for 26% of global InsurTech deals in Q1 2023 with InsurTech companies completing 177 deals, globally.

Superscript, a business insurance provider, had the largest European InsurTech deal in Q1 2023 after raising $55m (£45m) in their latest Series B funding round, led by BHL Holdings. Superscript plans to use the funds to further develop its underwriting and broking capabilities, enhanced by machine learning. The company has a fully “self-serve” online platform that allows customers to buy and manage insurance online with the help of machine learning technology. It will also expand its range of insurance and products and services for “international distribution” following the opening of its office in Rotterdam last year to support its growth plans in Europe. Having seen more than a fivefold increase in its customer base since its £8.5m Series A raise in 2020, the company now counts Amazon Business and Virgin Money Bank among its partners.

The UK was the most active InsurTech country in Europe with 14 deals, a 38% share of total deals. France was the second most active with six deals, a 16% share of deals and Germany was third with four deals, a 11% share of total deals.

The European Insurance and Occupational Pensions Authority (EIOPA) has outlined its strategy for 2023-2026, focusing on strengthening the insurance and pensions sectors and safeguarding consumer interests. Key priorities include sustainable finance, digital transformation, supervision, policy, financial stability, and internal governance. EIOPA plans to integrate ESG risks, conduct climate change stress tests, implement digital operational resilience measures, regulate the use of artificial intelligence, address consumer issues, and provide advice on the review of the IORP II Directive. Additionally, EIOPA will chair the Network of EU Agencies.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global