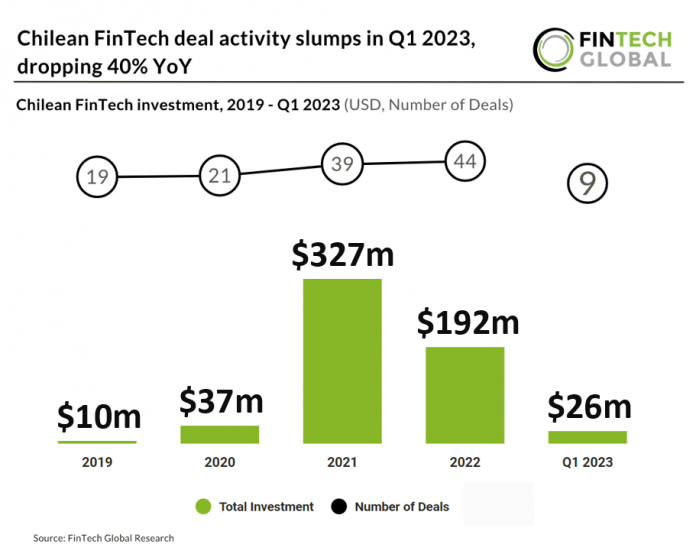

Key Chilean FinTech investment stats in Q1 2023:

• Chilean FinTech deal activity saw nine deals in Q1 2023, a 40% drop from Q1 2022

• Combined investment from Chilean FinTech companies reached $26m in Q1 2023, down 84% YoY

• The most active FinTech subsector in Q1 2023 was Lending Technology with three deals

Chilean FinTech deal activity and investment in Q1 2023 signals a slight downturn in 2023. Chilean FinTech deal activity saw nine deals in Q1 2023, a 40% reduction YoY. Based on Q1 2023 deal activity, 2023 is expected to see 36 deals, a 18% drop from 2022. Combined investment from Chilean FinTech companies reached $26m in Q1 2023, down 84% YoY. Based on Q1 2023 investment Chilean FinTech is on track to raise $104m in 2023, almost half 2022’s levels.

Destácame, which offers tools for managing finances, was the largest Chilean FinTech deal in Q1 2023, raising $10m in their latest private equity funding round, led by Santander X. The fresh capital will able Destácame to continue helping millions of people in Latin America to improve their finances: “With the capital increase, we devised two important challenges: promoting Destácame PRO for teams , where we provide tools to companies to help their collaborators to improve their finances and live calmer and calmer ”, said the company’s founders. The Santiago-based FinTech has over 4.5 million customers and their goal is to reach 10 million users by 2025.

Lending Technology was the most active Chilean FinTech subsector in Q1 2023 with three deals, a 33% share of total deals. PayTech and PropTech were the joint second most active FinTech subsectors with two deals each.

Chile’s latest FinTech impacting Law (Law 21.521) implemented since January 2023 regulates Open Finance and aims to promote competition, financial inclusion, and innovation. It establishes four regulated roles: Data Providers, Data Service Providers, Account Service Providers, and Payment Initiation Service (PIS) Providers. The law mandates obligatory data sharing by various entities, including financial institutions and even health and wellness-related service providers. It emphasizes interoperability, discouraging bilateral Open Banking agreements, and highlights the importance of advanced technology for identity and authentication. The law empowers the CMF to define API rules and standards for Chile’s Open Finance Ecosystem and establish guidelines for the necessary infrastructure.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2023 FinTech Global